Consumer credit has always played an important role in the socio-economic development of the country. Promoting consumer lending is considered an important solution to limit access to capital from informal channels, typically “black credit”, helping to reduce consequences and contribute to ensuring social security and order.

Statistics from the State Bank of Vietnam show that consumer credit activities in Vietnam have grown strongly in recent years in terms of outstanding loan size, number of participating credit institutions and diversity of products and services. To date, the total outstanding loan balance for living and consumption in Vietnam has reached about VND 2.8 million billion, equivalent to 20% of the total outstanding credit balance of the entire economy, becoming an important part of the credit structure of the credit institution system.

The economy is forecast to continue to grow positively, and Vietnam's consumer finance market is also expected to improve. First of all, these expectations stem from changes and improvements in policies when the State Bank of Vietnam recently issued Circular No. 12/2024/TT-NHNN amending and supplementing a number of contents of Circular No. 39/2016/TT-NHNN regulating lending activities of credit institutions and foreign bank branches to customers.

The new points of the policy will contribute to promoting stronger participation from commercial banks in consumer lending activities, thereby promptly and fully meeting the legitimate borrowing needs of the people. Notably, a new point in the circular is the regulation allowing credit institutions to lend amounts under 100 million VND without requiring customers to provide a feasible capital usage plan.

Instead, customers only need to provide minimal information on legal capital use and financial capacity before credit institutions lend capital. These changes are expected to help customers access small loans more easily and conveniently, especially people in remote areas and low-income people.

In addition, a report from Fiin Group shows that the consumer finance market is entering a new growth cycle. The market recovery will be more evident from the second half of 2024. In the short term, the recovery will be supported by positive signs from the macroeconomic environment including the expected recovery of manufacturing and export sectors, credit quality and credit demand of workers, unskilled workers, low- to middle-income earners who are the main customer groups in the consumer lending sector, and from the digitization of the customer journey, improving customer experience and increasing customer retention rates.

However, despite many signs of recovery, the consumer finance market is also facing many challenges, especially in the context of a general increase in bad debt at credit institutions. bad debt in the consumer lending sector is still quite worrying. Recently, there have been groups that entice and advise each other on how to default on debt, delay debt repayment, etc. on social networks. Although the lending units themselves have taken measures and the authorities have intervened, debt collection for this group of customers still faces many difficulties and challenges. Therefore, for the consumer finance market to truly recover and grow sustainably, many changes are needed from improving the legal environment, especially the regulations guiding debt collection.

Consumer lending organizations, in addition to being transparent in debt collection activities, loan costs, etc., also need to have measures to check and monitor the use of loans for the right purposes as committed and the repayment of debts by customers. This will help credit organizations limit bad debts, ensure the ability to recover principal and interest in full and on time as agreed. In addition, borrowers themselves must also be aware of responsible consumption and timely repayment.

Source

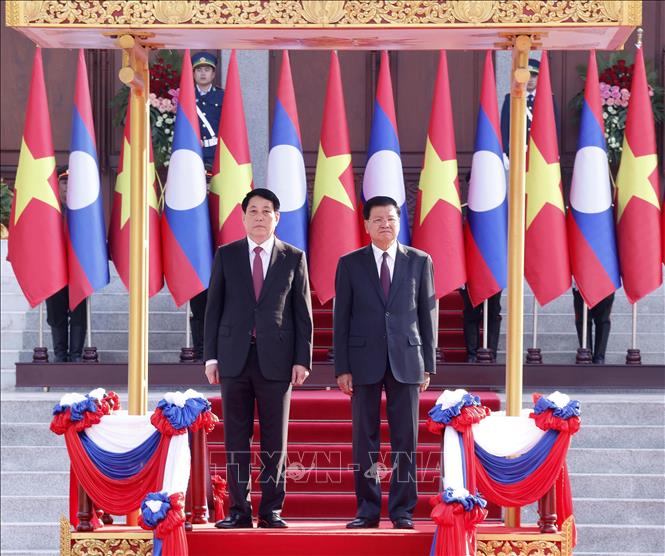

![[Photo] President Luong Cuong meets with Lao National Assembly Chairman Xaysomphone Phomvihane](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/dd9d8c5c3a1640adbc4022e2652c3401)

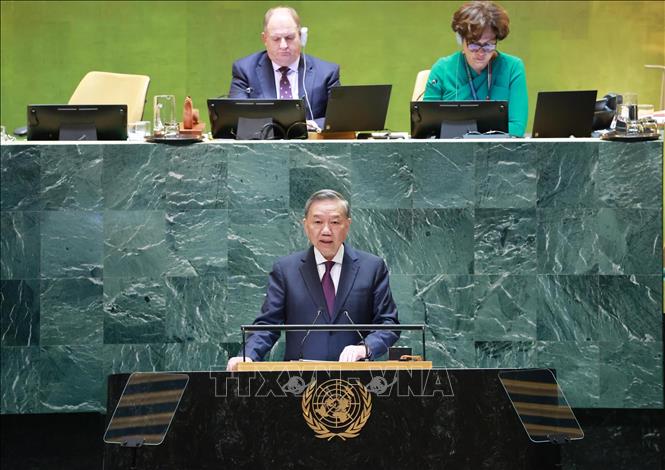

![[Photo] General Secretary To Lam receives Philippine Ambassador Meynardo Los Banos Montealegre](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/24/6b6762efa7ce44f0b61126a695adf05d)

![[Photo] Liberation of Truong Sa archipelago - A strategic feat in liberating the South and unifying the country](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/d5d3f0607a6a4156807161f0f7f92362)

![[Photo] President Luong Cuong holds talks with Lao General Secretary and President Thongloun Sisoulith](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/24/98d46f3dbee14bb6bd15dbe2ad5a7338)

Comment (0)