The financial system is the lifeblood of the economy , playing the role of providing capital directly or indirectly to the market, helping to promote production, investment and consumption activities. In the context of an ever-changing economy, the role of non-bank financial institutions, especially the group of securities and financial companies, is increasingly important.

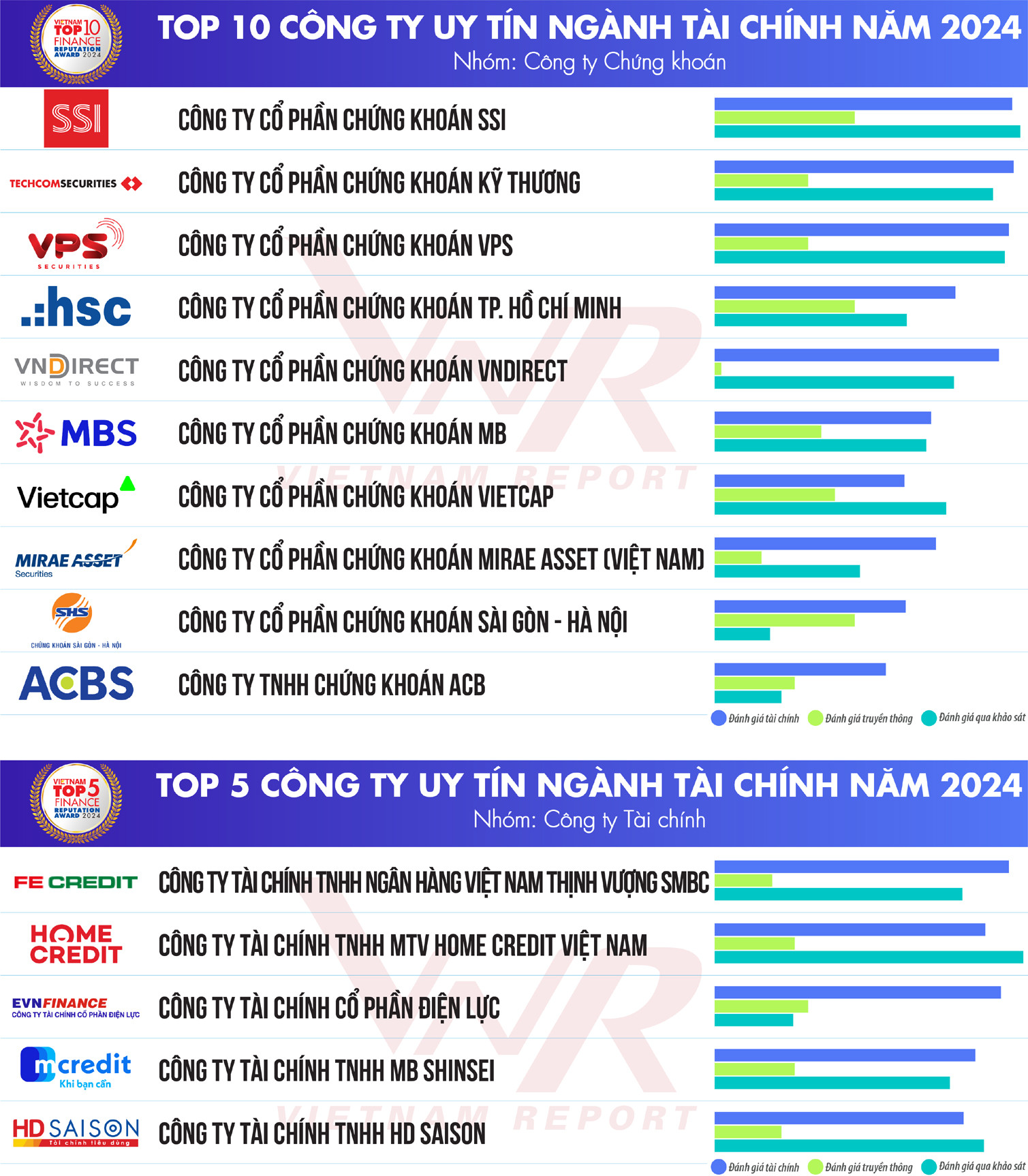

Top 10 reputable companies in the Finance industry are built on scientific and objective principles, with 3 main criteria: (1) Financial capacity shown in the most recent financial report; (2) Media reputation assessed by Media Coding method; (3) Survey of research subjects and stakeholders.

