VinaCapital’s early-year report said that interest rates are expected to stabilize this year and investors will focus on profit growth and stock valuations. Specifically, it forecasts that listed companies’ profits will recover from no growth in 2023 to 10-15% growth in 2024 and over 20% in 2025.

Ms. Nguyen Hoai Thu - General Director of VinaCapital Securities Investment Division believes that the market will still have potential risks and challenges, such as geopolitical tensions or slower-than-expected global economic growth. However, VinaCapita believes in the optimistic outlook of the Vietnamese economy and stock market.

According to VinaCapital, the attractive valuation of the market and some other supporting factors will push the market up in early 2024. With the above profit growth rate, this unit calculates that the P/E of VN-Index will be around 10 times for 2024, about 26% lower than the valuation of ASEAN-5 countries (Singapore, Malaysia, Indonesia, Philippines and Thailand).

To increase the attractiveness of the market, the State Securities Commission, together with relevant agencies and securities companies, are working to put the KRX trading system into operation soon and remove the requirement that institutional investors must deposit 100% of their funds before trading to buy securities. If the Vietnamese stock market is upgraded, VinaCapital estimates that the proportion of Vietnamese stocks will account for about 0.7% to 1.2% in the MSCI and FTSE Russell emerging market indexes, and additional foreign capital inflows into the Vietnamese stock market could reach 5-8 billion USD.

“Some sectors that will have positive prospects in 2024 are information technology, industrial parks, seaports, consumer goods, and businesses benefiting from infrastructure and energy investment projects. In addition, some banks are having attractive valuations and are expected to maintain positive growth in the coming years. However, the business results of each company in the above sectors will be differentiated, so choosing the right business to invest in will be very important,” Ms. Thu shared.

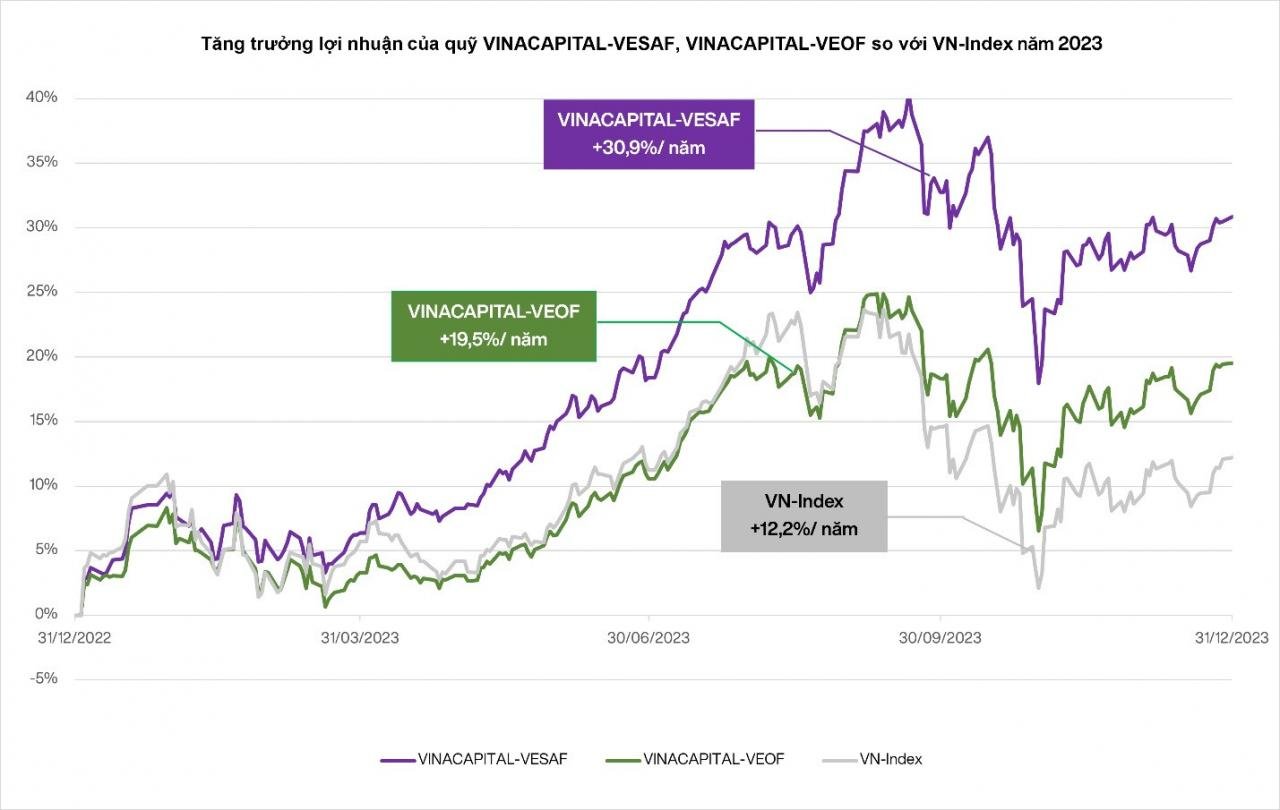

Ms. Thu also said that VinaCapital's open-end equity funds for individual investors often achieve superior returns compared to the market thanks to effective stock screening strategies, applying investment processes and controlling risks throughout. For example, the two open-end equity funds VinaCapital-VESAF and VinaCapital-VEOF achieved returns of 30.9% and 19.5% respectively in 2023, compared to an increase of only 12.2% of the VN-Index.

As of December 31, 2023, VinaCapital-VESAF's average return over the past 3 years was 18%/year, followed by VinaCapital-VEOF in second place with a return of 14%/year. Both VinaCapital equity funds have outperformed the VN-Index, which has an average increase of only 0.8%/year over the past 3 years.

The general consensus of experts predicts that the global economy will not have many positive points in 2024. However, the economic outlook for Vietnam in 2024 is considered to be positive, especially stocks.

VinaCapital's report forecasts Vietnam's GDP to grow by 6-6.5% in 2024, thanks to a recovery in exports and industrial production, and said this will have a spillover effect on people's income, positively affecting economic growth and stocks.

In fact, foreign investors expect the long-term development potential of the Vietnamese economy. Factors such as economic, political and social stability, economic openness, and Vietnam's investment promotion and attraction policies are catalysts that encourage investors to choose Vietnam over other markets. The possibility of upgrading the Vietnamese stock market from a frontier market to an emerging market in the near future is also an attractive factor for foreign investors.

According to data from the General Statistics Office as of December 20, 2023, in the context of slow growth in the world and domestic economies, total registered FDI capital in Vietnam still increased by 32.1% over the same period last year, reaching nearly 36.6 billion USD. Meanwhile, realized FDI capital reached nearly 23.2 billion USD, up 3.5% over the same period last year. This is the highest realized FDI capital in the past 5 years.

The processing and manufacturing industries account for nearly 80% of total realized FDI capital. According to VinaCapital, the growth of FDI capital flows, especially in the processing and manufacturing industries, is clear evidence of foreign investors' confidence in the Vietnamese economy in the long term.

Bich Dao

Source

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)