In the restructuring plan sent to the State Bank in 2012, the new leaders taking over TPBank built a roadmap with solutions to revive the bank. One of the items included was “Technology”.

After more than a decade, with the enthusiasm and vision of the leaders, technology has become the guiding principle in the development orientation, creating a breakthrough for the Purple Bank in the financial industry. The decision of Chairman Do Minh Phu became an important turning point, bringing TPBank from the smallest unit in the system to a brand in the top 5 largest private banks in Vietnam.

“ The application of technology in the banking industry actually comes from people's way of thinking ,” said Mr. Nguyen Hung, General Director of TPBank, who has been running the bank for over 10 years.

Chairman of the Board of Directors Do Minh Phu, a businessman who led TPBank to become a leading bank in the market after 10 years.

“ Before entering the financial sector, we saw that most banks were not truly customer-centric ,” Chairman of the Board of Directors Do Minh Phu recalled his thoughts when he first took over the bank.

TPBank changed its fate - from a unit with tens of thousands of customers and was classified as having to restructure, to a bank that nearly reached the 8,000 billion VND profit mark last year with more than 10 million customers - thanks to a different digital transformation philosophy. In that philosophy, digital transformation does not originate from computer chips, but from the human heart. The digital transformation journey begins with the questions: how are customers living?

Unnamed, difficult tasks that no one does, TPBank is a pioneer

Mr. Nguyen Hung, General Director of TPBank shared: “ TPBank chooses to dive into customers’ needs to find solutions through digitalization.” The purple color of the brand has penetrated the lives of more than 10 million people.

Technology was chosen as a competitive advantage from the beginning. TPBank Chairman Do Minh Phu and Vice Chairman Do Anh Tu are entrepreneurs who built their careers in fields where “retailing is everywhere and products need to be designed from user needs such as sanitary napkins, or perfect services such as gold jewelry”.

That is what the people who created the Diana and DOJI brands want to bring to the banking industry. They believe that they will build a bank that is “truly customer-centric ”.

Every feature on TPBank products is carefully crafted.

Open the TPBank application today, you will easily find the function of sharing balance fluctuations to other accounts. Shop owners can also easily download another TPBank application to turn their phones into card acceptance devices to replace POS machines - another small need - but TPBank cares.

One of TPBank's prides is ChatPay - a money transfer function with a conversational interface. TPBank believes that ChatPay's need to quickly track certain cash flows is very useful for many people. They are right: among TPBank's customers, for every 5 regular eBank users, there is one ChatPay user. This is also a feature that is especially loved by young people because of the new experience.

The number of functions and tools connected to the TPBank app is now so large that it has its own search engine. The service ecosystem that TPBank integrates into its application alone has reached more than 2,000 service heads.

TPBank application with trendy utilities chatpay, voicepay.

By applying the most advanced technology such as AI and Big Data in research, TPBank creates a smart eBank interface, understands what customers need, prioritize and desire most to bring to users. Operations and processes are shortened, bringing the fastest and most convenient.

Digital age, digital thinking, digital creativity

“ In a digital age, leaders must think digitally ,” said CEO Nguyen Hung, quoting Steve Balmer, co-founder of Microsoft.

Customers' digital mindset can be shaped by the tools they are served with: after all, people will naturally choose the fastest and most convenient.

After efforts to protect with the management agency, TPBank became the first bank to participate in the pilot of opening accounts through "electronic customer identification" (eKYC) - that is, customers can authenticate their identity through video call technology, biometric identification and a series of technologies to check the authenticity of ID cards/CCCDs and thereby open an account at LiveBank, without having to go to the counter.

59% of LiveBank transactions nationwide take place between 5pm and 7am the next day, not everyone can transact during business hours. A digital touchpoint allows them to do that, even in the middle of the night.

LiveBank is Vietnam's first 24/7 automated bank, a symbol of the digital transformation of TPBank in particular and the Vietnamese banking industry in general.

LiveBank is also known as TPBank's "technology hub". There, new technologies are tested. In 2020, TPBank confidently became the first bank to announce the completion of the eKYC process - electronic identification on mobile applications. From that time, customers can open accounts and cards on the application without going to the counter.

Bao Anh

Source

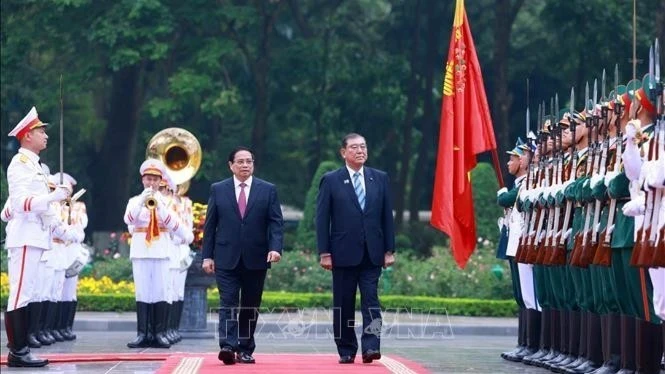

![[Photo] Welcoming ceremony for Japanese Prime Minister Ishiba Shigeru and his wife](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/1c97f7123f4f47078488e8c412953289)

![[Photo] Enjoying the experience of enjoying specialty coffee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/cb4f5818052e479392e8b3ad06cb1db0)

![[Photo] Prime Minister Pham Minh Chinh holds talks with Japanese Prime Minister Ishiba Shigeru](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/ee88e7119877496a9a73bb456f3414d3)

![[Photo] Fireworks light up Hanoi sky to celebrate national reunification day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/5b4a75100b3e4b24903967615c3f3eac)

Comment (0)