Joint Stock Commercial Bank for Foreign Trade of Vietnam ( Vietcombank - HoSE: VCB) has just announced unusual information on the Resolution of the Board of Directors approving the withdrawal of the content of the Extraordinary General Meeting of Shareholders (GMS) in 2024.

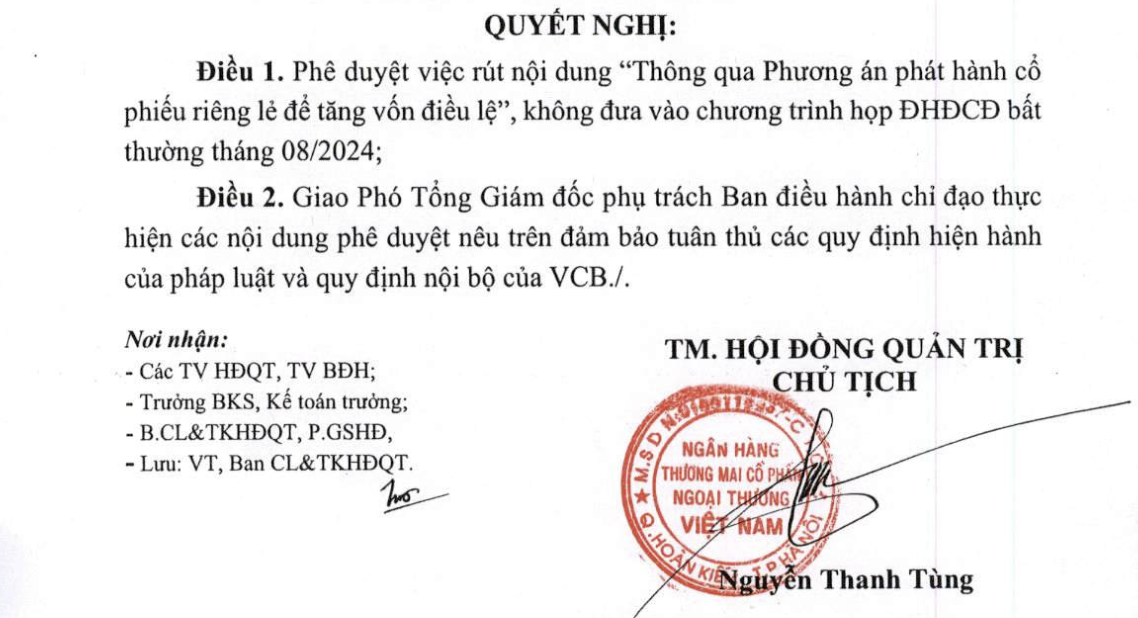

Specifically, Vietcombank's Board of Directors approved the withdrawal of the content "Approval of the method of issuing individual shares to increase charter capital" at the extraordinary General Meeting of Shareholders.

Previously, on June 28, Vietcombank's Board of Directors issued Resolution No. 318 approving the preparation for the extraordinary General Meeting of Shareholders, including approving the expected meeting content on the approval of the above plan.

On July 29, Vietcombank's Board of Directors (BOD) approved the draft documents for the extraordinary shareholders' meeting and posted them on the website. The contents include the private issuance plan and amendments to the operating regulations.

At the same time, the election of additional members of the Board of Directors and members of the Supervisory Board (the list of candidates approved by the State Bank) will be updated and posted after completion according to approval.

Resolution of Vietcombank Board of Directors on withdrawing the content "Approving the plan to issue individual shares to increase charter capital".

In addition to withdrawing the method of issuing individual shares to increase charter capital from the agenda of the August 19 General Meeting of Shareholders. Other contents remain unchanged and will be gradually updated on the website, according to the approval of the State Bank.

According to the documents of Vietcombank's 2024 Annual General Meeting of Shareholders, regarding capital increase, in 2023, the bank completed the payment of dividends in shares from the remaining profits of 2019 and 2020 after tax, after allocating funds and distributing dividends at a rate of 18.1% to increase charter capital to VND 55,891 billion.

Vietcombank is continuing to implement the plan to pay dividends in shares from the remaining profit in 2021 and the remaining accumulated profit up to the end of 2018 (about 27,200 billion VND), and the issuance of individual shares (6.5% of charter capital) to increase charter capital to consolidate and improve financial capacity.

Since 2019, Vietcombank has planned to privately offer 6.5% of its shares. Specifically, the bank plans to privately offer 307.6 million shares to partners. Of which, 46.1 million shares will be offered to Mizuho Bank and 261.4 million shares to other investors.

Before the extraordinary General Meeting of Shareholders, Vietcombank also had changes in senior personnel.

Accordingly, the bank's Board of Directors has appointed Mr. Nguyen Thanh Tung as Chairman of the Board of Directors. Previously, Mr. Tung was a member of the Board of Directors for the 2023-2028 term and General Director of Vietcombank.

The appointment term is from July 26, 2024 until the end of the 2023 - 2028 term. The Bank also dismissed Mr. Lai Huu Phuoc from the position of Head of the Supervisory Board for the 2023 - 2028 term.

The reason given is that Mr. Lai Huu Phuoc was accepted and appointed by the Governor of the State Bank of Vietnam (SBV) to hold the position of Deputy Chief Inspector and Banking Supervisor of the SBV Banking Supervisory and Inspection Agency from August 1 for a term of 5 years from the date of appointment.

At the same time, Ms. Tran My Hanh, Member of the Board of Supervisors, was appointed as Member in charge of the Board of Supervisors for the 2023-2028 term. The appointment period is from August 1 until a replacement decision is made.

Source: https://www.nguoiduatin.vn/vietcombank-hoan-phuong-an-phat-hanh-co-phieu-rieng-le-de-tang-von-204240814095654319.htm

![[Photo] General Secretary To Lam attends the conference to review 10 years of implementing Directive No. 05 of the Politburo and evaluate the results of implementing Regulation No. 09 of the Central Public Security Party Committee.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/2f44458c655a4403acd7929dbbfa5039)

![[Photo] President Luong Cuong presents the 40-year Party membership badge to Chief of the Office of the President Le Khanh Hai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/a22bc55dd7bf4a2ab7e3958d32282c15)

![[Photo] Close-up of Tang Long Bridge, Thu Duc City after repairing rutting](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/086736d9d11f43198f5bd8d78df9bd41)

![[Photo] Panorama of the Opening Ceremony of the 43rd Nhan Dan Newspaper National Table Tennis Championship](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/5e22950340b941309280448198bcf1d9)

![[Photo] Prime Minister Pham Minh Chinh inspects the progress of the National Exhibition and Fair Center project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/35189ac8807140d897ad2b7d2583fbae)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)