Supply disruption, businesses lack raw materials for production

The latest report from the Ministry of Agriculture and Rural Development shows that in the first five months of this year, our country exported 288 thousand tons of cashew nuts, earning 1.55 billion USD. Compared to the same period last year, the amount of exported cashew nuts increased sharply by 30.6% in volume and 19.3% in value.

Last year, Vietnam's cashew nut exports reached 644 thousand tons, worth 3.64 billion USD, up 24% in volume and more than 18% in value compared to 2022. Accordingly, Vietnam's cashew industry has maintained the world's No. 1 position in exports for many consecutive years.

Mr. Bach Khanh Nhut - Vice President of Vietnam Cashew Association - forecasts that cashew exports will continue to maintain high growth momentum, aiming for a new record of 3.8 billion USD this year.

However, on the evening of May 31, during a press conference to inform about the cashew industry, Mr. Nguyen Minh Hoa - Vice President of the Vietnam Cashew Association (Vinacas) - said that Vinacas recently received feedback from members about not receiving enough raw materials from partners in West African countries due to the sharp increase in raw cashew prices.

Vietnam imports about 3 million tons of raw cashew nuts each year, of which the supply from Africa is about 2.2 million tons (mainly West Africa). Notably, the price of raw cashew nuts in West Africa is increasing day by day. In February this year, the price of raw cashew nuts was only 1,000-1,050 USD/ton, now it has reached 1,500-1,550 USD/ton. The reason is that this region is having a bad harvest, some countries have applied a policy of temporarily suspending the export of raw cashew nuts to support domestic factories.

As a result, exporters sought to delay deliveries and demand price increases. According to preliminary statistics, only about 50% of the goods were delivered according to signed contracts.

Mr. Ta Quang Huyen, General Director of Hoang Son I Company, said that the company signed a contract to buy 52,000 tons of West African raw cashews but only received 25,000 tons at the correct price, "losing" about 12,000 tons. The company had to accept the price increase for the rest to get the goods for production.

Cashew shipments currently at sea are being offered at higher prices, but some processors still have to buy to have enough raw materials to fulfill production contracts with customers, Vinacas informed.

Currently, some cashew factories in our country are facing a shortage of raw materials for production. Because many shipments of raw cashews arrive late or the quantity of cashews arriving is less than the signed contract.

According to Mr. Hoa, when purchasing raw cashews, businesses will sign cashew nut export contracts corresponding to the raw material price. However, with the current fluctuation in raw material prices, from the end of the third quarter of 2024, there will be many contract disputes between Vietnamese businesses and importers. Due to high costs, many units are unable to fulfill signed contracts.

Imported raw materials up to 90%

For the past 16 years, Vietnam has continuously held the world's number 1 position in exporting processed cashew nuts. However, about 90% of raw materials for the Vietnamese cashew industry's production are imported from Africa and Cambodia. Our country's domestic raw material sources are quite modest due to the shrinking planting area.

According to the General Department of Customs, Vietnam imported about 2.77 million tons of cashew nuts, worth 3.19 billion USD in 2023. Compared to 2022, cashew nut imports increased by 46.2% in volume and 19.6% in value.

The imported item that accounts for a large proportion in the import structure is fresh unshelled cashew nuts.

There are 5 largest markets supplying cashew nuts to Vietnam, including: Ivory Coast, Cambodia, Nigeria, Ghana and Tanzania. Of which, cashew nuts imported from Ivory Coast and Cambodia account for 54.7% of the total import value of the entire cashew industry in 2023.

However, Vietnam has reduced imports from Cambodia and Tanzania, and increased imports from Ivory Coast, Nigeria and Ghana.

This year, by the end of April, our country imported 1.063 million tons of raw cashews, worth up to 1.322 billion USD, up 32% and 23.1% respectively over the same period. Compared to the export figure of 1.16 billion USD, the Vietnamese cashew industry continues to have a trade deficit.

The dependence on imported raw materials makes this industry more risky. This warning has been mentioned many times before.

In recent years, the policy of African cashew growing countries and Cambodia is to develop domestic processing industry, gradually reduce raw exports. Therefore, they have introduced many preferential policies, attracting investment in cashew processing factories. For raw cashew exports, they regulate and strictly monitor the minimum export price; apply high export tax rates. On the contrary, they exempt tax for exported cashew nuts.

At the Vietnam Cashew Association Congress for the 2021-2026 term, Vinacas is concerned that Vietnam's leading position in the global cashew supply chain and value chain is being shaken and will certainly be lost if we do not change.

Previously, the world cashew market was mainly supplied by Vietnam and India, of which Vietnam accounted for more than 80%. However, recently other sources of supply have emerged, especially from some African countries, causing Vietnam's cashew market share in the global market to decrease.

Vinacas fears that cashew processing enterprises for export, mainly FDI factories, will gradually block the source of raw cashew nuts for Vietnamese factories, causing small and medium-sized factories in our country to go bankrupt, and eventually dominate the world cashew nut market.

Vinacas leaders believe that businesses must take the initiative in supplying raw materials. In the context of difficulty in increasing acreage, it is possible to cooperate in exploiting and developing raw cashew material areas in Cambodia and southern Laos, including research cooperation, transferring varieties and cultivation techniques to the neighboring country. After that, businesses import this raw cashew source to Vietnam for processing.

