Gelex CEO said the group does not focus on quick M&A, but emphasizes the suitability of factors such as management capacity, finance and human resources.

Gelex Group Joint Stock Company (GEX) today held its 2024 annual shareholders' meeting. General Director Nguyen Van Tuan shared about the future direction of this group.

This year, shareholders' questions mainly revolved around Gelex's corporate governance, instead of side information like last year.

2023 - a turning point year for this group in business as they increase cooperation with international partners. Gelex established a joint venture with Frasers to develop industrial parks in the North, with a total investment of about 6,000 billion VND in the first phase. The group also worked with Sembcorp to transfer part of the energy sector.

This year, Mr. Tuan said, Gelex focuses on cooperating with major partners, looking for suitable mergers and acquisitions (M&A) deals. However, unlike before, this group has changed the criteria from "fast" to "suitable" when buying and selling M&As.

"Gelex does not prioritize quick acquisitions, but at this time prioritizes suitability for the group. We realize that if we want to go far, we need to build a solid foundation in governance. Investment opportunities need to go hand in hand with appropriate capacity, finance and human resources," said Mr. Tuan.

For member companies, Gelex's orientation also focuses on changing management, especially for advantageous units such as Cadivi. This is to develop advantageous subsidiaries, seek cooperation opportunities with foreign partners and transfer technology in higher value production areas.

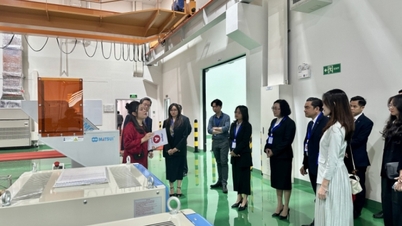

CEO Nguyen Van Tuan at the Gelex annual meeting in 2024, held on March 28. Photo: Minh Son

Gelex will continue to restructure its investment portfolio this year. In particular, the electrical equipment sector, industrial park infrastructure development and industrial real estate, and renewable energy are identified as top priorities.

In the industrial park real estate segment, Gelex plans to shift the investment model from factories and infrastructure to an industrial city integrated with an ecological urban area. The Group also expects to develop social housing projects, develop land funds, and invest in commercial and resort housing projects.

In response to a shareholder's question about why Gelex withdrew some member companies from the stock exchange, while listing conditions are increasingly strict, many businesses "want to go public but cannot", Mr. Tuan said this is the group's strategy.

According to the CEO of Gelex, the group currently holds the majority of shares in key member companies, 75-90%, and is oriented towards long-term investment, so these codes do not have high liquidity. However, because these companies are listed, periodic information disclosure and the organization of General Meetings of Shareholders must still be carried out, although sometimes only Gelex participates.

"Taking these businesses off the stock exchange to focus entirely on production and business," said Mr. Tuan.

Regarding the divestment of the wind power sector, Chairman of the Board of Directors Nguyen Trong Hien added that this plan is part of the group's strategy, but "not a complete divestment". That is, Gelex only divests part of the energy portfolio to find and select partners to accompany in the next projects. Currently, the group's energy portfolio is nearly 3,500 MW, including wind and solar power.

"The wave of investment in renewable energy over the past 5 years has helped Gelex draw many lessons to implement the next projects, so the group wants to accompany capable investors," said Mr. Hien.

This year, Gelex targets consolidated net revenue of more than VND 32,300 billion and consolidated pre-tax profit of more than VND 1,900 billion, up 7.7% and 37.5% respectively compared to last year.

Minh Son

Source link

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)