In the first 9 months of 2024, Vietbank recorded positive business results with pre-tax profit reaching VND 820.4 billion, up 96% over the same period last year and reaching 78% of the yearly plan.

Positive 9-month business results

Vietnam Thuong Tin Commercial Joint Stock Bank (Code: VBB) announced its financial report for the third quarter of 2024 with net interest income in the first 9 months of the year reaching VND 2,113 billion, up 66% over the same period last year. This is a positive sign in the context of the economy still facing many difficulties.

The bank's service activities also recorded positive results when net profit from service activities reached nearly VND 110 billion, an increase of more than 41% over the same period in 2023.

Thanks to efforts in digital transformation and effective cost reduction in recent times, Vietbank's operating costs only increased slightly by 6% to VND 1,103 billion.

Risk provisioning costs were VND364.5 billion in the context that many businesses and people continue to face difficulties in their ability to pay debts on time, especially after Typhoon Yagi. To help customers overcome difficulties, Vietbank has introduced appropriate solutions and support policies for customers. Recently, the bank continued to reduce loan interest rates from 0.5% to 1.2%/year for customers affected by storms and floods, helping to reduce financial burdens and create favorable conditions for businesses and people to restore production and business activities.

With the above results, at the end of the first 9 months of 2024, Vietbank's pre-tax profit reached VND 820.4 billion, a sharp increase of 96% over the same period last year and reaching 78% of the year plan.

As of the end of September, total assets reached VND151,957 billion, up 10% compared to the beginning of the year. Of which, customer loans were VND90,811 billion, up 13.6%. This is a higher growth rate than the average of the banking industry. Deposits from institutional and individual customers increased slightly to VND91,497 billion.

A representative of the bank's Board of Directors said that in the context of the current macro-economic challenges, Vietbank continues to focus on safe operations, strengthening risk management, complying with regulations, and sustainable development. At the same time, the bank also actively implements measures such as increasing charter capital to enhance financial capacity, increase operational efficiency through improving ROA and ROE ratios, improving service quality, and innovating technology and processes to serve customers.

In 2024, Vietbank sets a pre-tax profit target of VND 1,050 billion, an increase of 29% compared to 2023. Total assets reach VND 150,000 billion; capital mobilization reaches VND 116,000 billion. Total outstanding loans are VND 95,000 billion. This bank aims to expand market share, increase total asset size in both quality and quantity, and control bad debt below 3% according to regulations of the State Bank. Vietbank also aims to increase total assets to VND 170,000 billion by 2025, mobilize capital from market 1 to VND 135,000 billion; total outstanding loans to VND 110,000 billion; charter capital to VND 10,000 billion and pre-tax profit to VND 1,600 billion, bad debt is controlled below 3% of total outstanding loans according to regulations.

