Must stop placing orders with robots and algorithms due to... overload

In a recent dispatch sent to securities companies, the State Securities Commission (SSC) has require securities companies to review and immediately stop using automatic order placement; at the same time, take technical measures to prevent automatic order placement and require investors to stop using the above form without permission from the management agency. Accordingly, through the management and supervision of online securities trading service provision activities, the State Securities Commission has noticed the phenomenon of using robot technology to place automatic online securities trading orders with high frequency.

The State Securities Commission requires securities companies to immediately stop using robots to place automatic orders.

Automatic order placement causes a sudden increase in orders from securities companies to the Stock Exchange at the same time, leading to the number of orders entering the floor exceeding the design capacity of the entire system, causing system overload.

At the same time, this activity also poses the risk of a chain breakdown when the stock market is in a bad situation, thereby negatively affecting the risk management of securities companies. The State Securities Commission requires securities companies to strictly implement and take full responsibility before the law for the above issues.

Going against the needs and development trends?

The request of the State Securities Commission was made in the context of market liquidity continuously increasing in recent months with consecutive trading sessions reaching over 1 billion USD. In fact, many securities companies have applied algorithms or automatic order placing robots, increasing the frequency of placing orders in recent times.

Automatic order placement by robot or algorithm is the need and trend of stock investors

According to Mr. Nguyen The Minh - Director of Analysis, Yuanta Vietnam Securities Company - the requirement of the State Securities Commission will affect transactions in the market but not too much. Because the regulations do not allow it, the automatic order placement service is only provided in small groups and is not popular. This service is provided by securities companies to investors to increase transaction efficiency or to those who do not have time to directly monitor market transactions.

However, Mr. Nguyen The Minh said that in the world, automatic order placement and the use of robots have been applied for a long time, and there are even many other tools to support investors' transactions, especially when artificial intelligence develops. Therefore, the State Securities Commission can consider a roadmap for application. Particularly, to avoid system overload, it is necessary to quickly upgrade or accelerate the use of the new information technology system - KRX. At that time, along with the application of many new products and solutions such as shortening transaction time, allowing short selling..., automatic order placement, even copy trade services (algorithms that allow investors to copy the transactions of brokers...) are the needs of investors.

Agreeing, the general director of a securities company in Ho Chi Minh City commented that with the issuance of a document requesting to stop placing automatic orders, the market may also be affected but not much. However, the use of order-placing robots is no longer strange in the world financial market, even in many places it is considered an old technique and they are moving towards using artificial intelligence (AI) with many newer features. The State Securities Commission makes investors think that the current information technology system is outdated and weak.

Therefore, the most important and necessary thing is that the State Securities Commission must quickly put the KRX information technology system into operation after more than a decade. It is necessary to accelerate the upgrading of infrastructure to put into use many new trading products for the market. Only then can we accelerate the upgrading of the Vietnamese stock market, attracting more large investors in the world.

Source: https://thanhnien.vn/vi-sao-uy-ban-chung-khoan-nha-nuoc-yeu-cau-ngung-su-dung-robot-dat-lenh-185230910144815549.htm

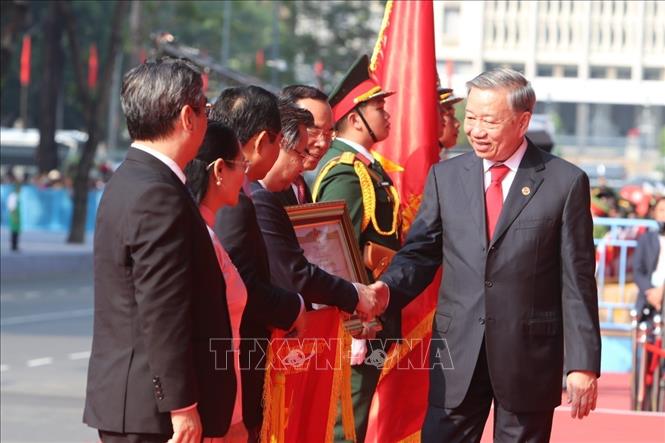

![[Photo] General Secretary To Lam presents the title "Hero of Labor" to the Party Committee, Government and People of Ho Chi Minh City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/08a5b9005f644bf993ceafe46583c092)

![[Photo] Flag-raising ceremony to celebrate the 50th anniversary of the Liberation of the South and National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/175646f225ff40b7ad24aa6c1517e378)

![[Photo] Demonstration aircraft and helicopters flying the Party flag and the national flag took off from Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/b3b28c18f9a7424f9e2b87b0ad581d05)

Comment (0)