Lack of human resources to serve the rich

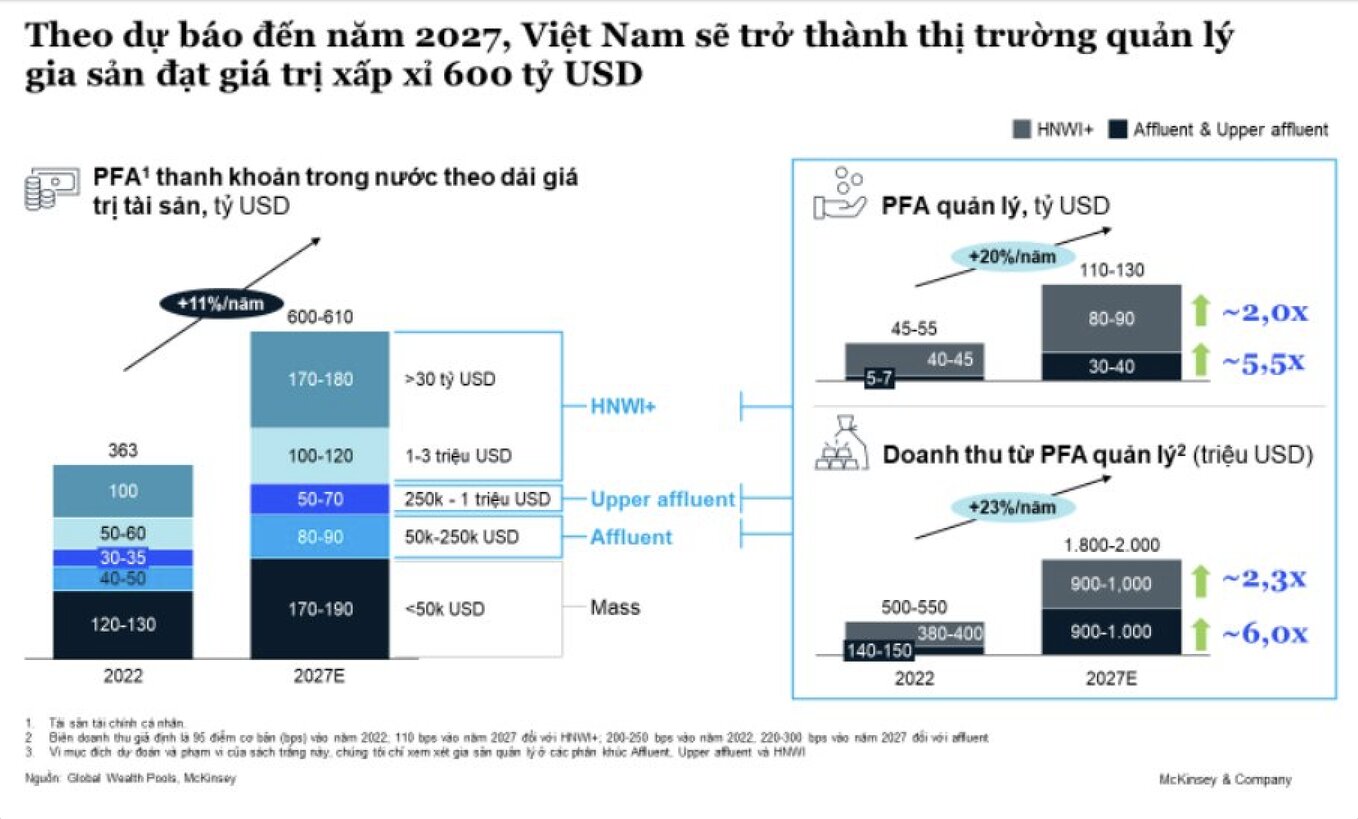

Vietnam’s financial market has grown significantly in recent years, in line with the growing demand for wealth management from customers. According to estimates from global management consultancy McKinsey, by 2027, Vietnam is expected to become a personal financial advisory (PFA) market worth around USD 600 billion. Correspondingly, it will grow at a rate of 11%/year from the base PFA of around USD 360 billion by the end of 2022.

Despite the huge potential, Mr. Bruce Delteil - Managing Director of McKinsey & Company Vietnam - assessed that the asset management industry in Vietnam has not developed commensurately and has barely kept up with customer demand. Challenges originating from within the financial services industry as well as other industries are holding back the asset management sector in Vietnam.

Among the shortcomings pointed out that make Vietnam's asset management industry fall behind, the representative from McKinsey emphasized the quality of experts when they fail to meet the needs of customers.

“One of the major challenges in Vietnam’s wealth management market is the limited availability of high-quality human resources to develop affluent client services. This is a topic that comes up repeatedly in our conversations with industry players,” said Bruce Delteil.

Sharing the same view, Mr. Ngo Thanh Huan - CEO of FIDT Asset Management JSC - said: "When the need for comprehensive financial planning increases, of course, there must be a need to learn knowledge and experience in financial management in a systematic and systematic way; not knowledge gathered from colleagues, friends or social networks.

It is time for the title of financial consultant or personal financial planner to have a legal framework on competency standards, practice standards and ethical standards like developed countries are doing.

Industry based on ethics

In order for the financial planning profession to become professional and develop in Vietnam, Mr. Ngo Thanh Huan emphasized the need to focus on the essential role of ethics in the working process. Because this industry is built on the trust and confidence that customers place in their financial planners. If financial planners behave unethically, they risk damaging the reputation of the industry and harming the interests of customers, causing a loss of trust.

Mr. Huan cited a study by Bigel in 1998 with financial planners practicing in the United States. The results showed that financial advisors with CFP certification received higher ethical ratings than those without this certification. This suggests that practicing ethical codes affects the ethical decision-making of financial planners.

In addition, Mr. Bruce Delteil suggests that units can boldly seek talent beyond the traditional workforce of the wealth management industry. For example, consider the workforce of high-end retailers and luxury car dealerships, who have a knack for customer service and customer relationship management. Partnering with prestigious organizations to develop certification programs can enhance reputation and create a differentiating value to attract high-quality staff.

Source

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)