According to Article 25 of Circular 67/2023/TT-BTC, instructions on methods and bases for calculating insurance premiums for motor vehicle insurance. Readers are invited to refer to the article below.

|

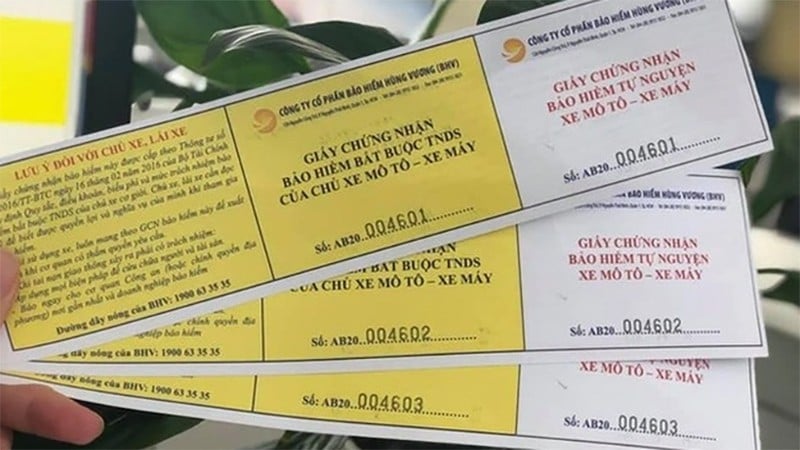

| New regulations on methods and bases for calculating insurance premiums for motor vehicle insurance from November 2, 2023. (Internet source) |

On November 2, the Minister of Finance issued Circular 67/2023/TT-BTC guiding a number of articles of the Law on Insurance Business, Decree 46/2023/ND-CP detailing the implementation of a number of articles of the Law on Insurance Business.

1. New regulations on methods and basis for calculating insurance premiums for motor vehicle insurance from November 2, 2023

According to Article 25 of Circular 67/2023/TT-BTC, instructions on methods and bases for calculating insurance premiums for motor vehicle insurance are as follows:

- Non-life insurance enterprises and branches of foreign non-life insurance enterprises shall proactively apply appropriate methods for calculating motor vehicle insurance premiums, ensuring that they meet at least the following requirements:

+ Insurance premiums are built to ensure compliance with the provisions in Point d, Clause 2, Article 87 of the Law on Insurance Business;

+ Insurance premium includes net premium, product implementation costs and expected profit. Net premium, insurance product implementation costs and expected profit are built according to the provisions in Clauses 2, 3, 4, Article 25 of Circular 67/2023/TT-BTC;

+ Apply the following risk-related factors as the basis for calculating insurance premiums, including:

++ Type of motor vehicle according to road traffic laws;

++ Business purpose (business vehicle, non-business vehicle);

++ Purpose of using motor vehicles (passenger vehicles, cargo vehicles, specialized vehicles);

++ Year of manufacture of motor vehicle.

In case of applying additional risk-related factors other than the above factors, non-life insurance enterprises and branches of foreign non-life insurance enterprises must ensure that they have data as prescribed in Point a, Clause 2, Article 25 of Circular 67/2023/TT-BTC;

+ Carry out specific registration of cases and bases for increasing and decreasing insurance premiums.

The increase in insurance premiums must be based on factors that increase the insured risk.

The reduction of insurance premiums must ensure that in all cases the insurance premium after the reduction is not lower than the pure insurance premium and is based on one or more factors that reduce, disperse, share risks or reduce the cost of implementing motor vehicle insurance products, including the scale of the number of insured vehicles, the choice of deductible level, deductible level, compensation history, form of product distribution and other factors (if any). In case of insurance premium reduction due to direct sales, the reduced insurance premium level does not exceed the insurance agent commission rate as prescribed in Article 51 of Circular 67/2023/TT-BTC;

+ The insurance premium of additional insurance terms must correspond to the insurance conditions and responsibilities; in case the additional term expands the insurance coverage, the insurance premium must be increased, in case the term narrows the insurance coverage, the insurance premium must be reduced, but in any case, it must not be reduced more than the net premium.

- Pure insurance premium is the insurance premium to ensure the performance of the obligations committed to the insurance buyer, corresponding to the insurance conditions and responsibilities.

Non-life insurance enterprises and branches of foreign non-life insurance enterprises shall establish net insurance premiums for a 1-year insurance term of motor vehicle insurance products, ensuring that the following requirements are met:

+ Net insurance premiums are determined based on actual statistical data of insurance companies and branches of foreign non-life insurance companies, ensuring scale and continuity over a minimum time series of 5 consecutive years.

