The British Embassy in Hanoi has just released the UK-Vietnam Agricultural Trade Report titled “Connecting the UK and Vietnam in Agriculture, Food and Drink”.

According to the report, some of the main factors strongly affecting the agricultural trade relationship between the two countries are that Vietnam's economy is often likened to a rising dragon in the Asia-Pacific region.

The report states that with a young population and a growing middle class, steadily rising incomes and increasingly sophisticated consumer habits, the Vietnamese market is experiencing increasing demand for high-quality, foreign-sourced products, presenting an attractive opportunity for UK food and drink.

In particular, the UK-Vietnam Free Trade Agreement (UKVFTA) has come into effect, opening up opportunities for Vietnamese consumers to access high-quality British food and beverages.

|

| Vietnam-UK agricultural trade still has much room for breakthrough growth. Photo: Huynh Quang |

Ms. Hoang Le Hang - First Secretary, Vietnam Trade Office in the UK - said that Vietnam's agricultural exports have maintained good growth over the past 3 years, partly thanks to the implementation of the UKVFTA. According to the agreement, 94% of the total 547 tariff lines on fruits and vegetables and fruit-based products were immediately eliminated. This creates a competitive advantage for many Vietnamese agricultural products compared to similar products originating from countries that do not have a free trade agreement with the UK.

Not only that, the dynamism and positivity of Vietnamese export enterprises and the Vietnamese business community in the UK, together with the support of the Ministry of Industry and Trade, the Ministry of Agriculture and Rural Development, the Vietnamese Embassy in the UK and professional associations such as the Vietnam Fruit and Vegetable Association, the Vietnam Coffee and Cocoa Association, the Vietnam Association of Seafood Processors and Exporters, the Handicraft and Wood Processing Association in Ho Chi Minh City... also contributed to maintaining the achievements of agricultural exports to the UK.

|

| Vietnamese agricultural products still account for only a small proportion of Vietnam's imports into the UK, currently accounting for 4.8%. Photo: Thang Anh |

Notably, the UK-Vietnam Agricultural Trade Report also confirmed that there is still much room for breakthrough growth in agricultural trade between the two sides. The report stated that British businesses are eager to explore Vietnam as a new market to introduce a variety of high-quality foods and beverages.

Food and drink is the UK’s largest manufacturing and processing industry with stringent regulations and certification processes. The UK’s comprehensive approach to ensuring food safety and quality standards is now a global benchmark.

Notable UK agricultural exports to Vietnam include whisky, seafood and confectionery. For whisky, around 85% of whisky consumed in Vietnam comes from Scotland. Thanks to the UKVFTA, the 45% import tariff will be gradually reduced to 0% over 6 years (currently 24%). This will be an important factor in promoting exports of this product.

Previously, during the visit of the British Trade Commissioner for Asia-Pacific Martin Kent to Vietnam, sharing with the press, Mr. Martin Kent said that British products have been popular throughout Vietnam, just as British seafood is also very popular in Vietnam. British products such as brown crab and lobster are loved by Vietnamese consumers across the country and are popular for their attractive flavor thanks to being farmed in clean, clear and cool waters around the British Isles.

Martin Kent also said that Scottish salmon is the UK’s largest food export and there is great opportunity for this premium product to be sold in high-end catering outlets in Vietnam. And it is exciting that we will soon see the first shipments of British pork and poultry to Vietnam. This is an important moment in our agricultural trade relationship as this is the first livestock and poultry product to be permitted to be exported from the UK.

In contrast, imports from Vietnam to the UK mainly include tropical fruits, coffee, nuts and seafood. According to the report, in 2023, the export value of fish and shellfish from Vietnam to the UK will reach nearly 300 million USD, making seafood the 5th largest product group among the main exports from Vietnam to the UK.

In addition, with the rapid expansion of Vietnamese restaurants in the UK, British consumers can also enjoy a wide variety of Vietnamese agricultural products that are being sold in supermarkets.

