Online fraud cases tend to increase, most of which are websites impersonating banking and financial institutions.

|

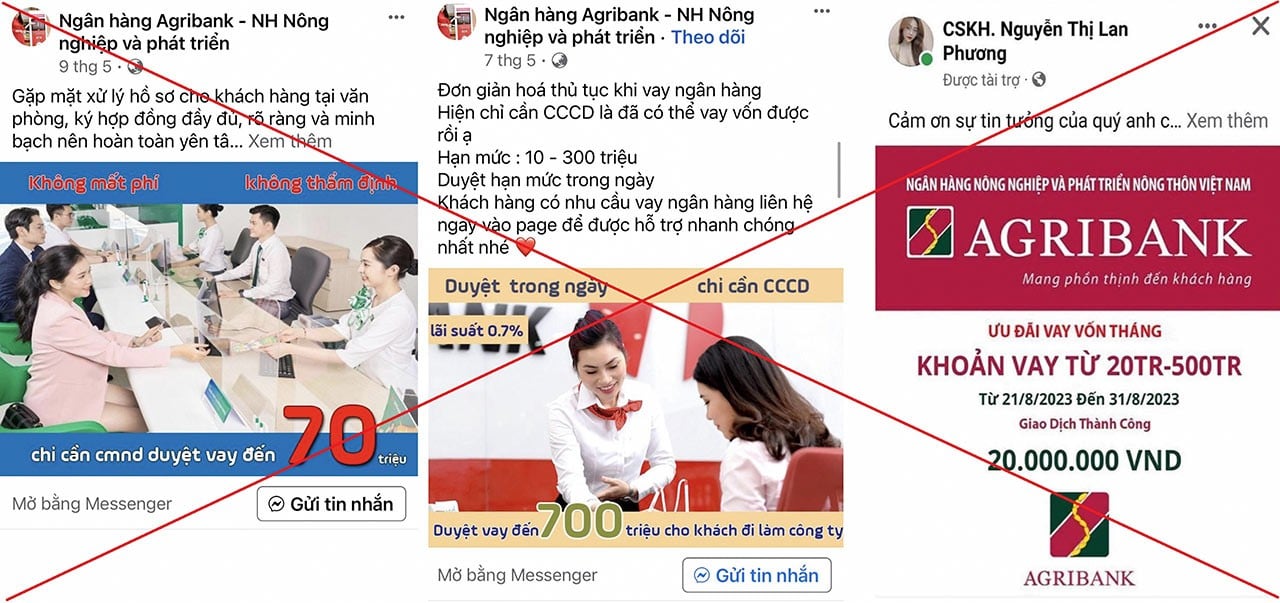

| Hundreds of fake domain names have appeared, 95% of which are internet scams targeting the banking and financial sectors. In the photo: Agribank warns about fake banking sites. (Source: Vietnamnet) |

Cyber attacks on banks increase

Data from the Ministry of Information and Communications shows that in the first half of 2023, the agency received more than 4,000 reports from Internet users about scams, of which more than 95% were scams targeting the banking and financial sectors.

In recent times, there have been many cyber attacks on banks.

In 2021, according to the "Security Endpoint Threat Report", Vietnam ranked 2nd in Asia in terms of the number of ransomware, an increase of 200% compared to 2020.

Research by Viettel Network Company in 2021 also showed that 90% of cyber attacks were related to the financial and banking system in 2021, an increase of 42.4% compared to 2020.

In 2022, Group-IB, a cybersecurity company headquartered in Singapore, discovered an unprecedented phishing attack in Vietnam.

Accordingly, 240 fake domain names were used to impersonate 27 familiar financial and banking organizations in Vietnam to collect customers' personal information, even steal their bank accounts and use techniques to bypass OTP verification.

At the seminar Sharing experiences in implementing solutions to ensure data security for the banking sector held on the morning of October 6, CDNetworks representatives shared the latest summary of the current network security situation.

According to CDNetworks experts, banks often face attacks on Layer 3/4, Layer 7 DDoS and web applications with a variety of attack methods.

Cyber attacks are also becoming more complex, with statistics showing that more than 87% of attacks combine two or more attack methods.

In addition, the banking system also faces the risk of slow connectivity with global applications, greatly affecting customer experience.

Banks constantly warn

Faced with this situation, banks are constantly issuing warnings about new fraudulent tricks to steal customers' accounts.

Agribank said that recently, taking advantage of the need to borrow money of some people, many subjects have impersonated bank employees to create Fanpages/Groups/Facebook accounts under the guise of "customer care", "customer support", "fast loans", "credit loan support", "online loans"... to defraud and appropriate assets.

The subject will ask customers to provide information (phone number, personal information), then call directly to advise, invite loans and request to transfer fees.

Fraudsters create hundreds of websites/Facebook accounts with fake information sources, participate in groups, forums, post advertisements for unsecured loans with low interest rates, simple loan procedures, no need to meet in person; bad debt can still be borrowed; no mortgage, no appraisal, only need ID card/Citizen ID and have a bank account/ATM card to be able to borrow money...

When a borrower approaches, the subjects will entice and ask the borrower to provide personal information, such as: full name, phone number, photo of ID card/CCCD, portrait photo... to serve the loan application, then the subjects will ask the borrower to transfer a small amount of money in advance (about 500,000 VND to 5 million VND), to serve the verification and loan approval support...

After enticing borrowers to transfer money to support loan verification and approval, the subjects continued to cite a series of reasons why the loan could not be disbursed due to errors in the borrower's application (such as incorrectly declaring the beneficiary's name, changing the beneficiary's name from lowercase to uppercase, not meeting loan conditions, having an extra or incorrect number on the citizen identification number, etc.).

From there, they ask the borrower to deposit additional funds to secure the loan or fix system errors; promising to refund the amount sent to the customer after the loan is disbursed. However, when the borrower transfers money to the account number provided by the subjects, the subjects will immediately appropriate it and cut off contact.

In case the customer does not transfer money as requested, they will threaten the customer that the customer's loan will be converted to bad debt to demand the transfer of money.

With the above sophisticated fraud tricks, the victim not only loses money but also loses all personal identity information, potentially risking continued exploitation for other illegal activities, such as: registering SIM cards that are not in the owner's name, registering to open bank accounts, e-wallets for fraud, money laundering, online betting, etc.

Banks recommend that customers do not access any website/fanpage/facebook links impersonating bank officers to support quick loans, quick procedures... Do not provide any personal information (ID card/Citizen ID, address, facial recognition image...) without accurately identifying the website, application and identity of the consultant.

Do not provide bank account information, OTP code sent to mailbox, mobile phone to the subjects. Do not transfer money to personal accounts provided by strangers, enticed...

Source

![[Photo] Ho Chi Minh City: Many people release flower lanterns to celebrate Buddha's Birthday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/5d57dc648c0f46ffa3b22a3e6e3eac3e)

![[Photo] General Secretary To Lam meets with Chairman of the Federation Council, Parliament of the Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/2c37f1980bdc48c4a04ca24b5f544b33)

Comment (0)