POS payment solution is considered the fastest, safest and most convenient payment tool for both sellers and buyers.

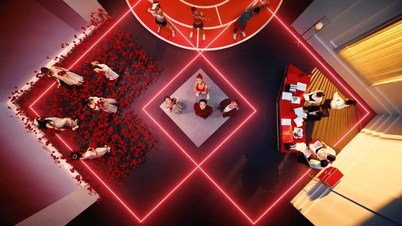

Deploying POS payment solution for small traders and business households. Photo: Techcombank

Cashless payments are on the rise At the end of March 2024, Visa - the world's leading electronic payment technology company - announced the latest insights into the payment landscape in Vietnam in the Consumer Payment Attitudes Study 2023 report. The report shows that the trend of switching to modern electronic payment methods is becoming increasingly popular in Vietnam. Accordingly, 56% of Vietnamese users participating in the survey are carrying less cash than the previous year, demonstrating consumers' proactive embrace of new financial technologies. In particular, young users are currently playing the role of a pioneering generation driving the growth of cashless payments, with 89% of survey participants having successfully accessed digital payment methods in their daily lives. In fact, in all needs of life, cashless payments have become very popular. For consumers, diversifying cashless payment methods for expenses has become a convenient habit when they do not have to carry money with them. "Now I don't need to carry cash anymore, all payments are now transferred quickly and conveniently. From vegetables to household goods or clothes... All stores accept QR or card payments, at least they can transfer money", Ms. Lan Anh in Ho Chi Minh City shared. For payment acceptance units such as small businesses, traders or stores, they must diversify payment methods to meet all payment needs of "customers". In the context that consumers can "get used to" any form of "paying the way they like", the "timeliness" of traders and stores must also be very fast. "Customers are kings. Whatever payment method they want, I will accept it to make them happy. Usually, nowadays everyone likes to swipe QR Code for quick payment or POS payment, bank transfer, everything is fast, safe, and does not waste time for both parties. In addition, I do not need to carry a lot of cash to deposit money to pay for goods and tracking revenue is also easy on electronic banking" - Ms. Thanh Ngan, owner of a fabric stall at Ben Thanh market, Ho Chi Minh City, shared. However, to pay by POS machine, there are many constraints, the fee is also quite high, so often for small traders the cost burden will be quite large: the cost of buying a POS machine can be up to 10 million VND depending on the machine model. Convenient cashless payment solution for supply and demand

SmartPOS & SoftPOS - two leading cashless payment solutions on the market today, deployed by Techcombank. Photo: Techcomnbank

In order to meet the payment needs of "Flexible - Convenient - Fast" for customers, some banks have pioneered in offering superior payment solutions for merchants - small traders and business households. Among them are SmartPOS & SoftPOS - two leading cashless payment solutions on the current market, deployed by Techcombank. "With an understanding of the needs and problems of small business owners or stores, Techcombank always invests in research and offers solutions suitable for each need of this customer group. In which, payment solutions are regularly updated by the bank to meet user trends and the reality of the scale of payment acceptance points. As a leading bank in technology investment, cashless payment solutions are continuously applied by Techcombank to best accompany customers and bring outstanding values and experiences", Techcombank leaders shared. With SoftPOS, the solution helps merchants accept multi-payment methods without using a specialized POS device. Just install the Techcombank ePOS application, which will turn your Android phone/tablet into a device that accepts QR code/contactless card payments thanks to the integration of NFC (contactless) technology. This solution is suitable for businesses with less than 5 stores, allowing users to install the application on smartphones or tablets, accepting international cards (Visa, Master) & domestic cards; supporting contactless payments; only issuing electronic invoices; 100% free transaction fees when paying via QR; preferential card transaction fees with card payment turnover under 1.9 billion VND/year. In addition, depending on the needs and actual use, store owners can use the SmartPOS payment method - a 2-in-1 payment receiving solution, integrating a variety of cashless payment methods on a single device. This payment method will be suitable for businesses with 5 or more stores with specialized payment devices; accepting international cards (Visa, Master, JCB) & domestic cards and supporting card swiping or contactless payments, issuing electronic invoices and paper invoices. For the SmartPOS solution, the card transaction processing fee is preferentially low and the more transactions the store makes, the lower the fee. At the same time, Techcombank waives the equipment rental fee for the first year, the rental fee from the second year is only 200,000 VND/month. To encourage stores and businesses to use it, Techcombank offers many incentives for store owners when registering to use the SoftPOS solution with preferential card transactions from only 0.5%; exempting all service fees until December 31, 2024; 100% exemption of transaction processing fees from now until December 31, 2024. After 12 months of implementing personalized value propositions for small traders and business households, by the end of the second quarter of 2024, Techcombank has recorded positive feedback from more than 600,000 small traders and business households nationwide, especially with many positive results in the first half of 2024. The average number of new merchant accounts opened per month in the first 6 months of 2024 increased by 45%. With modern payment solutions leading the market, Techcombank continues to be the right choice for businesses and stores to develop in the best way. Source: https://tuoitre.vn/trien-khai-giai-phap-nhan-thanh-toan-qua-pos-cho-tieu-thuong-ho-kinh-doanh-2024111518133362.htm

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

Comment (0)