For example, in January 2023, the People's Committee of Cao Phong district (Hoa Binh province) coordinated with the Department of Agriculture and Rural Development of Hoa Binh province to organize a ceremony to export the first shipment of 7 tons of Cao Phong oranges to the UK. Then, in May 2023, a shipment of 5 tons of typical Vietnamese Ri6 durian was distributed to supermarkets across the UK...

However, according to assessments, Vietnamese agricultural products still only account for a small proportion of Vietnam's imports into the UK, currently accounting for 4.8%. This situation shows a huge and important growth opportunity in the agricultural and related sectors, which are expected to play a more significant role in shaping UK-Vietnam trade relations.

Previously, with the support of the Vietnam Trade Office in the UK, 8 Vietnamese enterprises displayed and introduced food and beverage products at the International Food and Beverage Fair (IFE) 2024, taking place from March 25-27 at ExCel, the largest national exhibition center in London, UK.

Vietnamese booths at the fair attracted visitors with fresh fruit products such as grapefruit, guava, durian, red-fleshed dragon fruit, Lai Thieu mangosteen; frozen seafood; dried pho noodles of all kinds; coffee and tea of all kinds; coconut products such as coconut water, dried coconut, coconut oil; ginger products… This is a great opportunity for Vietnamese businesses as well as businesses in the UK to meet directly with potential customers and grasp market trends.

![[Photo] President Luong Cuong attends the 90th Anniversary of Vietnam Militia and Self-Defense Forces](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/678c7652b6324b29ba069915c5f0fdaf)

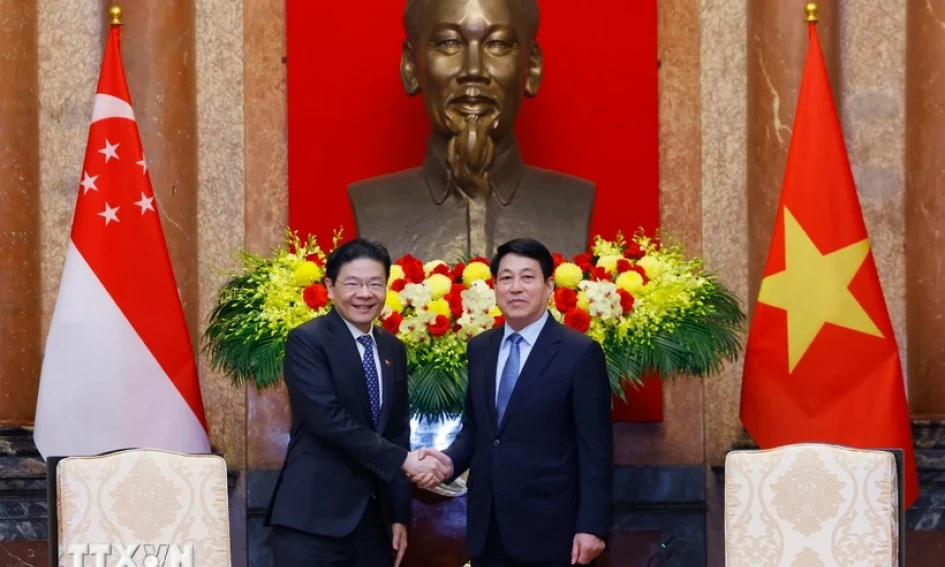

![[Photo] General Secretary To Lam receives Singaporean Prime Minister Lawrence Wong](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/4bc6a8b08fcc4cb78cf30928f6bd979e)

![[Photo] Editor-in-Chief of Nhan Dan Newspaper Le Quoc Minh receives Iranian Ambassador Ali Akbar Nazari](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/269ebdab536444818728656f8e3ba653)

![[6pm News] Proposal to keep 11 provinces unchanged, including Thanh Hoa](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/2ffa21acb3844cd78a9433fec227511d)

Comment (0)