| Commodity market today (August 21): Market sentiment remains cautious, MXV-Index moves sideways Commodity market today August 22: Coffee prices set new historical record, wheat prices plunge 2% |

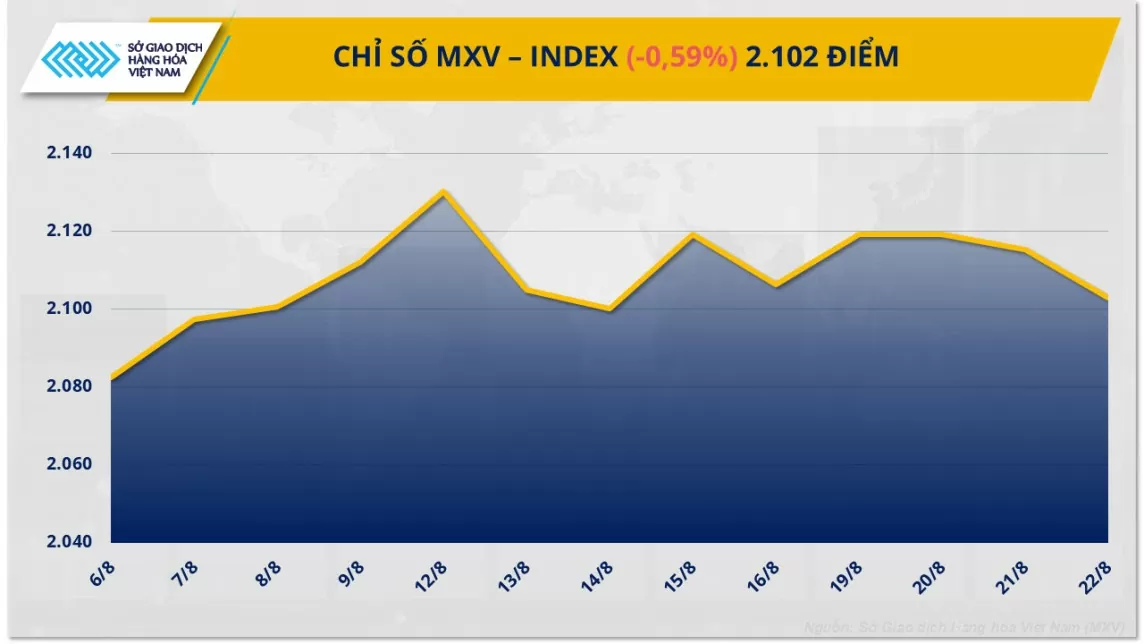

Overwhelming selling pressure pulled the MXV-Index down another 0.59% to 2,102 points, extending its three-session losing streak. At the close, red covered most of the metal and agricultural product price lists.

|

| MXV-Index |

US dollar recovery puts pressure on metal prices

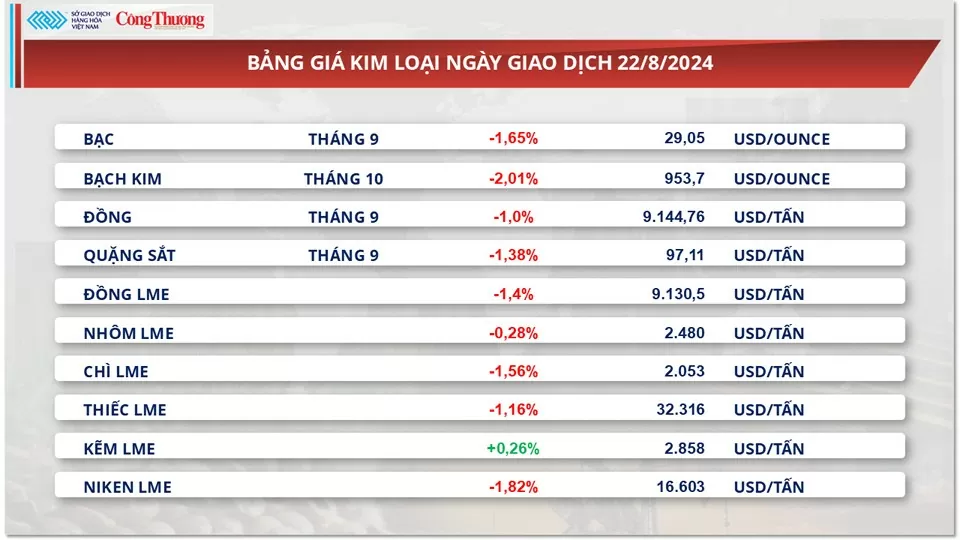

The metal market was red yesterday as most metal commodities fell by 1-2%. For precious metals, the stronger US dollar put pressure on silver and platinum. At the close, platinum fell 2.01% while silver weakened 1.65%, ending a five-session winning streak.

