The conference aims to actively implement the Prime Minister's Official Dispatch No. 993/CD-TTg, review and assess the specific situation of the real estate market and real estate credit, discuss and agree on active measures to remove difficulties for businesses, real estate projects and difficulties and obstacles of commercial banks in real estate credit activities.

According to the report of the State Bank of Vietnam, since the beginning of 2023, the banking sector has ensured liquidity and expanded credit limits from the beginning of the year; continuously adjusted down the operating interest rates of the State Bank of Vietnam 4 times; directed credit institutions (CIs) to reduce costs to reduce lending interest rates to support businesses to recover and develop production and business;

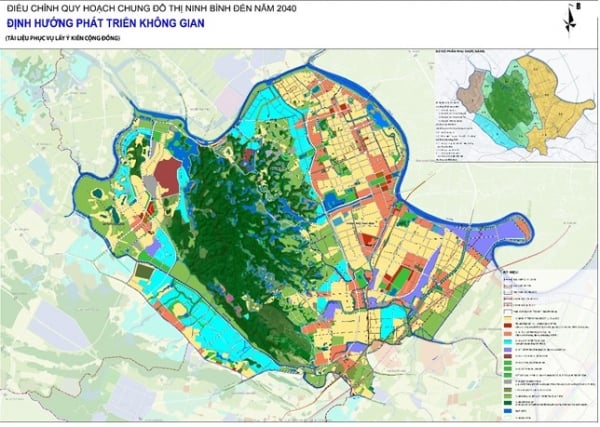

Total outstanding real estate credit of credit institutions reached 2.74 million billion VND. (Photo: DO)

At the same time, the State Bank has issued a policy to restructure debt repayment terms and maintain the debt group (Circular 02/2023/TT-NHNN; Removing difficulties for the bond market (Circular 03/2023/TT-NHNN); Managing credit to meet the capital needs for production and business in a timely manner, serving the living and legitimate consumption needs of people and businesses.

The State Bank also directed credit institutions to diversify banking products and services, simplify, publicly list and make transparent loan procedures and processes; promote the implementation of consumer credit programs, the Bank-Business Connection Program in 63 provinces and cities nationwide, and specialized credit conferences.

Regional credit conferences aim to promptly remove difficulties and obstacles in accessing bank credit sources... As a result, by October 31, 2023, credit for the economy reached more than 12.8 million billion VND, an increase of 7.39% compared to the end of 2022.

Regarding the real estate sector, the State Bank encourages credit institutions to focus capital on the segments of low-cost commercial housing, social housing, and housing for workers; at the same time, control credit risks in the real estate business sector to promote the healthy and sustainable development of the real estate market.

By September 30, 2023, the total outstanding credit balance for the real estate sector of credit institutions reached VND 2.74 million billion, an increase of 6.04% compared to December 31, 2022, accounting for 21.46% of the total outstanding credit balance for the economy. Of which, real estate credit focused on consumption/self-use purposes accounted for 64% and outstanding credit balance for real estate business activities accounted for 36% of outstanding credit balance in the real estate sector.

However, in the first 9 months of the year, real estate business credit grew higher than the general credit growth rate and the same period last year. This shows that the solutions and efforts of the Government, the Banking sector and ministries, sectors and localities in removing difficulties and obstacles for the real estate market are gradually showing effectiveness. In addition, credit institutions are also actively implementing loans according to the Government and Prime Minister's housing programs.

Currently, the real estate market is still facing many difficulties and challenges, including many long-standing problems and obstacles such as problems with the legal procedure system related to land, planning, and construction investment; The imbalance of supply and demand in segments, excess of high-end housing and villas while social housing and low-cost housing are still limited; Market demand in some segments is experiencing a sharp decline;

The financial capacity of enterprises is still limited and depends mainly on external sources of capital such as loans, bonds, and mobilization from home buyers; other capital mobilization channels have not really been effective, especially the capital market (corporate bond market, stock market) which has some problems and has not developed commensurate with its role in providing medium and long-term capital for the economy; housing prices are high compared to the financial capacity and income of many people...

To contribute to promoting the healthy and sustainable development of the real estate market, many opinions at the Conference said that it is necessary to implement comprehensive solutions with the coordination of many ministries, branches and localities to continue to handle and resolve legal procedural problems in the real estate sector; develop the medium and long-term capital market; and continue to carry out the tasks assigned by the Prime Minister in documents such as Resolution 33/NQ-CP, Official Dispatch No. 993/CD-TTg.

Regarding the banking sector, in the coming time, closely following the direction of the Government and the Prime Minister, the State Bank will continue to proactively, flexibly and synchronously manage monetary policy tools, closely coordinate with fiscal policy and other macroeconomic policies to control inflation, stabilize the macro economy, and contribute to promoting economic recovery.

In the coming time, the State Bank will continue to review and perfect the legal framework on banking activities, proactively review, amend and supplement policies and legal regulations on banking activities in accordance with reality.

Currently, the State Bank of Vietnam is urgently reviewing and assessing the implementation of Circular 03 and Circular 06 to promptly issue amendments and supplements in accordance with market realities, increase access to credit capital for the economy, and ensure system safety in accordance with the direction of the Prime Minister.

The State Bank continues to direct credit institutions to implement solutions to improve access to capital for businesses and people; continue to implement the policy of restructuring debt repayment terms and maintaining debt groups to support customers facing difficulties according to Circular 02/2023/TT-NHNN.

At the same time, the State Bank will monitor and closely follow the implementation of the 120,000 billion VND Program to coordinate with the Ministry of Construction to review and propose solutions to promote the implementation of the Program, contributing to promoting investment, construction as well as purchase of social housing by people.

The State Bank will coordinate with ministries and branches to complete legal regulations to support the sustainable development of the real estate market while controlling risks and ensuring the safety of credit institutions' operations. Strengthening work and supervision; preventing and combating violations of the law in the banking sector; ensuring the safety of credit institutions' operations.

Source

![[Photo] More areas of Thuong Tin district (Hanoi) have clean water](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/55385dd6f27542e788ca56049efefc1b)

![[Photo] Prime Minister Pham Minh Chinh and Japanese Prime Minister Ishiba Shigeru visit the National Museum of History](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/93ae477e0cce4a02b620539fb7e8aa22)

![[Photo] Prime Minister Pham Minh Chinh and Japanese Prime Minister Ishiba Shigeru attend the Vietnam - Japan Forum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/fc09c3784d244fb5a4820845db94d4cf)

![[Photo] Prime Minister Pham Minh Chinh receives Cambodian Minister of Commerce](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/be7f31fb29aa453d906df179a51c14f7)

Comment (0)