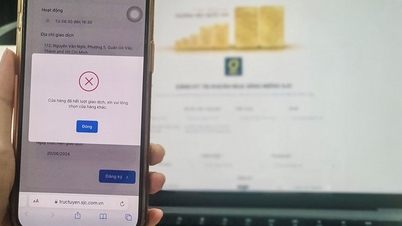

The State Bank of Vietnam (SBV) will sell gold directly to four banks: Vietcombank, BIDV, VietinBank and Agribank at a price determined by the SBV based on world prices. These banks will then sell gold directly to the public in order to quickly narrow the gap between domestic and world gold prices.

The new intervention plan of the State Bank is evaluated positively by experts as being feasible and more effective than the gold auction plan. However, there are still some issues that need to be clarified.

Good solution but depends on price

Speaking to VietNamNet reporter, Mr. Huynh Trung Khanh, Vice President of Vietnam Gold Business Association, advisor to the World Gold Council in Vietnam, said that the SBV's direct sale of gold to four state-owned commercial banks is similar to a gold auction. This is a positive measure, but the success or failure of the result depends on the selling price.

“We still do not know exactly at what price the State Bank will sell to the Big4 group and at what price the banks will sell to the people.

If the State Bank of Vietnam says the selling price is based on the world price, and the current international gold price is around 72-73 million VND/tael, then the selling price of 80 million VND/tael is great, only a difference of 5-7 million VND/tael," said Mr. Khanh.

However, according to experts, it also depends on the amount of gold sold. If it is too little, the price will be difficult to reduce even if it is sold cheaply. However much is sold, all is bought, then there will be a shortage of goods, the price will increase again. Therefore, it is necessary to sell at least about 3-4 tons within a month to reduce to the desired price.

Meanwhile, Associate Professor Dr. Nguyen Huu Huan, Ho Chi Minh City University of Economics, said that the solution of the State Bank selling gold directly to 4 state-owned commercial banks is similar to gold bidding; however, "why are only the Big4 group allowed to participate and not other banks? What is the fixed price of the State Bank? What is the profit of the Big4 group?".

If banks see no profit, they will not be interested in participating even if the State Bank assigns and directs them to do it, they will do it.

According to Associate Professor Dr. Nguyen Huu Huan, the State Bank needs to be transparent about the selling price for the Big4 group and the price that banks sell to the people to avoid "prioritizing relatives".

If the selling price is close to the world price, people will buy a lot. However, Mr. Huan is concerned, if many people buy, will there be enough supply? When people buy a lot, will banks sell at a high price?

Gold trading enterprises have no chance to manipulate prices?

Also sharing with VietNamNet reporter, gold expert Tran Duy Phuong assessed that the new intervention plan of the State Bank is more positive, feasible, and effective than the gold auction plan, because the State will decide the price as desired to narrow the price gap between domestic and world prices.

Previously, prices were decided by businesses and banks based on demand and profit, so it was difficult to stabilize prices.

“Instead of gold trading businesses proactively setting and listing prices according to their wishes based on supply and demand as before, in the near future, they may have to look at the prices of the Big 4 group to set their own prices,” said Mr. Phuong.

According to the expert, by replacing the Big4 group with the option of selling gold as directed by the State Bank, the selling price will be based on the world price, plus a certain profit margin to create a reasonable selling price, according to the State Bank's expectations. This will create a psychological effect, many people will no longer speculate and hoard. Selling pressure has appeared in the market, prices have begun to decline.

“When selling gold through the Big4 group, the gold will go to the people; businesses and organizations will not be able to buy; this will eliminate hoarding and price hikes. Especially with the abundant resources and extensive network of the Big4 group, the gold market will basically gradually decrease to a more reasonable price,” Mr. Phuong added.

Vice President of the Vietnam Gold Business Association Huynh Trung Khanh also said that Big4 banks directly selling gold to people will not affect the group of gold and jewelry businesses, because they still have their own customer base.

However, businesses will have to adjust their selling prices according to the prices of state-owned banks; if they sell at higher prices, there will be no buyers.

“I don’t think gold trading companies manipulate prices. The sharp drop in domestic gold prices is due to more people selling gold than buying it, due to consumer psychology and market psychology. Especially when businesses are being inspected, they are not foolish enough to manipulate prices,” Mr. Khanh analyzed.

In the coming time, when the inspection results are available, it will be clear whether the business is manipulating prices or not. In addition, when the State Bank sells gold directly to the Big 4 group, these banks use their extensive distribution system to sell retail gold, from which they will see the real demand in the market.

However, according to Mr. Khanh, banks selling gold is only a short-term intervention solution. In the long term, Decree 24 must be revised and the monopoly of SJC gold bars must be reconsidered. Along with that, raw gold imports must be allowed.

Gold price today June 1, 2024 continuously decreases, SJC is only over 83 million VND

Source: https://vietnamnet.vn/ngan-hang-ban-gia-vang-80-trieu-luong-ong-lon-het-cua-lam-gia-2286247.html

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

![[Photo] General Secretary To Lam and international leaders attend the parade celebrating the 80th anniversary of the victory over fascism in Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/4ec77ed7629a45c79d6e8aa952f20dd3)

![[Photo] Prime Minister Pham Minh Chinh chairs a special Government meeting on the arrangement of administrative units at all levels.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/6a22e6a997424870abfb39817bb9bb6c)

![[Photo] Russian military power on display at parade celebrating 80 years of victory over fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/ce054c3a71b74b1da3be310973aebcfd)

Comment (0)