Financial Market Picture 2023: Alternating Bright and Dark Spots

Securities companies have shown a strong recovery in business results in 2023, after the bottom recorded the previous year due to a series of events in the real estate and banking markets.

By the end of 2023, the number of securities accounts will reach 7.2 million, an increase of nearly 400,000 accounts compared to 2022. However, the journey to upgrade the Vietnamese stock market is still unfinished.

Meanwhile, the group of financial companies faced many difficulties when the economy did not grow as expected, inflation pushed interest rates up and only decreased in the second half of the year, greatly affecting consumer demand and people's ability to pay. According to the State Bank, the total assets of financial and leasing companies as of the end of January 2024 decreased by more than VND 6,900 billion compared to the end of 2023 and decreased by nearly VND 15,000 billion in the period from the end of 2022 to the beginning of 2024, clearly reflecting the difficult situation of the industry.

Finance industry is closely linked to economic recovery in 2024

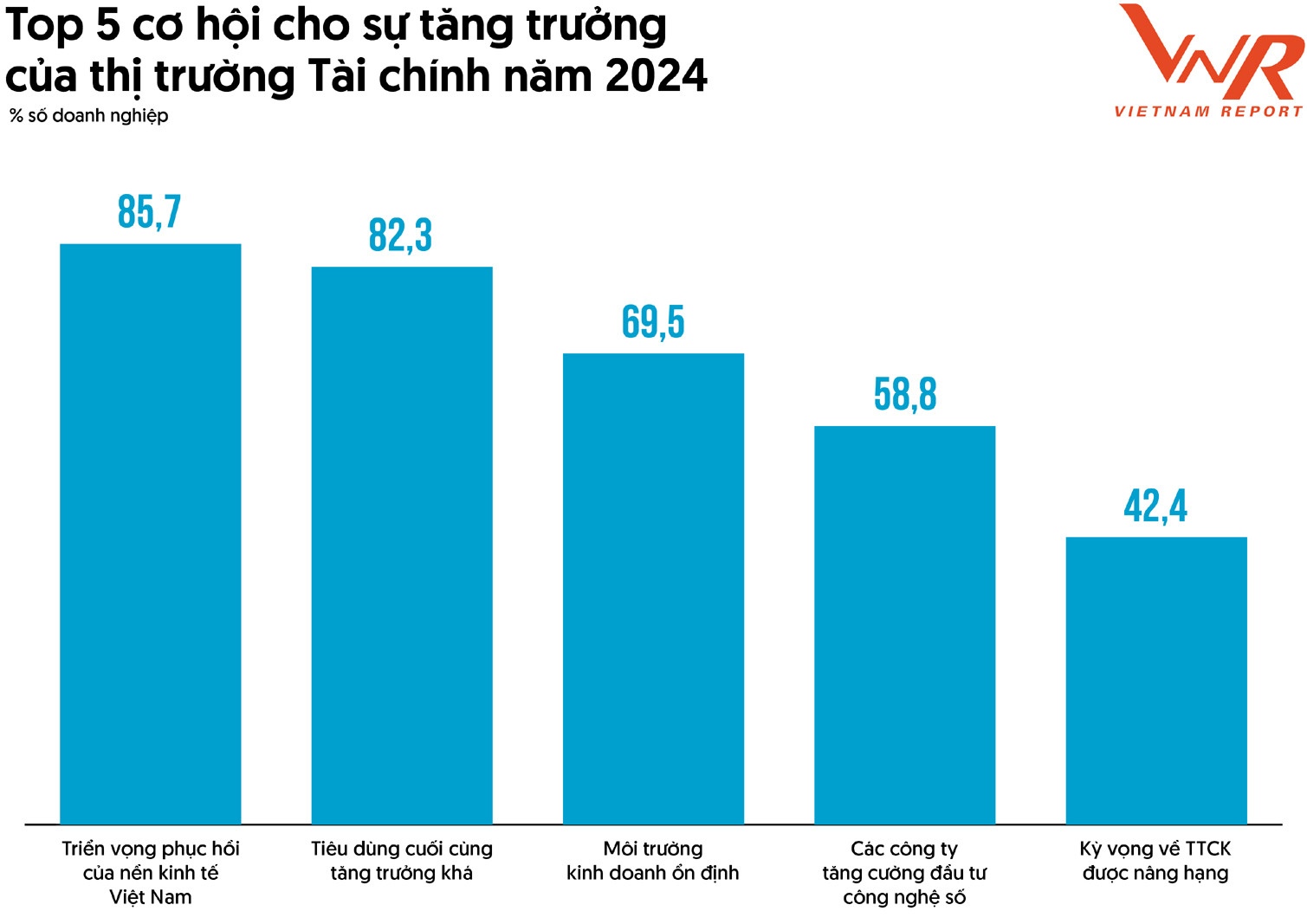

According to a survey by Vietnam Report, 85.7% of businesses and experts in the Finance sector believe that the recovery prospects of the Vietnamese economy are the biggest opportunity for market growth, followed by macro factors such as fairly high growth in final consumption, stable business environment, etc.

