Investment trends in the first half of 2024 show healthy growth

In a recent report, experts from Dragon Capital said the VN-Index increased by 4.3%. This shows that the market has found balance after the exchange rate fluctuations in early May.

An analysis also shows that the market is focusing more on high-quality stocks with strong growth prospects. Margin debt is also at a safe level, and the profit-to-risk ratio of the VN-Index has improved.

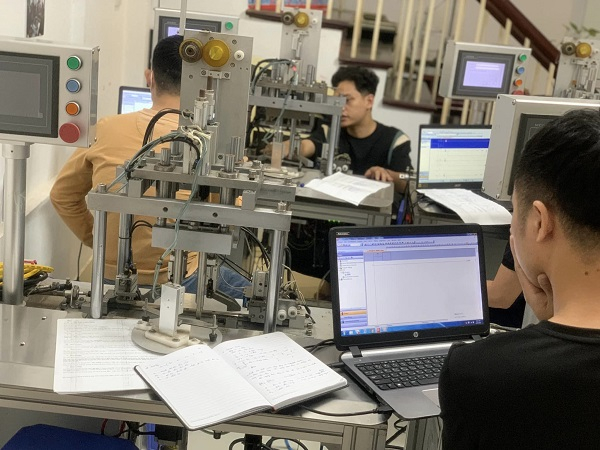

Information technology service industry stocks have good growth prospects (Photo TL)

The stocks chosen by investors in the first half of 2024 are skewed towards companies with good corporate profits and bright business prospects. This shows that the market is in a healthy growth phase rather than being driven by short-term speculative activities.

Another notable point is that the ROIC, ROE and cash flow generation ability of the top group stocks compared to the bottom group have a clear difference in performance. This is a sign that investors are interested in stocks with sustainable operations instead of investing with a high risk appetite.

Which industry groups are of interest to the market?

The indexes of leading stocks show that investors have chosen to be safe in the first half of the year. This further reinforces the sustainable growth of the market instead of the increase due to short-term stock speculation.

According to Dragon Capital's assessment, some sectors will be particularly attractive to investors thanks to the benefits from policies. First, the performance of information technology service stocks reached 50%. This result was achieved thanks to optimism and expectations for the semiconductor and artificial intelligence (AI) industries.

Meanwhile, real estate stocks only increased by 3.8%, showing investors' cautious sentiment towards this group of stocks, especially in the context that many real estate businesses are facing difficulties and are still waiting for policies from state agencies to ease the situation.

In addition, Dragon Capital experts also believe that the group of state-owned enterprises will have a slower growth rate than private enterprises. Due to the specific nature of their operations under specific regulations and policies. In particular, state-owned commercial banks will maintain a lower interest rate than the market. Or some state-owned enterprises will postpone projects until specific policies and guidelines are issued.

One of the highlights that Dragon Capital focuses on is that the market is supported by favorable factors. For example, the projected P/E ratio for 2024 is at 11.6 times, the EPS growth rate is 1.5%. The private enterprise sector is also recovering strongly and can become the growth driver of the stock market in the coming time.

Source: https://www.congluan.vn/thi-truong-chung-khoan-dang-tang-truong-lanh-manh-chu-khong-phai-dau-co-post299632.html

![[Photo] Prime Minister Pham Minh Chinh chairs a special Government meeting on the arrangement of administrative units at all levels.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/6a22e6a997424870abfb39817bb9bb6c)

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

Comment (0)