At the beginning of the school year, the issue of "letting children bring money to school" attracted the attention of parents. Some primary school teachers sent messages in the parents' group advising parents not to let students bring money to class for many reasons such as children losing money, having their money stolen by friends, avoiding children buying snacks, unsafe street vendors, or the school not organizing a cafeteria...

NEED TO TEACH STUDENTS FINANCIAL EDUCATION FROM EARLY

However, Ms. Pham Thi Ngoc Lan, founder of the career guidance and financialeducation project SeedCareer (HCMC), said that students should not be banned from bringing money to school, but that it is important to educate children about finance early.

"Primary school is a miniature society. As soon as children finish preschool and enter primary school, the cafeteria with many snacks attracts their attention, stimulating their need to spend money. Some students even stand and look at the items in the cafeteria during recess. Some students want to buy something in the cafeteria themselves rather than have their parents buy it for them. Depending on their personality, some children may ask their parents for money to buy snacks, while others find ways to get money," said Ms. Nguyen Hoang Duy Hieu, a teacher at Nguyen Trai Primary School (District 12, Ho Chi Minh City).

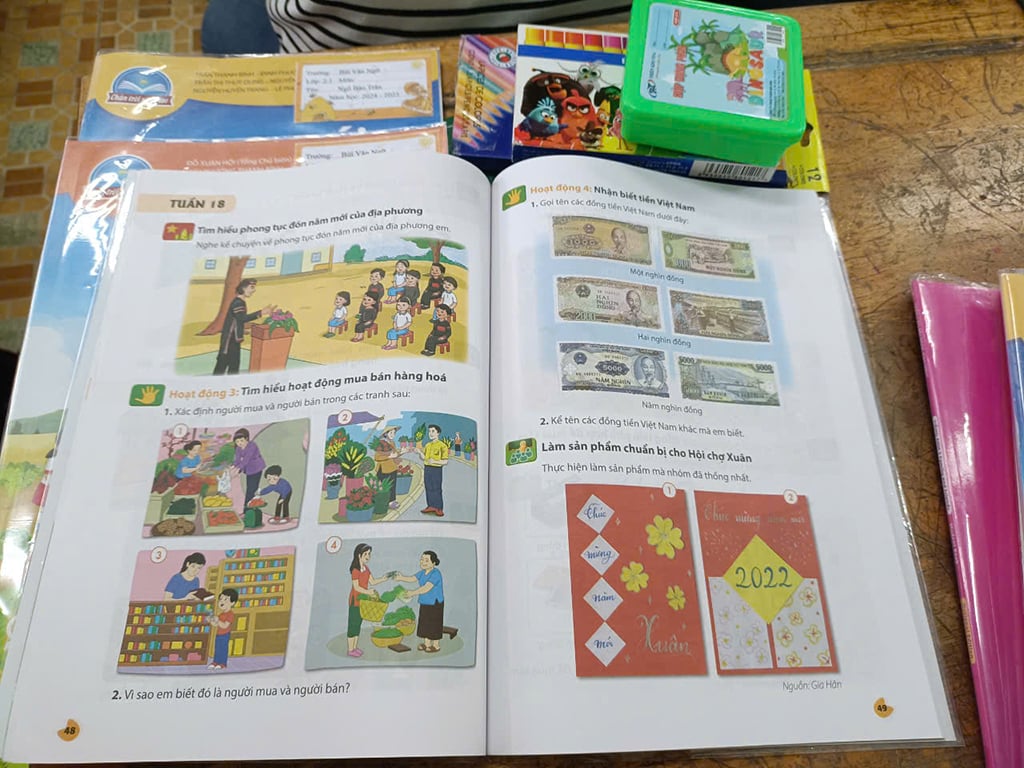

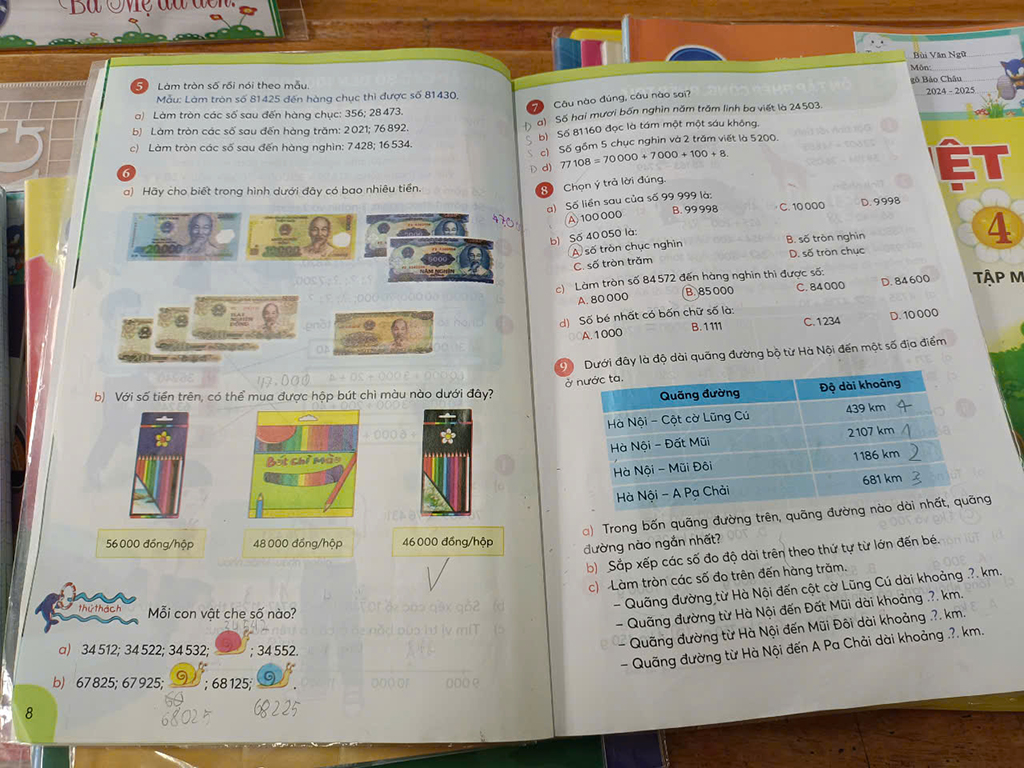

In the 2018 General Education Program, financial education is integrated into subjects from grades 2 to 12, focusing on middle and high school classes. For example, the math book for grade 2 (Connecting knowledge with life series) has a lesson introducing Vietnamese currency, helping students get acquainted with banknotes. "Financial education lessons are often integrated by teachers into subjects such as math or experiential activities. For example, after the math lesson introducing Vietnamese currency, teachers can educate students about saving money," Ms. Duy Hieu shared.

Financial education should be integrated into primary school students from an early age. Math books for grade 2 (Connecting knowledge with life) and grade 4 (Creative horizons) have an introduction to Vietnamese currency.

However, primary school teachers shared that there are also some cases where students give money to their friends to get their attention or simply to have more friends. Ms. Hong, whose child studies at Kim Dong Primary School (Go Vap District, Ho Chi Minh City), said: "I was shocked when I discovered a 500,000 VND bill in my second grade son's bag. When I asked, he said he got it from a friend. After that, I contacted the homeroom teacher to return it." According to Ms. Hong, the teacher observed, investigated and discovered that a student in the class often took money from his mother's bag, not knowing the value of the money, simply because he saw the beautiful paper. The child took a total of more than 2 million (with bills of different denominations) and brought it into the classroom to give to his friend. The teacher worked with the parents and got back more than 1.8 million VND.