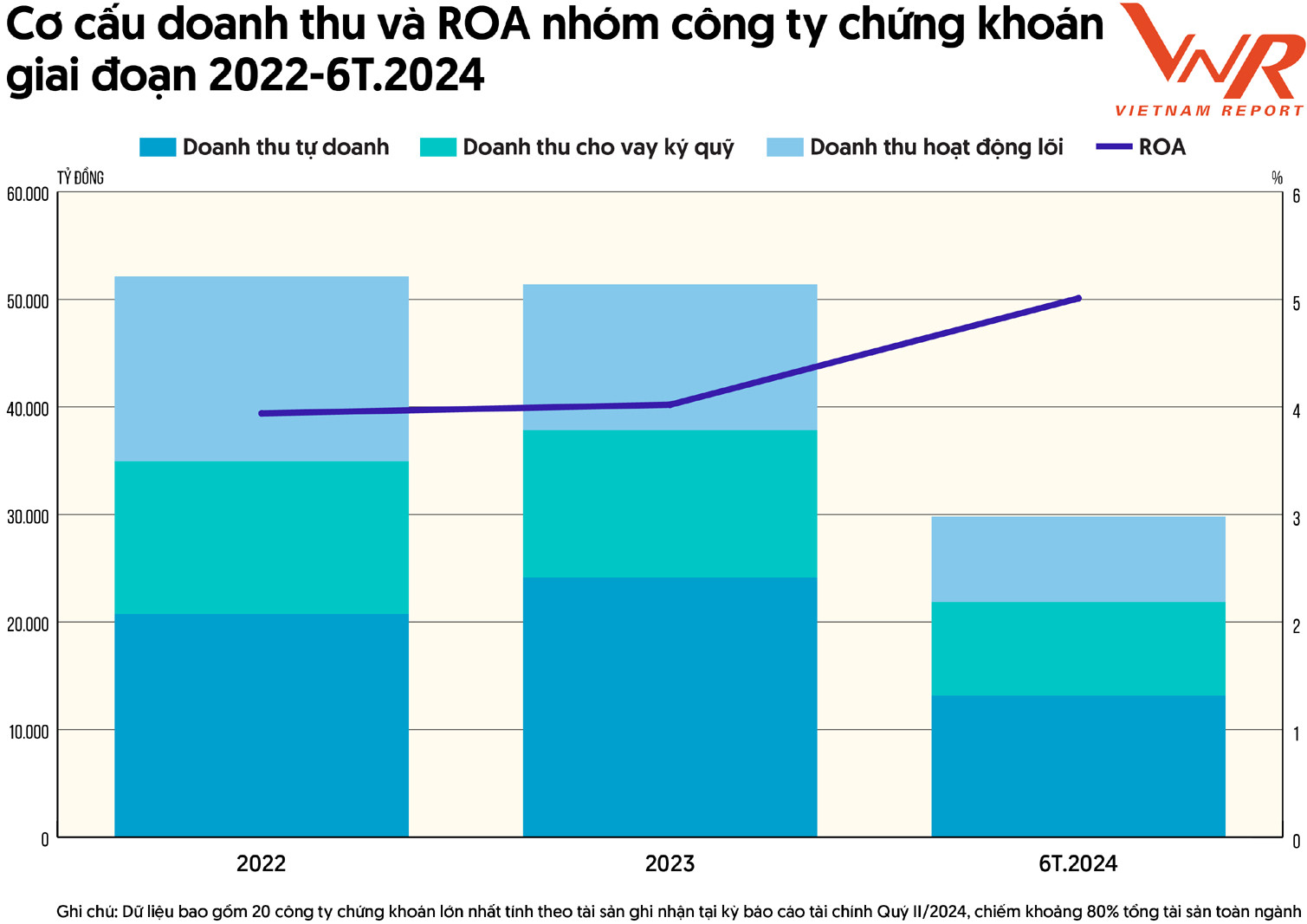

In the first 6 months of 2024, the group of securities companies had good business results. According to statistics from Vietnam Report with the 20 largest securities companies in terms of assets recorded in the financial reporting period of the second quarter of 2024 (accounting for about 80% of the total assets of the whole industry), the ROA performance index tends to increase. The structure revenue has recorded a shift in recent years when the proportion of core revenue has decreased, self-trading revenue has increased and margin lending revenue has remained stable below 30%.

