Over the past week, the Vietnamese stock market has experienced many "unprecedented" trading sessions. The VN-Index dropped more than 200 points in 4 consecutive sessions when US President Donald Trump announced the imposition of high reciprocal tariffs on many trading partners, of which Vietnam was subject to a rate of 46%.

The market only ended the week in chaos and recovered when on April 9, Mr. Trump announced a 90-day delay in reciprocal tariffs on countries that "don't retaliate", except for China. The VN-Index increased by 128 points in the two sessions on April 10-11, helping the market close the week at over 1,200 points.

During the recent volatile period, investors' psychology and actions changed continuously in just a few days. Many people went from panic selling stocks in the session of April 8 or 9 to "buying the bottom" and buying stocks when the market exploded in the following two sessions.

On April 9, when the market fell sharply due to the uncertainty of Mr. Trump's tariffs, Ms. Hoa (an investor in Hanoi) chose to "buy the bottom" of HPG shares of Hoa Phat Group and VCB (Vietcombank). These codes hit the ceiling consecutively afterwards, helping Hoa earn a profit of 10% after only two sessions of "investing".

But not all investors are as quick and profitable as Hoa. In the context of the US's constantly changing tariff policies, affecting the financial market, Mr. Nguyen The Minh, Director of Research and Development for Individual Clients at Yuanta Securities Vietnam, said that investors should change their cash flow allocation strategy.

Mr. Minh analyzed that at the beginning of the year, many investors were optimistic and had faith in the market, they were willing to spend large amounts of money to buy stocks. However, in the current context, investors should have a more balanced strategy. Accordingly, they can spend half of their assets on stocks, the rest on other accumulation channels such as buying gold or saving in banks.

In case investors want to spend most of their money on stocks, they still have many opportunities. According to experts from Yuanta Vietnam Securities, investors with a large proportion of cash should take advantage of the current recovery to make a profit by buying good stocks. As for those with a high proportion of stocks and losses in early April, they can buy more at a discount, taking advantage of the market's excitement to reduce losses.

For investors with high margin trading ratios, in addition to buying more stocks to lower capital costs, Mr. Minh recommends that they reduce their debt to a low ratio, in case the market suddenly "turns around".

Investors should also restructure their portfolios, according to experts. The US tax policy targets a list of goods that protect the country's industrial production, such as garments, electronic components, steel, etc. Meanwhile, the information technology service industry is less affected. On April 12, President Trump announced a reciprocal tax exemption for electronic devices such as smartphones, laptops, hard drives, memory chips, as well as machinery for the production of semiconductors, semiconductors, and solar panels.

Meanwhile, real estate, banking, retail, public investment, electricity and securities groups mainly serve domestic activities and do not export products, so they are less directly affected by US tariffs.

Therefore, according to Mr. Minh, investors should reduce the proportion of ownership of stocks directly affected by tariffs such as textiles, seafood, footwear... to less affected industries including technology services, banking, securities, consumer goods.

Not to mention, according to analysis from MB Securities (MBS), real estate stocks can grow thanks to the low interest rate environment, land prices have shifted in the wave of city-province mergers. This securities company estimates that real estate industry profits will increase by 6% this year.

Similarly, the securities group also has many prospects for price increases thanks to the support from low interest rates and the future market upgrade period. Along with that, the book value (P/B) of some companies such as SSI, HSC, Vietcap or MBS is currently only 1.5-1.8 times, lower than the average of the past 5 years (over 2.3 times). The lower the P/B of the enterprise, the more potential the company's stock has to increase in price.

Mr. Dinh Quang Hinh, Head of Macro and Market Strategy Department, VNDirect Securities Analysis Division, recommends that investors should not be hasty and should maintain a cautious mindset.

However, investors should not sell off stocks in the export sector, as seafood and textile companies may see a surge in orders during the 90-day tax deferral. US buyers may increase orders as they are not subject to high reciprocal tariffs. As a result, profits for this group are expected to grow positively in the second quarter.

In the short term, Mr. Nguyen The Minh believes that the upward trend may continue when the risk factors that caused the market to decline are resolved. The 1,300-point mark is forecast to return, but stocks "will find it difficult to go up vertically."

Mr. Quang Hinh pointed out some positive factors supporting the stock market. In particular, the market's price-to-earnings (P/E) is low, around 12 times. In addition, the good growth in the first quarter of businesses, along with the State Bank's plan to launch a preferential credit package of VND500,000 billion for the infrastructure and digital technology sectors, are new growth drivers for the market. Mr. Hinh predicted that the threshold of 1,240-1,260 points is the resistance zone for this recovery.

However, the market still faces many risks as the US-China trade tensions continue to escalate. So far, Washington has announced three additional import tariffs on Chinese goods. Of which, the reciprocal tariffs have been raised twice in the past few days. Currently, Chinese goods are subject to a total tax of 145% during Mr. Trump's term.

Beijing has responded with similar tariffs, restricting exports of many important metals and adding dozens of US companies to its export restriction list. US goods entering China are currently subject to a 125% tariff.

Mr. Nguyen The Minh said that fluctuations in the US tariff policy are risks that could cause further shocks to the stock market. In addition, many investors have suffered losses in the four sessions when the market fell 200 points, and they sold to get money back when the VN-Index recovered. Those who successfully "fished the bottom" when the market was down will take profits and this will cause market fluctuations. "The more the market increases, the more fluctuations occur," Mr. Minh commented.

Duong Chung (According to vnexpress.net)

Source: http://baovinhphuc.com.vn/Multimedia/Images/Id/126766/What-investors-should-do-after-the-stock-market-recovers-strongly

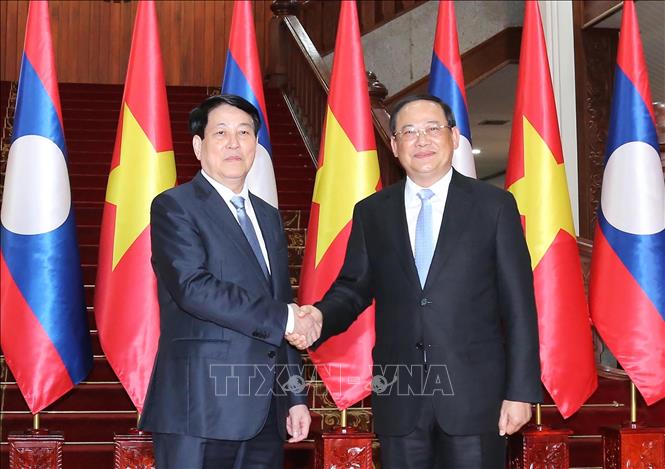

![[Photo] President Luong Cuong meets with Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/3d70fe28a71c4031b03cd141cb1ed3b1)

![[Photo] Liberation of Truong Sa archipelago - A strategic feat in liberating the South and unifying the country](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/d5d3f0607a6a4156807161f0f7f92362)

![[Photo] Ho Chi Minh City welcomes a sudden increase in tourists](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/dd8c289579e64fccb12c1a50b1f59971)

Comment (0)