Sharing with the press, Ms. Yun Liu, economist in charge of ASEAN markets, HSBC Global Research Department, expects that Vietnam will be the fastest growing economy in the ASEAN region this year. Previously, HSBC assessed that Vietnam has the basis to set the expectation of the economic growth target for 2025 assigned by the National Assembly to the Government of 6.5-7%, striving for 7-7.5%.

Growth "star" in ASEAN bloc

Not long ago, a group of experts from the Foreign Exchange, Capital Markets and Securities Services Division of HSBC Vietnam Bank published a report assessing the macroeconomic situation over the past year as well as reviewing the prospects for the upcoming year 2025.

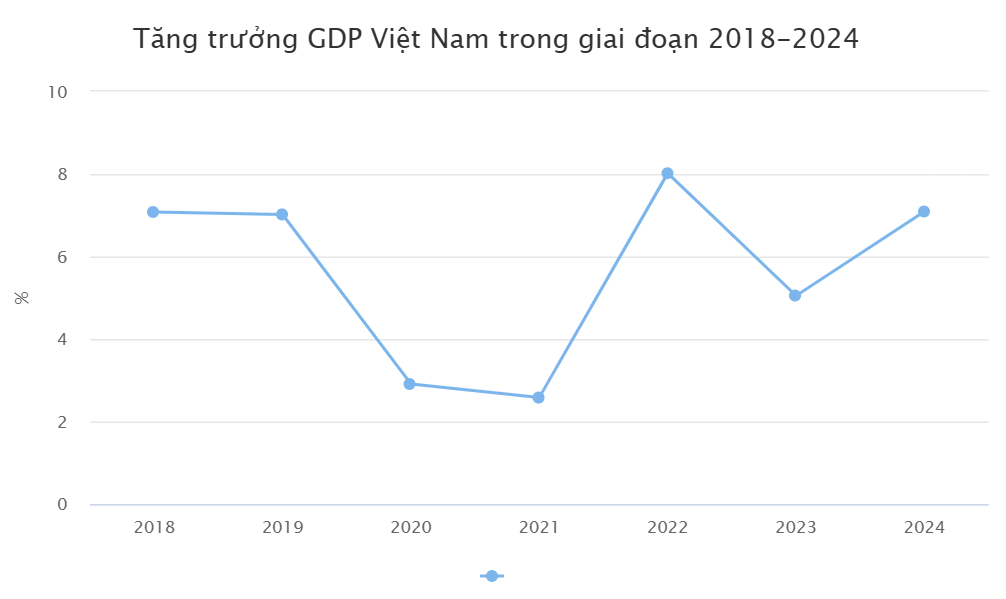

HSBC experts assessed that Vietnam's economy has experienced an economic year with many ups and downs. After a difficult start in the first quarter of 2024, the domestic economic picture has been mostly more positive as the recovery momentum has gradually strengthened over the months of the year, quickly bringing Vietnam back as a growth "star" in the ASEAN bloc.

Specifically, growth improved and unexpectedly increased to 6.9% in Q2 and 7.4% in Q3 2024 compared to the same period last year. The recovery has begun to expand to other sectors beyond consumer electronics, although domestic consumption has not been too positive despite witnessing incremental improvements.

Regarding the economic growth target for 2025 assigned by the National Assembly to the Government of 6.5-7%, striving for 7-7.5%, higher than the plan and equivalent to the Government's target this year, which is over 7%, reflecting expectations of improvement in economic activities next year.

HSBC believes that Vietnam has grounds to set this expectation. The manufacturing sector has emerged strongly from last year's difficulties. This has supported strong double-digit export growth, with growth spreading more evenly across sectors such as agricultural products.

Following the strong recovery in Q3/2024, HSBC raised its GDP growth forecast for 2024 to 7.0% from 6.5%, while maintaining its GDP growth forecast for 2025 at 6.5%. In addition, HSBC maintained its inflation forecast for Vietnam at 3.6% in 2024, well below the State Bank of Vietnam's target ceiling of 4.5%. For 2025, HSBC maintained its inflation forecast at 3.0%.