On August 22, at the Jackson Hole Economic Conference, US Federal Reserve (FED) policymakers expressed support for cutting interest rates next month, citing the fact that US inflation pressures have cooled sharply and the labor market is weakening. However, some officials supported a cautious and slow approach, contrary to market expectations.

|

| Metal price list |

This has reduced market confidence that the Fed will cut interest rates next month, combined with better-than-expected services PMI data, the USD was pulled back to recover yesterday. The Dollar Index recovered from an 8-month low with a gain of 0.46% to 101.51 points, ending a series of 5 consecutive sessions of decline.

For base metals, the rising US dollar also weighed on prices of commodities in the group. However, LME zinc prices went against the group, increasing 0.26% to $2,858/ton, as the oversupply situation in the market has narrowed significantly.

Specifically, according to the August supply-demand report of the International Lead and Zinc Study Group (ILZSG), the global zinc market surplus narrowed to 8,700 tonnes in June, down from an upwardly revised surplus of 44,000 tonnes in May. In the first 6 months of this year, the global zinc market had a surplus of 228,000 tonnes, down sharply from 452,000 tonnes in the same period last year.

The risk of supply disruptions in China, which supplies more than half of the world’s refined zinc, has also helped boost demand. According to Bloomberg, the country’s zinc smelters are discussing plans to cut production due to the shortage of ore. Accordingly, the country’s zinc output is expected to continue to fall this month after falling to a one-year low in July.

Soybean prices plunge more than 2% on prospects of bumper US crop

November soybean futures plunged more than 2% on Aug. 22, snapping a three-session winning streak. While U.S. exports are still performing well, the prospect of a bumper crop this year has left sellers in the dark.

|

| Agricultural product price list |

The 2024 Crop Tour survey in the Midwest, the main soybean growing region in the US, concluded on Tuesday with positive results. Specifically, the number of soybeans per 3x3 square feet in Illinois averaged 1,419, higher than last year's 1,270 and the three-year average of 1,266. In addition, the number of soybeans per 3x3 square feet in many areas of Iowa was almost all higher than last year's figure and the three-year average. These are the two largest soybean producing states in the US, so the above results open up a positive outlook for this year's oilseed supply from this country, and have put a lot of pressure on prices.

In addition, in the Daily Export Sales Report yesterday, the US Department of Agriculture (USDA) said that exporters sold orders for 198,000 tons of soybeans for the 2024-2025 crop year to China. This is also the fourth consecutive session of large soybean orders sold to this Asian country. In addition, according to data from the Export Sales Report yesterday, the US sold 1.68 million tons of soybeans for the 2024-2025 crop year in the week ending August 15, up 25% from the previous week and exceeding market expectations. These figures show that demand for US soybeans is increasing, somewhat narrowing the decline in prices.

Red also covered the price list of two finished soybean products in yesterday's session. The price of soybean meal for December contract decreased by 1.49% to 335 USD/ton. Meanwhile, the price of soybean oil for December contract ended a series of 4 consecutive increases with a decrease of 1.52%.

Prices of some other goods

|

| Industrial raw material price list |

|

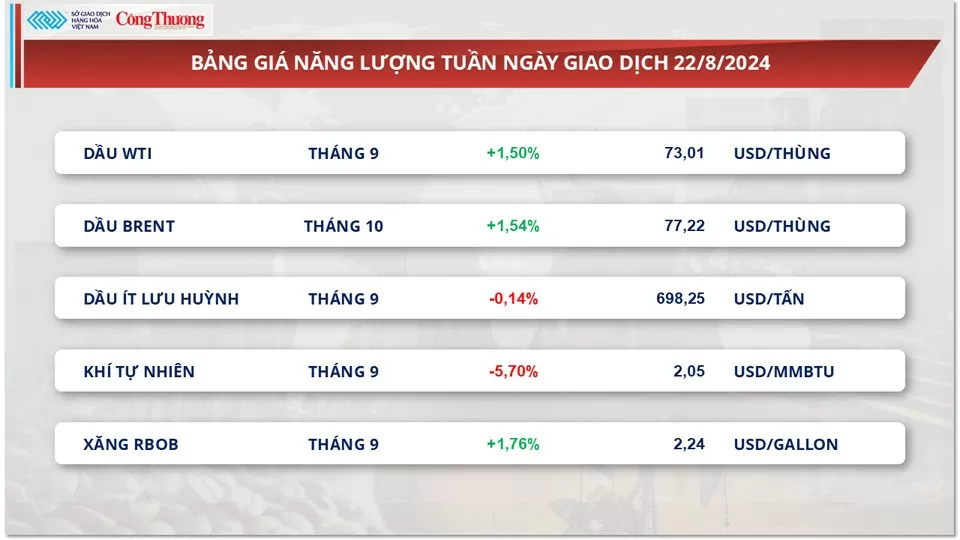

| Energy price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-238-thi-truong-kim-loai-va-nong-san-do-lua-keo-mxv-index-tiep-tuc-roi-340878.html

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

Comment (0)