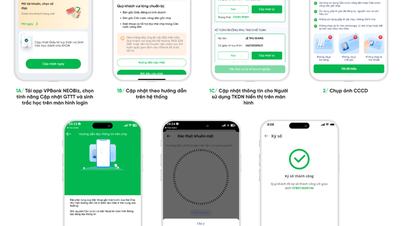

Statistics in the first half of 2024 show that the market welcomed more than 750,000 new securities trading accounts, meaning that on average, hundreds of thousands of accounts were added each month. Most of them came from domestic individuals. This is also the group of investors who have disbursed more than 2 billion USD in net stock purchases since the beginning of the year. This is a signal that the stock market is on the rise and the need to allocate a portion of capital to this investment channel is increasing. But in reality, many new investors lack experience in the market, do not have enough resources (time, knowledge, information, etc.) or a foundation to seek profits in the market. Difficulties in preserving capital and maintaining "achievements" are the reasons why a number of investors leave the market or reduce their scale. This reality raises the need for professional investment support products. Professionalism is mentioned because to solve the problem of asset growth for the majority, supporting products need to be able to replicate, apply to a large enough part, and accumulate over the long term. Professionalism helps investors feel more secure when "choosing a face to entrust" their capital. This need will be met more easily in the position of organizations and professional investors as this is the target segment of fund management companies in the market. As for individuals who want to access the stock investment channel in a simple and professional way but still have to optimize capital flow, grow assets according to the trend of "accumulating small amounts to make a big amount", is there any comprehensive solution for the above needs? Listening to the needs and realizing the goal of "cultivating prosperity" for customers, VPBank Securities (VPBankS) has built a sample portfolio asset product (ePortfolio) and has been widely accepted by customers. The value of assets under management (AuM) has continuously increased over time. In the spirit of building a highly "tailored" product to meet diverse needs, the number of sample portfolios is continuously expanded and updated by VPBankS experts according to the developments of the general market. Investors have more options to suit their investment strategy and taste. Most recently, Life Portfolio was designed by VPBankS based on growth and value strategies, with the stock selection criteria of two investment geniuses, Warrant Buffett and Philip Fisher. VPBankS's ePortfolio sample portfolio "basket" adds diversity to the previously launched portfolios with outstanding performance such as Competitive Advantage, Trend Investing, Growth Finance, Stable Dividend.

Statistics in the first half of 2024 show that the market welcomed more than 750,000 new securities trading accounts, meaning that on average, hundreds of thousands of accounts were added each month. Most of them came from domestic individuals. This is also the group of investors who have disbursed more than 2 billion USD in net stock purchases since the beginning of the year. This is a signal that the stock market is on the rise and the need to allocate a portion of capital to this investment channel is increasing. But in reality, many new investors lack experience in the market, do not have enough resources (time, knowledge, information, etc.) or a foundation to seek profits in the market. Difficulties in preserving capital and maintaining "achievements" are the reasons why a number of investors leave the market or reduce their scale. This reality raises the need for professional investment support products. Professionalism is mentioned because to solve the problem of asset growth for the majority, supporting products need to be able to replicate, apply to a large enough part, and accumulate over the long term. Professionalism helps investors feel more secure when "choosing a face to entrust" their capital. This need will be met more easily in the position of organizations and professional investors as this is the target segment of fund management companies in the market. As for individuals who want to access the stock investment channel in a simple and professional way but still have to optimize capital flow, grow assets according to the trend of "accumulating small amounts to make a big amount", is there any comprehensive solution for the above needs? Listening to the needs and realizing the goal of "cultivating prosperity" for customers, VPBank Securities (VPBankS) has built a sample portfolio asset product (ePortfolio) and has been widely accepted by customers. The value of assets under management (AuM) has continuously increased over time. In the spirit of building a highly "tailored" product to meet diverse needs, the number of sample portfolios is continuously expanded and updated by VPBankS experts according to the developments of the general market. Investors have more options to suit their investment strategy and taste. Most recently, Life Portfolio was designed by VPBankS based on growth and value strategies, with the stock selection criteria of two investment geniuses, Warrant Buffett and Philip Fisher. VPBankS's ePortfolio sample portfolio "basket" adds diversity to the previously launched portfolios with outstanding performance such as Competitive Advantage, Trend Investing, Growth Finance, Stable Dividend.

Verified by historical data, Life Portfolio has performance more than 3 times higher than VN-Index

Outstanding performance of Life Portfolio. Photo: VPBankS.

![[Photo] Award ceremony for works on studying and following President Ho Chi Minh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/a08ce9374fa544c292cca22d4424e6c0)

![[Photo] Vietnamese shipbuilding with the aspiration to reach out to the ocean](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/24ecf0ba837b4c2a8b73853b45e40aa7)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)