Make your mark with green awards and sustainable development

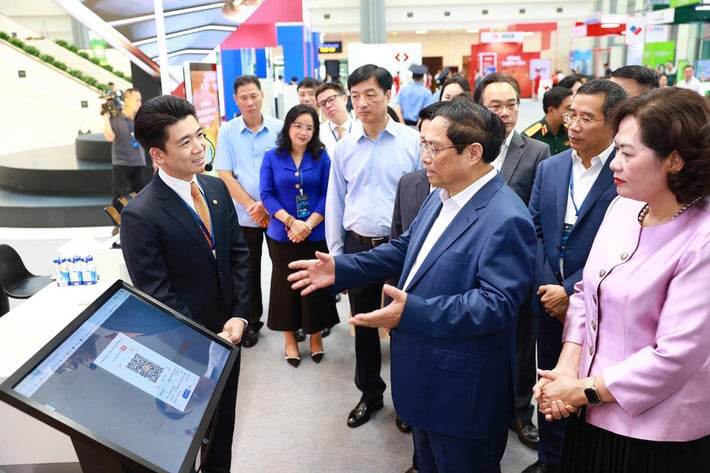

Green growth and sustainable development are becoming a prominent trend globally. In Vietnam, ESG (Environmental, Social and Governance) standards are increasingly receiving attention from the Government, especially after Prime Minister Pham Minh Chinh's commitment to achieving net zero emissions by 2050 at the COP26 Conference. This is also considered an important factor helping Vietnamese enterprises create a competitive advantage in attracting foreign investment capital.

Among Vietnamese enterprises, Saigon-Hanoi Commercial Joint Stock Bank (SHB) is highly appreciated by many prestigious organizations and investors for its application of ESG standards in its business operations. In 2024, Finance Asia Magazine awarded SHB the “Bank with the Most Positive ESG Impact in Vietnam” award for the second consecutive year. Previously, Asiamoney Magazine also honored SHB as “Bank with the Best ESG Impact in Vietnam in 2023”.

Notably, for two consecutive years, SHB is the only representative in Asia-Pacific to be honored by Global Finance as the “Bank with the best sustainable financing activities”. At the Green Economy Forum for a Sustainable Development Country in 2023 organized by the Vietnam Environmental Association, SHB was in the Top 10 green and sustainable development enterprises. This bank is also in the Top 10 banks arranging effective investment capital for Vietnam energy projects in the period of 2017-2021 honored by the Vietnam Energy Association.

With the vision of becoming a pioneer bank in the field of sustainable development in Vietnam, integrating ESG standards into all practical activities, contributing to promoting a green economy, a fair society and transparent governance, SHB aims for a Sustainable Development Model Framework. This is a transformation roadmap consisting of many components including integrating ESG analysis and operations into each group of activities from governance, strategy, risk management to data and information disclosure reports.

SHB also applies transparent and responsible corporate governance measures according to best standards and practices to ensure sustainability in all bank operations. Information on operating results is publicly and transparently disclosed to investors, shareholders and customers.

Unblocking the flow of "green" capital

As an important financial supply channel for the economy, the banking system in general and SHB in particular always identify their role and responsibility in "greening" capital flows for sustainable development goals, actively accompanying the Government towards the goal of responding to climate change.

The bank is increasing capital sources for projects that go along with the national strategy such as sustainable agriculture projects, clean energy, key projects, logistics, etc. SHB's outstanding credit balance for the green sector currently accounts for nearly 10% of total outstanding loans. One of the completed projects that has been highly appreciated by green economic experts is the Hanh Phuc rice factory - the largest investment project in Asia in An Giang, inaugurated in January 2022.

Green energy projects are always SHB's choice. The bank has provided credit to Yang Trung Wind Power Plant, one of the large wind power clusters located in Gia Lai. Thanks to the credit provided, Yang Trung Wind Power Plant, after being put into operation, has become a major contributor to the national power grid with nearly 1 million MWh.

Along with agricultural and clean energy projects, SHB has always actively invested in key national projects. In 2013, SHB sponsored VND6,200 billion for key national transport and infrastructure projects such as the three-storey overpass at the Hue-Da Nang intersection; the project to expand National Highway 1 through Thua Thien Hue and Khanh Hoa... In addition, SHB also provides credit for a number of projects in areas such as logistics and seaport transport - key economic sectors of the country.