In case the statistical data does not ensure scale and continuity, insurance enterprises and branches of foreign non-life insurance enterprises can use the following sources:

++ Net insurance premium announced by competent authorities and organizations;

++ Public, official statistics published by competent domestic organizations to determine net insurance premiums;

++ Net insurance premiums provided by the parent company or reinsurance enterprise, foreign insurance organization accepting reinsurance; in this case, the reinsurance enterprise or organization must be rated at least “BBB” by Standard & Poor's or Fitch, “B++” by AMBest, “Baal” by Moody's or equivalent ratings by organizations with other rating functions and experience in the fiscal year closest to the time of submitting the application for registration of the method and basis for calculating insurance premiums and must have experience in exploiting reinsurance for this type of risk in the Vietnamese or Asian market.

In case of adjustment of net insurance premium of foreign reinsurers (increase or decrease), insurance enterprises and branches of foreign non-life insurance enterprises must explain the reasons.

The use of pure insurance premiums provided by reinsurance enterprises and organizations must be consistent with the insurance benefits that the insurance enterprise or foreign non-life insurance enterprise branch intends to provide in the rules and terms of the insurance product.

+ Net insurance premium is determined specifically for each risk or for some of the following risks: collision, collision (including collision with other objects); overturning, toppling, sinking, falling; being hit by other objects; fire, explosion; natural disasters; theft; and other risks (if any).

- Short-term (less than 01 year) or long-term (over 01 year) net insurance premium is determined on the basis of net insurance premium for a 01-year insurance period and must include an explanation of the risk allocation assumptions corresponding to the insurance period.

- Non-life insurance enterprises and branches of foreign non-life insurance enterprises must ensure that assumptions on costs and profits included in insurance premiums do not exceed 50% of insurance premiums.

- Document explaining the method and basis for calculating insurance premiums according to the form specified in Appendix IV issued with Circular 67/2023/TT-BTC.

2. Forms of providing insurance services and products on the network environment

According to Article 5 of Circular 67/2023/TT-BTC, the forms of providing insurance services and products on the network environment include:

- Electronic information portal/website with a domain name registered in accordance with current legal regulations, e-commerce sales website or applications installed on electronic devices connected to the network allowing service users or insurance buyers to access the Electronic information portal/website, e-commerce sales website;

Or applications installed on the Portal/Website, e-commerce sales website or e-commerce application established by insurance companies, branches of foreign non-life insurance companies, mutual organizations providing micro-insurance to serve the provision of insurance services and products in the network environment.

- Portal/Website with a domain name registered in accordance with current laws, e-commerce sales website, e-commerce service providing website or applications installed on electronic devices connected to the network allowing service users or insurance buyers to access the Portal/Website, e-commerce sales website, e-commerce service providing website established by insurance brokerage enterprises and insurance agents to serve the provision of services and insurance products in the network environment.

Websites providing e-commerce services include the following types:

+ E-commerce trading floor;

+ Other types of websites as prescribed by the Ministry of Industry and Trade .

See also Circular 67/2023/TT-BTC effective from November 2, 2023, except for the following cases:

- Points a, b, c, d, đ, i, Clause 1, Points b, d, Clause 2, Points a, b, Clause 3, Article 20, Points a, b, Clause 1, Article 29, Articles 33, 34, 45, 46, 47, 48, 51, Clause 1, Article 52, Article 55, Section 3 and Section 4, Chapter IV of Circular 67/2023/TT-BTC take effect from January 1, 2023.

- Clause 2, Clause 3, Article 29 of Circular 67/2023/TT-BTC takes effect from July 1, 2024, sales illustrations of joint-linked products must have minimum information according to Appendix I issued with Circular 52/2016/TT-BTC; sales illustrations of unit-linked insurance products must have minimum information according to Appendix II issued with Circular 135/2012/TT-BTC; sales illustrations of retirement insurance products must have minimum information according to Appendix IV issued with Circular 115/2013/TT-BTC.

Circular 67/2023/TT-BTC replaces Circular 50/2017/TT-BTC, Circular 01/2019/TT-BTC, Article 1 of Circular 89/2020/TT-BTC, Article 1 of Circular 14/2022/TT-BTC, Circular 135/2012/TT-BTC, Circular 115/2013/TT-BTC, Circular 130/2015/TT-BTC and Circular 52/2016/TT-BTC.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)