Yeah1 (YEG) issues 55 million shares to shareholders

Yeah1 Group Corporation (Code: YEG) has just approved a plan to issue shares at a ratio of 1000:722. Accordingly, each shareholder owning 1000 shares will receive an additional 722 newly issued shares.

The capital for the above stock issuance plan is taken from the accumulated equity surplus on the audited separate financial statements for 2022 and is expected to be implemented in 2023 after the plan is approved by the State Securities Commission.

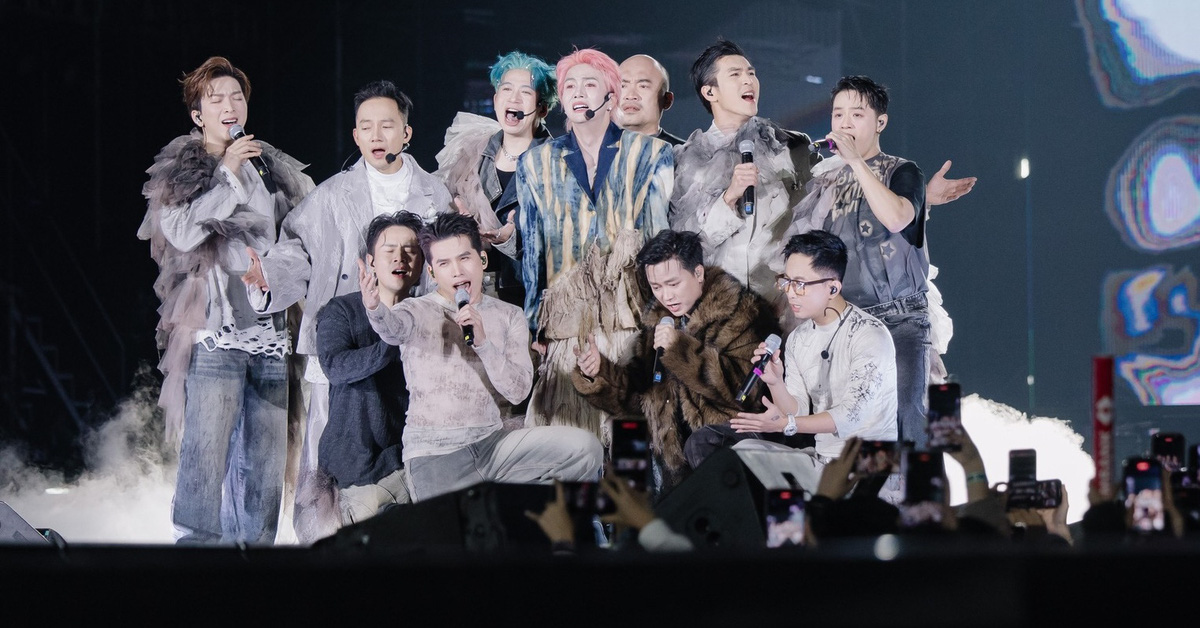

Yeah1 (YEG) issues 55 million more shares to increase charter capital (Photo TL)

Currently, Yeah1 has 76.28 million shares in circulation on the market. Thus, it is estimated that Yeah1 will have to issue an additional 55.07 million shares, equivalent to a par value of VND550.74 billion.

In the consolidated financial statements for the third quarter of 2023, Yeah1's capital sources include VND 337.4 billion in liabilities and VND 909.9 billion in equity. Of which, the owner's contributed capital accounts for VND 312.8 billion and the surplus capital accounts for VND 550.9 billion.

The above issuance plan will change Yeah1's capital structure with the target of increasing owner's equity by VND550.74 billion. The surplus capital will be reduced to almost zero.

In 2023, Yeah1 also issued 45 million individual shares at VND10,000/share. The total capital raised was VND450 billion, the issued shares were restricted from transfer for 3 years.

Third quarter profit drops 78.4%, interest burden increases

Regarding Yeah1's business situation, in the third quarter of 2023, the company achieved revenue of VND 111.5 billion, an increase of 57.5% over the same period. Although revenue exploded, high cost of goods sold caused gross profit to only reach VND 21.9 billion, a slight increase of 6.8%. Gross profit margin decreased from 29% to only 19.4%.

Financial revenue in the period decreased by nearly 2/3, from 31.3 billion to only 10.8 billion VND. Meanwhile, financial expenses increased sharply from 1.7 billion to 7.1 billion VND. Notably, interest expenses increased 4 times, from 1.6 billion to nearly 7 billion VND. This is also the main reason for the decline in profits in the third quarter of Yeah1.

Yeah1 recorded a loss of VND3.5 billion in the operations of its associates. Sales expenses increased from VND3 billion to VND4.1 billion while business management expenses dropped sharply from VND23.3 billion to only VND15.4 billion, a decrease of 33.9%.

After deducting all expenses, Yeah1's net profit from business operations was only VND2.7 billion, down 88.8% year-on-year. The company's after-tax profit was VND3.2 billion, down 78.4%.

Cash is down sharply, Yeah1 is lending 137 billion VND to the CEO

Regarding Yeah1's asset structure, by the end of the third quarter of 2023, the company recorded a nearly 50% increase in total assets, from VND 1,241 billion to VND 1,851.8 billion. However, the amount of cash held decreased from VND 26.5 billion to only VND 9.7 billion. Yeah1's bank deposits currently only account for VND 230 million.

Meanwhile, the company is recording a sharp increase in short-term receivables from VND541.3 billion to VND883.3 billion. Short-term receivables from customers increased from VND161.7 billion to VND209.3 billion.

Notably, the short-term loan receivable increased from VND164.4 billion to VND394.6 billion. According to the financial statement explanation, these loans resulted in two additional large loans: VND137 billion for Ms. Le Thu Tam and VND119 billion for Vital Investments Group JSC. Ms. Le Thu Tam is currently the CEO of Yeah1.

In addition, Yeah1 is also having to make provisions for short-term doubtful receivables of up to 72.8 billion VND.

Regarding long-term assets, the notable change comes from financial investments in associates, increasing from VND 132.2 billion to VND 360.2 billion. However, at the end of Q3/2023, because Yeah1 could not determine the fair value of the newly increased investment of VND 231.8 billion, the company has not yet provided a specific explanation for this investment.

Regarding capital structure, at the end of Q3/2023, Yeah1's equity increased sharply from VND 906.8 billion to VND 1,369.1 billion after successfully issuing 45 million individual shares. Liabilities also tended to increase from VND 334.2 billion to VND 482.7 billion.

Notably, spending on short-term loans increased from VND94.3 billion to VND141.6 billion. The company also increased long-term loans from VND1 billion to VND50.2 billion. Thus, in just the first 9 months of the year, Yeah1 increased its debt by VND96.5 billion. This also partly explains the sudden increase in interest expenses on business results.

Source

![[Photo] Bustling construction at key national traffic construction sites](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/2/a99d56a8d6774aeab19bfccd372dc3e9)

![[Photo] "Lovely" moments on the 30/4 holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

Comment (0)