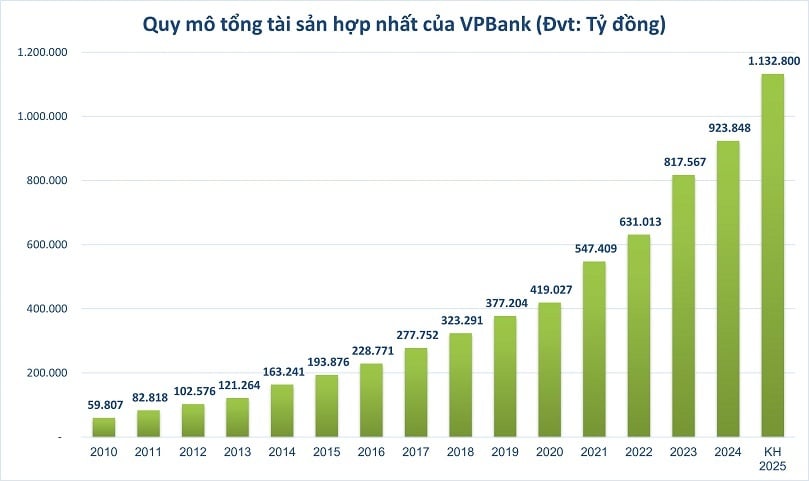

According to the recently announced 2025 Annual General Meeting of Shareholders (AGM), Vietnam Prosperity Joint Stock Commercial Bank (VPBank, HoSE: VPB) aims to have total consolidated assets of VND1.13 trillion by the end of this year, an increase of 23% compared to the end of 2024. If this plan is completed, VPBank will become the next bank to join the trillion-dollar group, which is currently dominated by the state-owned group.

By the end of 2024, only 5 banks in the banking system will reach the milestone of total assets of trillions of VND, including BIDV, VietinBank, Agribank, Vietcombank and MB. The common point of this group is that they are all partly or mostly owned by State shareholders. VPBank, by the end of 2024, recorded a total consolidated asset size of more than 923,848 billion VND.

"Million Dollar" Club

For the banking industry, total assets are one of the key indicators reflecting scale, financial capacity and competitive position.

Total assets play a fundamental role in evaluating operational efficiency through financial indicators such as ROA (return on total assets), demonstrating the ability to effectively manage and exploit resources, contributing to the sustainable and stable development of the bank. At the same time, a bank with large total assets often has a clear advantage in terms of reputation with customers, investors and partners, helping to improve the ability to mobilize capital and meet international financial standards.

In 2016, for the first time, the Vietnamese banking system recorded banks with total assets exceeding 1 quadrillion VND, namely Agribank and BIDV. At that time, most of the top private banks only reached the asset threshold of 200,000 - 300,000 billion VND. The quadrillion mark became the "boundary" dividing the two groups of state-owned banks and private commercial banks.

However, with dynamism in strategy, coverage in separate segments and the ability to quickly adapt to market fluctuations, Vietnamese private banks are gradually narrowing the gap in total asset size compared to the state-owned banking group.

In the period of 2022-2023, the asset size of leading private banks such as VPBank, Techcombank, MB, or ACB will grow dramatically, reaching 800,000 - 900,000 billion VND, equivalent to about 50% of the state-owned group, compared to only about 30% 5 years ago. For the first time, the banking industry recorded that the private group could reach the milestone of total assets of millions of billions of VND.

This narrowing gap stems from private banks' strong focus on digital transformation, promoting the development of retail banking products and effectively exploiting the individual and SME customer segments with high profit margins and large segment coverage.

In addition, flexible governance structures, the ability to respond quickly to market fluctuations and build integrated digital ecosystems also help private banks effectively take advantage of business opportunities, thereby promoting stronger and more sustainable total asset growth compared to state-owned banks, which are limited by many barriers, especially the ability to increase capital.

VPBank's rapid progress

Among the private banking group, VPBank's progress can be considered the most outstanding. In 2010, VPBank's total assets were only a modest VND59,800 billion, compared to the average of over VND100,000 billion of the leading private group or the VND300,000-500,000 billion of the state-owned group. However, the bank's total assets have continuously increased at a rapid rate, surpassing VND400,000 billion in 2020, nearly 7 times in just a decade.

Notably, since 2021, VPBank's total asset growth rate has increased significantly, surpassing the important milestones of VND 500,000 billion in 2021 and continuing to exceed VND 800,000 billion in 2023. VPBank's total assets are expected to reach VND 1.13 million billion by the end of 2025, nearly double that of 2021 and increase by nearly 40% compared to 2023.

In particular, the 2022-2025 period witnessed the fastest growth rate, supported by VPBank's implementation of billion-dollar deals such as the agreement to sell 49% of charter capital at FE CREDIT to SMBC Finance Company with a valuation of 2.8 billion USD in 2021 and the private issuance of 15% of equity capital to strategic partner SMBC Group with a value of more than 35,900 billion VND in 2023. These outstanding figures show that important strategic decisions such as expanding the ecosystem, developing digital banking, as well as improving capital mobilization efficiency and expanding the customer network have clearly shown their effectiveness.

In addition, growth is driven by many strategic factors. VPBank has expanded its financial ecosystem through the development of diverse and comprehensive fields of operation, including: VPBank Securities Company (VPBankS), OPES Insurance Company and recently acquired GPBank under a compulsory transfer plan. The strategic cooperation with SMBC Bank of Japan also helps VPBank expand cooperation opportunities with FDI customers, rapidly increasing the size of large customer groups.

This year, along with VPBank, Vietnamese banks continue to target double-digit growth in total assets. In this year's banking industry outlook report, the analysis team from Vietnam Investment Credit Rating Company (VIS Rating) expects the creditworthiness of Vietnamese banks to improve, following the recovery trend from the second half of 2024, led by state-owned banks and some large banks. In particular, many government policies implemented to support economic growth and resolve legal issues will promote business activities in key sectors that banks lend to, such as manufacturing, trade, construction and real estate.

Source: https://thoibaonganhang.vn/tham-vong-trieu-ty-dong-cua-mot-ngan-hang-tu-nhan-162893.html

![[Photo] Ho Chi Minh City welcomes a sudden increase in tourists](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/dd8c289579e64fccb12c1a50b1f59971)

![[Photo] Liberation of Truong Sa archipelago - A strategic feat in liberating the South and unifying the country](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/d5d3f0607a6a4156807161f0f7f92362)

![[Photo] President Luong Cuong meets with Lao National Assembly Chairman Xaysomphone Phomvihane](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/dd9d8c5c3a1640adbc4022e2652c3401)

Comment (0)