Actively expand network, accompany small and medium enterprises

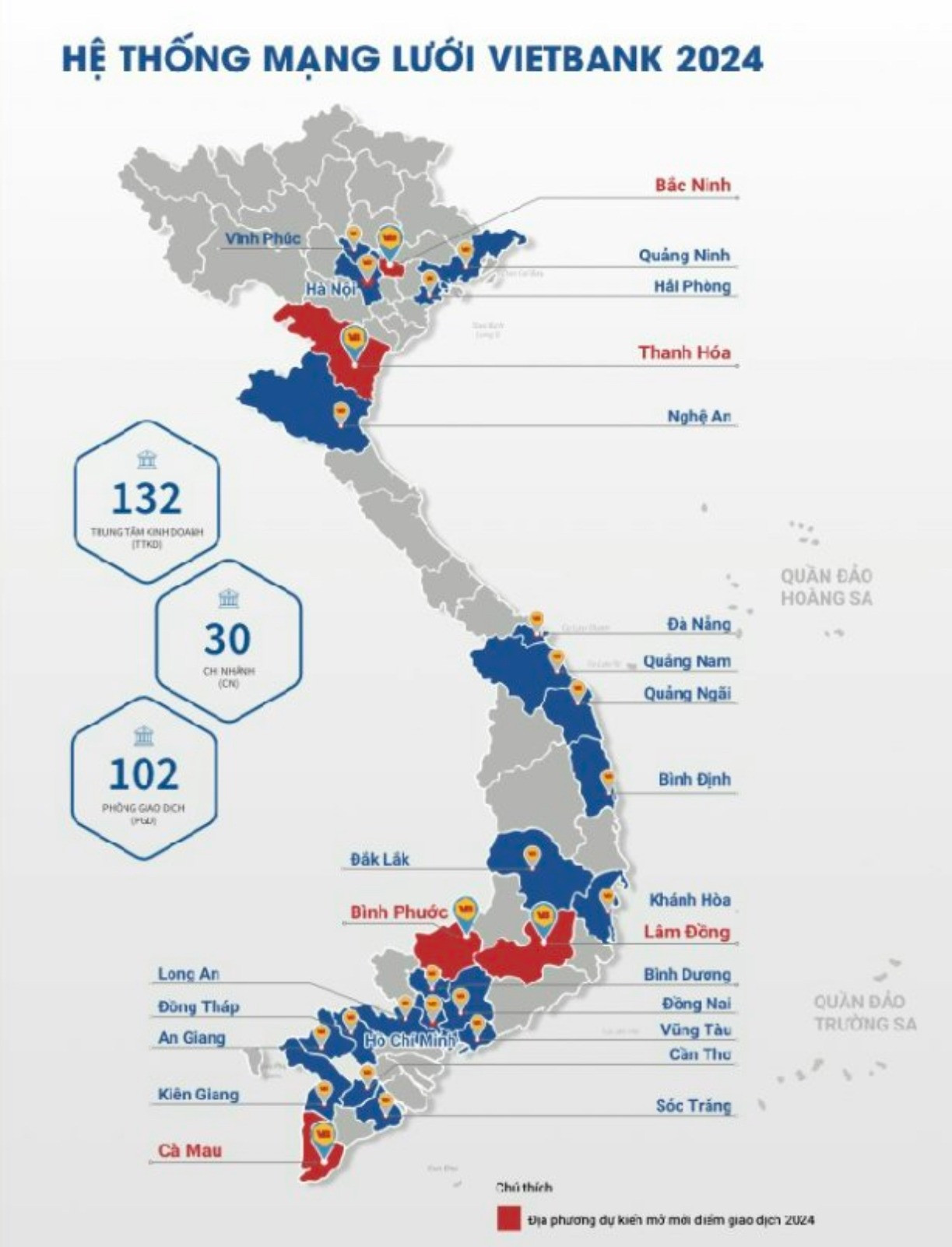

With the goal of covering the nationwide network to bring products and services closer to customers, Vietbank is actively opening many new transaction offices and branches. On October 28, 2024, the bank held the opening ceremony of the 124th transaction point, Vietbank Chau Doc Transaction Office - An Giang Branch in Chau Phu A Ward, Chau Doc City, An Giang Province. Currently, Vietbank has 124 transaction points, including 26 branches and 98 transaction offices. By the end of 2024, this number is expected to increase to 132 transaction points with 30 branches and 102 transaction offices.

Not stopping there, in order to help small and medium enterprises access capital easily, thereby optimizing costs and improving competitiveness, from now until the end of 2024, Vietbank offers the credit package "Easy capital access, business progress". This is a flexible preferential loan package with attractive interest rates from only 6.25% with many fixed term options (3 - 6 - 12 months), empowering businesses to proactively manage working capital and invest in expanding scale.

With flexible loan packages from 500 million VND and simple procedures, small and medium enterprises can easily access capital to invest, build and upgrade facilities, thereby improving competitiveness and expanding production scale, contributing to promoting economic development.

Bui Huy

Source: https://vietnamnet.vn/vietbank-lai-truoc-thue-tang-96-trong-9-thang-2337363.html

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

Comment (0)