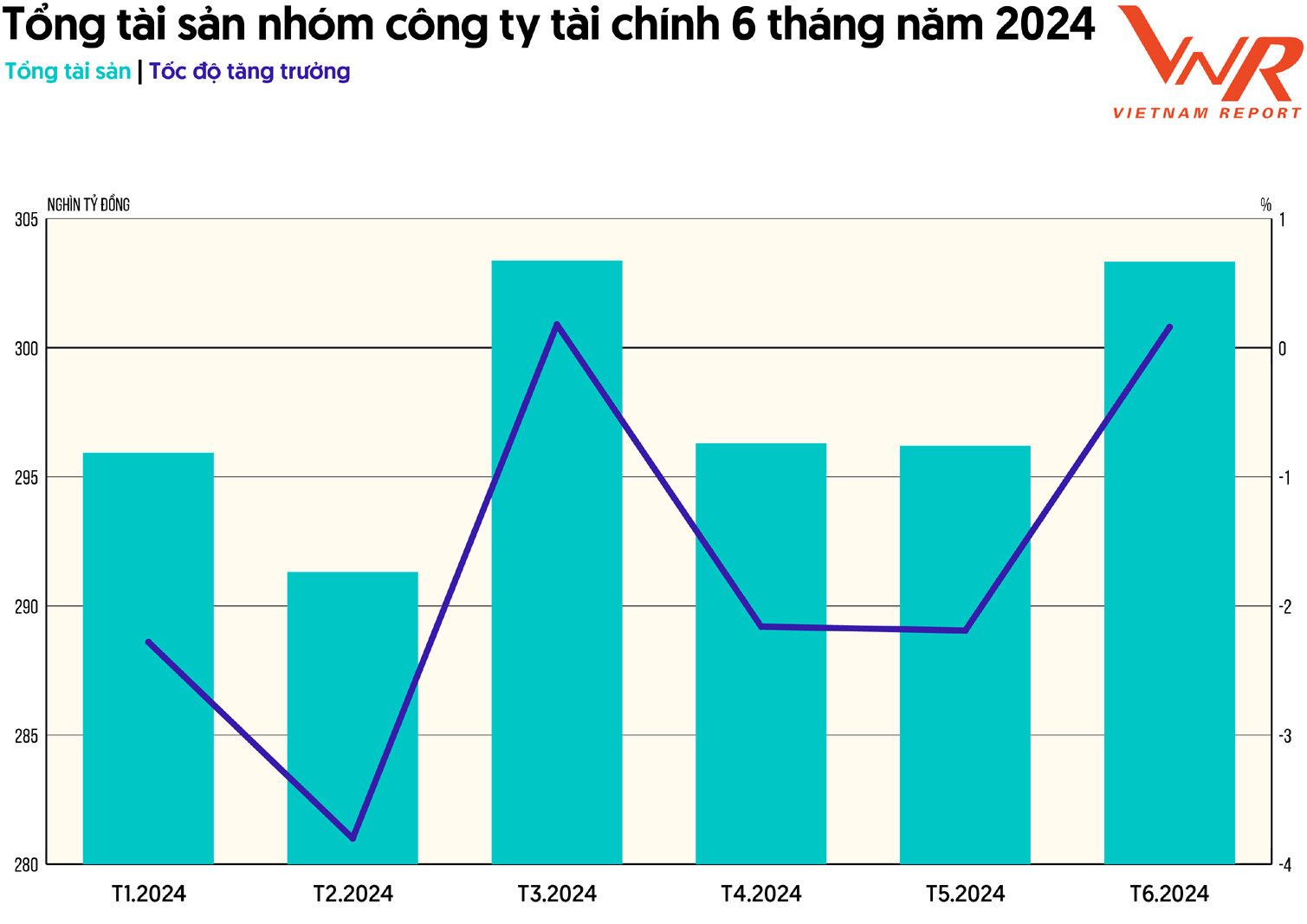

For the group of financial companies, the total assets of the companies have rebounded from the bottom in February 2024. The capital adequacy ratio (CAR) as of June 30, 2024 for this group was 18.95%, always maintained much higher than the prescribed level of 9%.

Solving difficulties in the Finance industry

According to a survey by Vietnam Report, the top 4 challenges facing the Finance industry today include: (1) Increased technological risks and financial crimes; (2) Increased bad debt, potential systemic safety risks; (3) Market demands for higher quality financial products; and (4) Competition among businesses in the industry.

Cybersecurity is one of the important issues for securities companies, especially in the context of increasingly deep digitalization. To prevent cybersecurity risks, companies need to focus on upgrading systems, improving the capacity of employees, especially IT staff, and preparing scenarios for all incidents to ensure that data is securely encrypted.

In addition, experiencing a series of difficulties such as pandemics, natural disasters, geopolitical tensions, economic recessions, etc., businesses and people are having difficulty paying off previous debts. The solution for financial companies is to screen risky customers by building a detailed customer database, while improving customer experience.

In addition to the above challenges, policy support is the basis for the sustainable development of the market. The survey results of Vietnam Report recorded a number of policy recommendations from businesses to promote the Vietnamese financial market, including: Continuing to improve and perfect the system of relevant legal documents (100%); Operating monetary policies appropriately and flexibly with market developments (83.3%); Promoting digital transformation and information security (75.5%); Speeding up the progress of solutions to upgrade the stock market (66.3%); Promoting the implementation of solutions to control bad debt (66.3%).

The financial market is a channel for capital transmission, the lifeblood of the economy. Although the recovery rate is not too strong, in the first half of this year, securities and financial companies have shown positive signals, along with the positive outlook of the economy to open up a more promising prospect.

(Source: Vietnam Report)

Source: https://vietnamnet.vn/top-10-cong-ty-uy-tin-nganh-tai-chinh-nam-2024-2328001.html

![[OCOP REVIEW] Bay Quyen sticky rice cake: A hometown specialty that has reached new heights thanks to its brand reputation](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/3/1a7e35c028bf46199ee1ec6b3ba0069e)

Comment (0)