On the afternoon of October 17, Savills Vietnam held a press conference to share the performance of the industrial real estate segment in Vietnam and forecast the future market.

Rent increased by 20%, occupancy rate over 80%

At the press conference, Mr. John Campbell - Deputy Director, Head of Savills Vietnam Industrial Services - said that as of the first half of the year, there were 397 industrial parks (IPs) established with a total land area of 122,900 hectares. Of which, 292 IPs are in operation with a total land area of over 87,100 hectares. Another 106 IPs are under construction with a total land area of 35,700 hectares.

Mr. John Campbell - Deputy Director, Head of Industrial Services, Savills Vietnam (Photo: Nhat Quang).

Industrial parks nationwide have a high occupancy rate of over 80%, of which the key northern provinces reach 83% and the key southern provinces reach 91%.

In terms of rental prices, in the North, the average rental price reached 138 USD/m2/rental cycle, an increase of 35% compared to the same period in 2022. Meanwhile, in the South, the rental price was at 174 USD/m2/rental cycle, an increase of 15%. Thus, the average rental price in both regions reached 156 USD/m2/rental cycle, an increase of 22%.

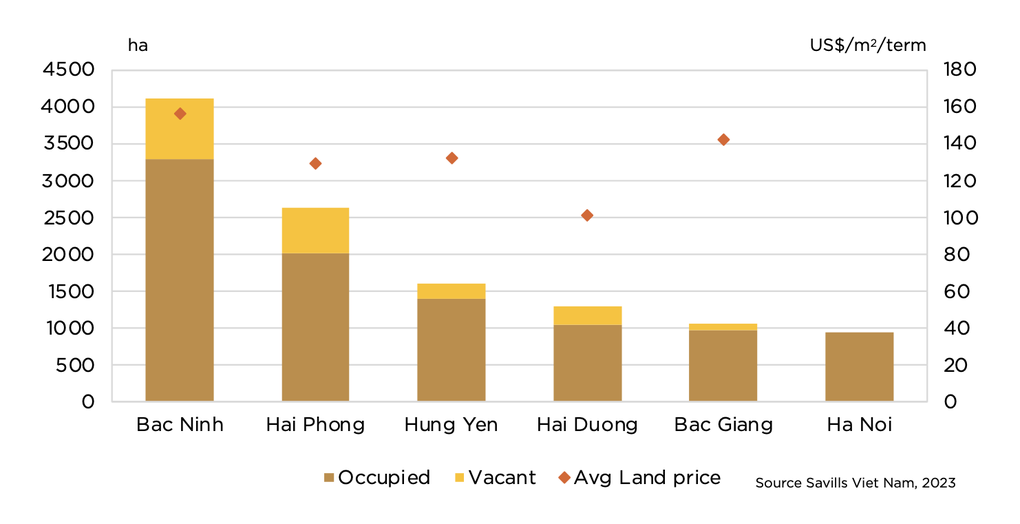

Occupancy rate (brown column), vacancy rate (yellow column) and rental price (orange dot) of industrial real estate in provinces/cities in the Northern region.

The Northern Economic Zone has a developed road network, enhancing connectivity between Hanoi and key industrial provinces such as Bac Ninh, Hung Yen, Bac Giang, Hai Duong, Hai Phong and Quang Ninh.

Hung Yen recorded a 45% increase over the same period last year to 132 USD/m2; Hai Duong increased by 33% to 101 USD/m2 and Hai Phong increased by 28% to 129 USD/m2.

Occupancy rate in Bac Ninh decreased to 80% from 91% last year, due to the record of new supply available in Gia Binh IP (277 ha), Thuan Thanh (231 ha) and VSIP Bac Ninh II (137 ha).

Occupancy in Hai Duong fell 5 percentage points to 81%. In contrast, Hai Phong’s occupancy rate increased 13 percentage points year-on-year to 76%, and Hung Yen’s occupancy rate reached 88%, an improvement of 14 percentage points.

