Stopping gold bar auction is appropriate

The State Bank of Vietnam (SBV) recently organized 9 gold bar auctions , of which 6 were successful with a total winning volume of 48,500 taels, equivalent to more than 1.8 tons of gold.

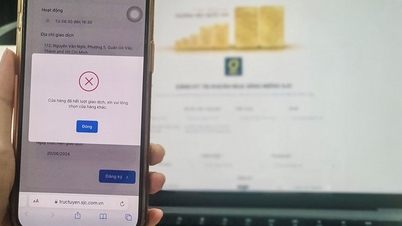

However, the State Bank of Vietnam suddenly announced that it would stop auctioning gold bars and would implement an alternative stabilization plan, which is to sell gold directly to four commercial banks for retail sale to the people.

Commenting on this decision, Associate Professor Dr. Ngo Tri Long - an economic expert - said that at one point, the difference between domestic and international gold bar prices was up to 18-20 million VND/tael. This difference caused huge consequences, such as gold smuggling, foreign currency loss, tax evasion, and creating an unhealthy competitive environment. The gold market was unstable because domestic prices were not close to world prices.

The reason, Mr. Long said, is due to lack of supply and increased demand.

“The gold price trend is increasing, with forecasts of up to 3,000 USD/ounce, while other investment channels such as real estate are quiet, savings interest rates are low, stocks are unstable... so gold investment is relatively attractive, high liquidity makes many people pour into gold.

The imbalance between supply and demand makes the price gap even bigger, so we have to increase supply to reduce the price. However, the recent gold auctions were wrong when they based on the market price to decide the reference price for the deposit, invisibly admitting that price is the market price. The goal of lowering the market price, narrowing the domestic and world prices was not achieved," Mr. Long analyzed.

According to this expert, in gold auctions, almost all of it is not sold, some sessions only sell 20%, the remaining 80% is "unsold"... so it is not effective.

"Gold auctions have not achieved the goal of reducing price differences, so stopping gold auctions is a wise, appropriate and timely solution," Mr. Long assessed.

Sharing the same view, Mr. Nguyen The Hung, Vice President of the Vietnam Gold Business Association, said that the Prime Minister requested to reduce the gold price, reduce the difference between domestic and international prices, but the gold auction did not achieve that goal because the State Bank set the reference price as high as the market price. Meanwhile, after buying at the winning price, businesses had to sell at a higher price to make a profit. That is an unreasonable and inappropriate problem.

“The State Bank of Vietnam sold 1.8 tons of gold bars, but will the gold be available on the market? If the bidding continues, where will we get foreign currency to import gold?”, Mr. Hung worried.

Decree 24 needs to be comprehensively revised.

According to economic expert Ngo Tri Long, we are currently operating the gold market with Decree 24 (2012), but it is too inadequate, outdated, and inappropriate. Therefore, the first solution is to urgently replace Decree 24.

“For the past 3-4 years, the State Bank has issued a draft but has not yet reached the “final” stage. Decree 24 must be replaced immediately, not amended, because the amendment principle only amends 20% of the content. To replace the decree, managers must change their thinking about gold management, in a way that is consistent with the Prime Minister’s guiding ideology of following market principles to manage the gold market.

There are three measures to manage the gold market: administrative, organizational and economic. Of which, the economic solution is the best solution, while administrative and organizational measures are the worst solutions,” Mr. Long said.

The expert reiterated many solutions that he had proposed, which is the need to change management thinking. The State Bank should only perform its functions, not do business; create a level playing field, in accordance with international practices. There must be many gold products, avoid one brand. In addition to physical gold, it is necessary to pay attention to gold certificates, use derivatives, open gold exchanges...

Vice President of the Vietnam Gold Trading Association Nguyen The Hung also said that the association's view is that there is no need to bid for gold, nor import gold, but only need to change the policy by amending Decree 24, removing the monopoly on SJC gold bars. From there, the gold price will drop immediately, without spending any foreign currency to import gold.

"We should consider SJC gold as well as other types of gold, the quality of 9999 is the same, don't focus on gold bars," Mr. Hung suggested.

While waiting for the amendment of Decree 24, Mr. Hung suggested that the State Bank still imports gold and sells it to businesses licensed to trade in gold bars, at prices lower than market prices.

“Enterprises are just distribution channels for the State Bank, selling at the price set by the State Bank. For example, if the State Bank imports gold, with the cost of 75 million VND/tael, it only needs to sell for 76-78 million VND/tael. Meanwhile, businesses sell for no more than 78.5 million VND/tael. That will narrow the gap and reduce the price difference,” Mr. Hung cited.

The Vice President of the Vietnam Gold Business Association said that there are enough tools to do it.

Sharing with VietNamNet, gold expert Tran Duy Phuong said that the State Bank stopped the gold auction because the auction was ineffective. Although the gold auction has relieved the market's thirst for gold, it has not met the State Bank's wishes as well as the Prime Minister's direction to reduce the gap between domestic and world gold prices to a more reasonable level.

According to Mr. Phuong, SJC gold accounts for 80% of the market. Before 2012, when SJC gold was not a monopoly, people still preferred SJC gold. Therefore, the monopoly of SJC gold should be abolished.

“The State Bank can import raw gold and resell it to large gold organizations/enterprises so that they have a source to produce gold bars and jewelry. Only that solution can stabilize the price quickly and effectively,” said Mr. Phuong.

Gold price today May 29, 2024: SJC suddenly dropped sharply after news that the State Bank sold gold

Source: https://vietnamnet.vn/nhnn-nhap-ve-ban-ra-lai-thap-xoa-duoc-ngay-gia-vang-chenh-cao-vo-ly-2285399.html

![[Photo] Closing ceremony of the 18th Congress of Hanoi Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/17/1760704850107_ndo_br_1-jpg.webp)

![[Photo] General Secretary To Lam attends the 95th Anniversary of the Party Central Office's Traditional Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/18/1760784671836_a1-bnd-4476-1940-jpg.webp)

![[Photo] Collecting waste, sowing green seeds](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/18/1760786475497_ndo_br_1-jpg.webp)

Comment (0)