That is the opinion of many experts when predicting the development of the Vietnamese stock market after the National Day holiday on September 2.

Mr. Nguyen The Minh, Director of Research and Product Development, Yuanta Vietnam Securities Company, said that in the context of banks continuously lowering deposit interest rates, along with the loosening of monetary policy by the State Bank, cash flow has the motivation to shift into the stock investment channel.

“In addition, the stock market still depends largely (estimated at over 90%) on personal cash flow, I boldly predict that there will be clear waves in the last months of 2023,” said Mr. Minh.

Mr. Phan Manh Ha, Business Director of VnDirect, also agreed: “The forecast of an increase in stocks after the holidays until the end of the year is well-founded, reflecting the effectiveness of economic recovery policies issued by the Government in recent times. This creates expectations for the recovery of the economy and businesses in the coming time.”

Analyzing some policies that can have a positive impact on the stock market, Mr. Ha explained: From the Government's drastic direction, many banks have continuously reduced operating interest rates; tax authorities have also reduced value added tax, registration tax, land use tax; ministries, branches and localities have promoted the disbursement of public investment capital... All of these will stimulate economic recovery and development.

According to Mr. Ha, the interest rate issue is one of the most notable highlights in the year-end period. For the stock market, a decrease in interest rates is always a variable that creates a positive effect, especially in the context of production activities still facing many difficulties.

Many signals show a positive recovery of stocks after the 29th holiday. (Illustration photo: VNN)

Commenting on the stock market in the coming time, Mr. Dang Tran Phuc, Chairman of the Board of Directors of AZfin Vietnam Joint Stock Company, said that the socio-economic situation in the first 8 months of the year has been announced. This shows both positive and negative aspects, in which the positive factor is the main factor.

Mr. Phuc analyzed: On the positive side, the trade surplus increased very high, up to 20.19 billion USD in 8 months, a rare level in history, with the trade surplus in August alone reaching 4.96 billion USD.

Second, the total public investment capital increased by 23.1%, which is also a very high increase and is continuing to accelerate, with a very strong upward trend in September.

Third, although registered FDI capital has decreased, disbursed and implemented capital has increased, and many countries are now interested in investing in Vietnam. We have every reason to expect that FDI capital flows will continue to increase strongly, creating momentum for socio-economic development.

Regarding negative factors, Mr. Phuc pointed out that the sudden increase in prices of some essential goods such as gasoline, food, rice... has affected the consumer price index in August and may last until the end of September.

“However, the inflation rate of 2.96% over the same period is still much lower than the National Assembly's allowed level of 4.5%. It is highly likely that Vietnam will still control inflation well at 3.5 - 4%. This is a level suitable for the current Vietnamese economy,” Mr. Phuc commented.

Another issue is that the VND exchange rate has decreased by 1.8% in August, which is also a short-term risk pressure for the Vietnamese stock market. This also poses a situation where there may be a massive withdrawal of capital from foreign investors if the exchange rate continues to fluctuate strongly.

“However, the yield on US government bonds is also cooling down, reducing pressure on the exchange rate and there is a high possibility that the State Bank will be able to control the exchange rate reasonably and effectively,” Mr. Phuc believes.

Talking about the decline of stock indexes in recent sessions, Mr. Phuc said that after a period of strong growth, this adjustment is necessary and normal.

“ This is an adjustment to purify the market. Currently, market valuations are still cheap and the macroeconomic outlook is quite positive, so there is a high possibility that the stock market will have positive developments in September as well as the end of the third quarter and the fourth quarter ,” said Mr. Phuc.

In a recent announcement, Chairwoman of the State Securities Commission Vu Thi Chan Phuong also said that at present, the stock market is being supported by many positive factors.

Public investment groups and cyclical benefit stocks such as securities, retail, and highly stable industries such as pharmaceutical technology, beverages, etc. will still attract cash flow in the coming time. In addition, investors can consider some industries that have bottomed out in terms of profits and may have an improvement trend in the future.

"In addition, recently issued support policies such as Circular 02/2023/TT-NHNN of the State Bank guiding credit institutions to restructure debt repayment terms and maintain debt groups; Decree 12/2023/ND-CP of the Government on extending the deadline for payment of value-added tax and corporate income tax; Circular 03/2023/TT-NHNN of the State Bank allowing credit institutions to buy back unlisted corporate bonds are practical solutions to remove difficulties for businesses and people," said Ms. Phuong.

These are factors that positively affect market liquidity in the third and fourth quarters of 2023.

The Chairman of the State Securities Commission affirmed: “The State management agency will continue to manage and ensure the stock market operates transparently and healthily, meeting the requirements of the important capital channel of the economy, sharing the pressure on the bank credit channel. In particular, focusing on increasing the quality of goods for the market to quickly restore investor confidence, ensuring a solid foundation for the market to develop sustainably in the long term” .

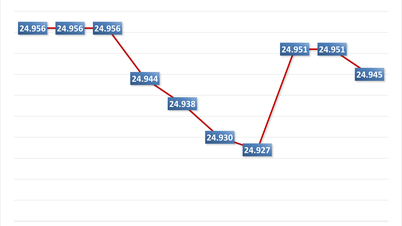

Before the September 2 holiday, at the end of the trading session on August 31, the VN-Index increased by 10.89 points (0.9%) to 1,224.05 points. The HNX-Index increased by 1.79 points (0.72%) to 249.75 points.

PHAM DUY

Source

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

Comment (0)