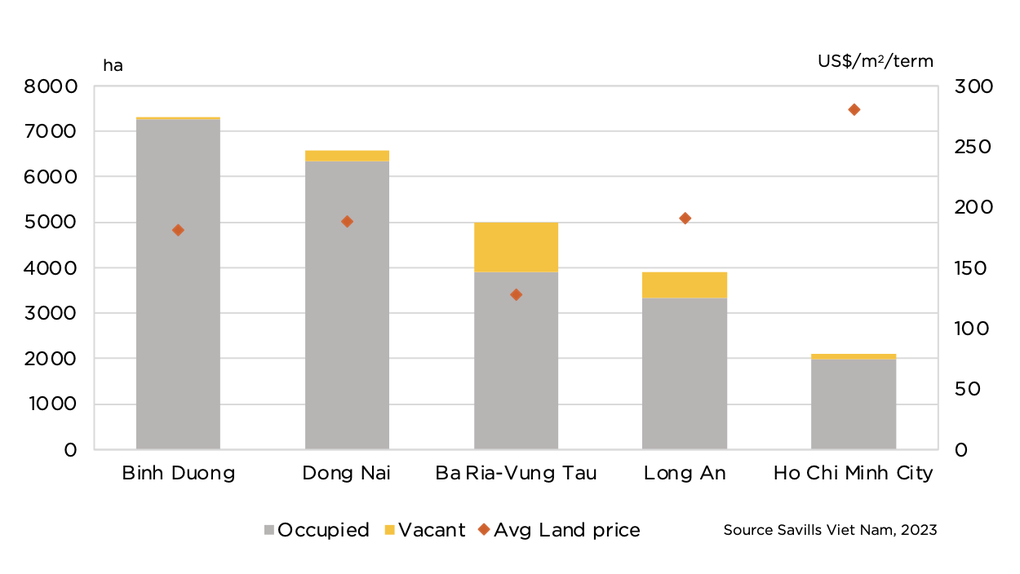

The Southern Key Economic Zone recorded 122 industrial park projects with a leased land area of 24,883 hectares. Tenants mainly operate in the fields of food and beverage processing, construction materials, textiles, and rubber and plastic products.

Mr. John Campbell said that in the first half of the year, Ba Ria - Vung Tau had the largest rental price increase with an increase of 35% compared to the same period last year, up to 128 USD/m2/rental period. The rental price increase was partly due to the increase in prices at Phu My 3 Industrial Park, one of the most expensive industrial parks in this province.

Occupancy rate (gray column), vacancy rate (yellow column) and rental price (orange dot) of industrial real estate in provinces/cities in the Southern region.

Long An had a 23% increase compared to the same period last year, to 191 USD/m2, and Dong Nai increased by 18% compared to the same period last year, to 188 USD/m2. Binh Duong and Ho Chi Minh City have almost no vacant land, no price increase.

Occupancy in Long An increased to 85% from 60% last year. In Ba Ria - Vung Tau, occupancy reached 78%, up 8 percentage points. Occupancy in Binh Duong was high at 99% and in Dong Nai was stable at 96%.

High rents may reduce competitive advantage

The Savills leader assessed that rental prices are starting to exceed double digits, which reduces the competitive advantage of the Northern economic region compared to the Southern economic region.

Industry and manufacturing will lead the way in attracting foreign capital flows, with foreign investors showing interest in industrial land and high-quality ready-built supply. However, finding industrial land supply is becoming a difficult problem for businesses, as the occupancy rate of industrial parks is always high.

Mr. John said that the rental price as well as the occupancy rate announced by Savills are also at a relatively high level. However, in the coming time, this rate may also fluctuate slightly, because in 2024, the market will continue to receive new supply, key projects in Dong Nai and Bac Ninh.

Source

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] General Secretary To Lam visits exhibition of achievements in private economic development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/1809dc545f214a86911fe2d2d0fde2e8)

Comment (0)