TEACHING CHILDREN TO MANAGE PERSONAL FINANCE

In addition to the awareness of saving money, when children are 10 years old, parents can accompany and equip their children with personal financial management skills, according to Ms. Pham Thi Ngoc Lan.

"Early financial education will help children understand where money comes from, the value of money, and gradually form the habit of spending properly, not just asking for money from their parents. Teaching children about personal financial management is not a big deal and can be integrated into daily life. For example, at the beginning of the new school year, parents should take their children to a store or bookstore to buy school supplies, so that they can compare the price and quality of a pen or book in each place, and where to buy it," Ms. Pham Thi Ngoc Lan suggested.

Financial education lessons in elementary school are often integrated by teachers into subjects such as math or experiential activities.

At a higher level, Ms. Pham Thi Ngoc Lan said that parents can discuss with their children about the family's monthly living expenses, and make a list of things to buy before going to the supermarket to become smart consumers. "Such a simple activity also helps children understand and recognize budgeting, forming personal financial management skills," she added.

Besides, according to this expert, giving children a weekly or monthly amount of money and guiding them to spend it appropriately is also a useful practice that parents can do with their children.

For example, Ms. Nguyen Thi Ngoc Lan, a parent in District 10, Ho Chi Minh City, said: "I give my child school money every week from grade 3. When my child goes to middle school, I will give him pocket money every month so that he can get used to planning appropriate spending."

Ms. Nguyen Thi Ngoc Lan added: "When teaching my children about the value of money, I tell them how much I earn in a day so they understand how hard it is for their parents to earn money, then ask them questions to help them calculate how much they spend in a day and a month, and what they use the money to buy. This helps them somewhat visualize the value of money and know how to save."

Source: https://thanhnien.vn/ban-khoan-hoc-sinh-tieu-hoc-mang-tien-den-lop-185240922205033918.htm

![[Photo] Gia Lai provincial leaders offer flowers at Uncle Ho's Monument with the ethnic groups of the Central Highlands](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/9/196438801da24b3cb6158d0501984818)

Comment (0)