Source: https://vietnamnet.vn/nhap-90-hat-dieu-nguyen-lieu-dn-lao-dao-vi-doi-tac-be-keo-2286725.html

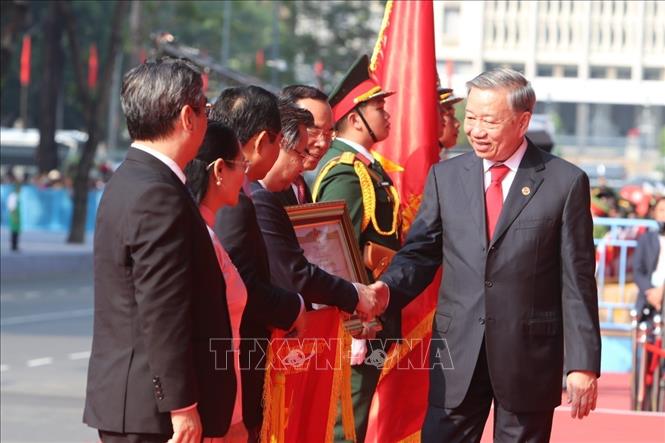

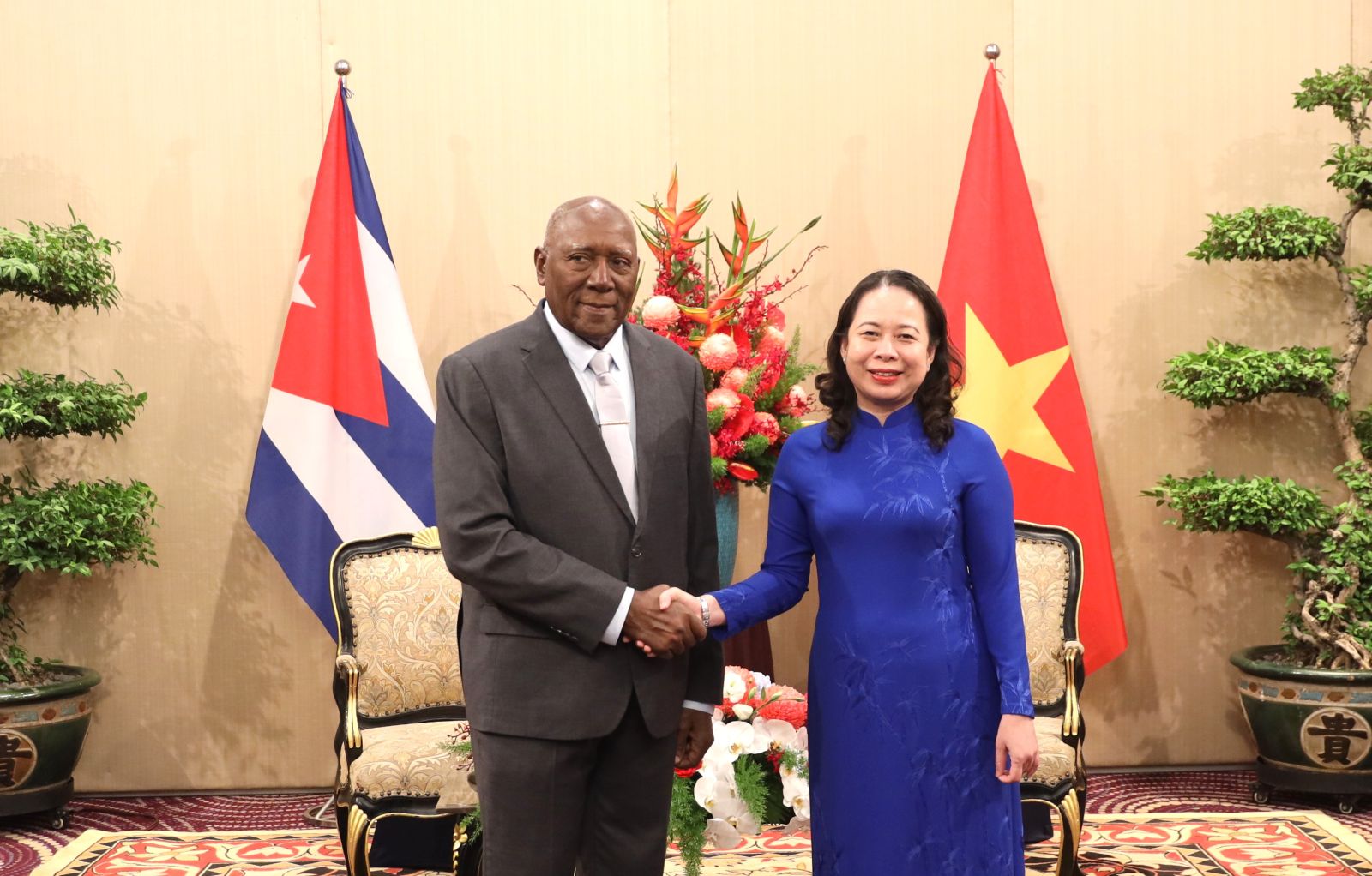

![[Photo] Chinese, Lao, and Cambodian troops participate in the parade to celebrate the 50th anniversary of the Liberation of the South and National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/30d2204b414549cfb5dc784544a72dee)

![[Photo] Performance of the Air Force Squadron at the 50th Anniversary of the Liberation of the South and National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/cb781ed625fc4774bb82982d31bead1e)

![[Photo] Flag-raising ceremony to celebrate the 50th anniversary of the Liberation of the South and National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/175646f225ff40b7ad24aa6c1517e378)

Comment (0)