In addition to positive forecasts, HSBC has pointed out risks that the Vietnamese economy may face in 2025.

In addition to global energy prices, Vietnam is also vulnerable to food shocks, according to HSBC. For example, pork prices have increased due to pork supply being affected by African swine fever. Or the risks related to tariffs when Mr. Trump officially takes office as US President in January 2025.

How much demand for goods improves will be key to determining the strength of the recovery, as Western markets account for nearly half of Vietnam’s exports. Therefore, the trajectory and pace of consumer spending in these markets should be closely monitored, HSBC advised.

The bank said it was too early to assess the specific impact of the Trump administration’s policies. However, any policy would affect ASEAN, including Vietnam, in various ways, according to the group of experts.

With Mr. Trump's intention to impose a blanket tariff of 10-20% on all goods imported into the US, exporters of some domestic products may have difficulty finding alternative markets if this policy is implemented.

For example, Vietnam’s garment and footwear exports to the US account for more than 40% and 33%, respectively. Europe is the second largest market for these products, but it is difficult to fully absorb them in the short term. However, Vietnam can hedge against potential tariff risks from the US in the medium to long term through its many free trade agreements (FTAs).

In addition, the risk of a possible resurgence of exchange rates is an issue that HSBC believes is worth paying attention to. Vietnam was labeled a “currency manipulator” by the US Treasury Department in December 2020, before being removed from the list in April 2021. However, Vietnam remains on the US Treasury Department’s most recent monitoring list, meaning that trade data needs to be closely monitored.

The USD’s performance is also a factor to consider for the upcoming exchange rate trend. With an uneven recovery and a high growth target for next year, HSBC expects the State Bank to maintain a flexible monetary policy, keeping the operating interest rate unchanged at 4.5% until the end of 2025.

Fastest growing ASEAN in 2025?

Speaking to the Government Electronic Newspaper, Ms. Yun Liu commented that Vietnam started 2025 with a fairly solid foundation. The three main factors driving Vietnam's growth this year include trade, FDI and public investment.

HSBC economists believe that Vietnam will have strong growth in 2025 despite facing some risks to growth, especially in the trade sector as Vietnam has a more open economy and is heavily dependent on global trade.

"We see a lot of uncertainty in global trade, especially with regard to the new US administration's tariff policies. However, there are still favorable factors, such as the prospect of foreign direct investment (FDI) and domestic consumption recovering from unexpected impacts. Therefore, I think 2025 will be challenging for Vietnam, but at the same time, it will also open up many opportunities," Ms. Yun Liu shared.

According to HSBC economists, the FDI story has been a key factor in Vietnam’s development over the past decade. Vietnam is becoming an increasingly attractive destination for many foreign investors and has good incentives to attract high-quality FDI. In the coming years, Vietnam’s goal is to move up the value chain, attract more stable and high-quality FDI, and diversify its investment portfolio.

In addition, domestic consumption has recovered more slowly than the overall economic recovery over the past two years. However, HSBC experts hope that this year, domestic consumption will catch up with the growth of trade, thereby creating the necessary momentum to promote stronger growth of Vietnam's economy.

HSBC welcomed some very encouraging policies from the Government, including the extension of the 2% VAT reduction for the first 6 months of 2025. In addition, an important factor in maintaining strong growth is the Government's efforts to accelerate the disbursement of public investment capital. The progress of public investment disbursement plays a key role in maintaining growth.

Referring to the long-term potential of Vietnam's capital market, Ms. Yun Liu said that Vietnam's capital market has a lot of potential. Currently, Vietnam still relies heavily on credit to mobilize capital, which can increase risks when economic conditions weaken. Therefore, developing and improving the capital market is very important, especially in diversifying and expanding capital mobilization channels. This will help strengthen Vietnam's financial resilience. In addition, many investors hope to open up Vietnam's capital market through the upgrade to emerging market status this year.

Source: https://baodaknong.vn/viet-nam-tang-truong-nhanh-nhat-asean-trong-nam-2025-243030.html

Comment (0)