Over the years, SHB has been a trusted partner of many financial institutions such as WB, IFC, ADB… bringing credit flows to clean energy projects, “green” projects and SMEs, women-owned businesses.

Integrating ESG with business pillars, spreading good values to the community

In the period of 2024-2028, SHB focuses resources on implementing a strong and comprehensive Transformation Strategy based on 4 pillars: Reforming mechanisms, policies, regulations, and processes; People are the subject; Taking customers and markets as the center; Modernizing information technology and digital transformation.

In line with the Transformation Strategy, SHB also integrates ESG into its business pillars. With the pillars of mechanisms and policies, the bank constantly strives to improve the quality of governance and ESG risk management. SHB builds a roadmap to integrate ESG into its corporate governance structure, while continuing to improve its risk management system according to ESG standards, periodically assessing and monitoring ESG risks in business operations.

With the pillar of “People are the subject”, SHB promotes social responsibility and human resource development. The bank implements programs to support education, health and economy for the community; encourages employees to participate in volunteer activities. Along with that, SHB builds an equal and diverse working environment, creating conditions for employees to be trained in ESG and professional skills. In particular, the “greening” process is taking place strongly in all internal activities of the bank. SHB has been implementing many measures to reduce energy and resource consumption at branches and transaction offices such as using renewable energy, prioritizing the use of recycled materials, environmentally friendly in daily business activities... The bank organizes a very special program, the “Green Ideas” challenge - where the bank's employees come together to propose ideas for green living and environmental protection.

With the pillar of “Taking customers and markets as the center”, SHB develops a portfolio of green products such as granting green credit for renewable energy projects, organic agriculture, clean industry, waste reduction; ESG integrated products such as green bonds, sustainable investment funds, etc. The bank also applies ESG criteria in credit assessment and approval; encourages customers to implement sustainable projects, etc. In addition, SHB continues to cooperate with international organizations to access capital and knowledge about ESG; participate in forums and associations on sustainable development.

With the fourth pillar, SHB promotes digital banking services to minimize the use of paper and resources; applies electronic management systems in internal operations. The bank also invests in green technology and fintech to improve efficiency and sustainable development; uses technology to monitor and report ESG indicators.

Originating from the heart, throughout more than three decades of construction and development, SHB has always actively participated in social security programs, for the community, responding to programs launched by the Party and the State. In 2024, SHB contributed to the Program to Launch Support to Eliminate Temporary and Dilapidated Houses for Poor and Near-Poor Households nationwide and implemented interest exemption and reduction for customers, supporting people affected by storms and floods, estimated at nearly 150 billion VND. In addition, the bank also sponsored 2 school projects in Dien Bien province with a total value of 12.5 billion VND and continued to accompany the Ministry of Public Security to build 150 houses and a school for people in disaster-affected areas.

SHB is always determined with the orientation of sustainable, safe and effective development, continuously improving management capacity according to international standards and modern models. In addition, the bank will continue to accompany the creation and spread of good values to society and the community, joining hands to build the country in the new era - the era of national development.

The Bank sets a strategic goal of becoming the Top 1 Bank in terms of efficiency; the most favorite Digital Bank; the best Retail Bank and at the same time the Top Bank providing capital, financial products and services to strategic private and public corporate customers, with a supply chain, value chain, ecosystem, and green development.

Source: https://nhandan.vn/shb-no-luc-thuc-thi-esg-dong-hanh-cung-dat-nuoc-phat-trien-trong-ky-nguyen-moi-post860373.html

![[Photo] Bustling construction at key national traffic construction sites](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/2/a99d56a8d6774aeab19bfccd372dc3e9)

![[Photo] "Lovely" moments on the 30/4 holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

![[Video] Creating a foreign language ecosystem to make English a second language in schools](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/2/6e7e61760a664910804b5305d08958d6)

![[Photo] Ha Giang: Many key projects under construction during the holiday season](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/8b8d87a9bd9b4d279bf5c1f71c030dec)

Comment (0)