(CLO) In the short term, the supply of residential real estate in 2025 will continue to grow, about 10% compared to 2024. In fact, many projects also have plans to "launch" to anticipate the market's recovery opportunity.

Real estate prices are still rising

According to the Vietnam Association of Realtors (VARs), the Vietnamese real estate market has passed its most difficult period with a sharp increase in supply year on year. New housing projects, especially in the apartment segment, have recorded good absorption rates. However, the market still faces many challenges.

VARs commented: The market recovery still has clear differentiation between segments, regions, product types and even between suppliers.

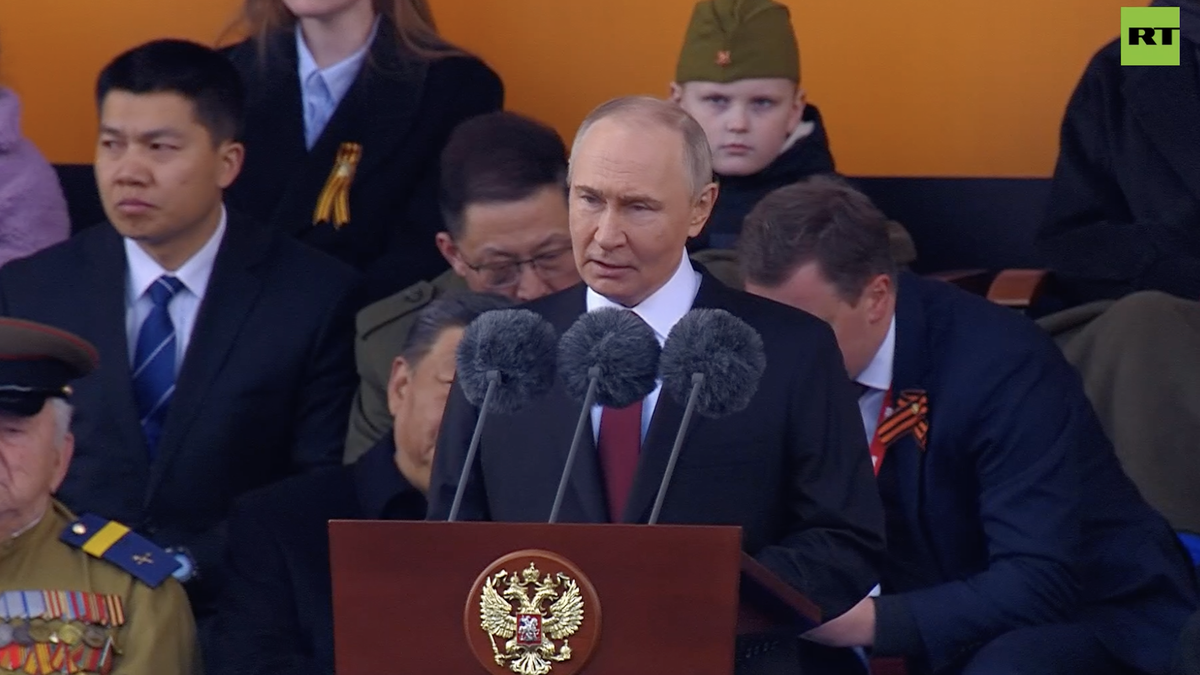

In the short term, the supply of residential real estate in 2025 will continue to grow, about 10% compared to 2024. (Photo: ST)

Housing supply is still insufficient in both quantity and quality to meet the actual needs of the people, causing real estate prices in some localities to continuously increase, establishing a new price level. This factor brings advantages to investors who own "clean" land funds in the short term.

However, the price being pushed up too high also poses a difficult problem for the market in the long term when it affects the cost of compensation for site clearance, land use fees and the cost of developing new projects.

In particular, the rising cost of capital makes it difficult for real estate prices to decrease, far beyond the affordability of many people. This increases the risk that projects are opened for sale but have difficulty liquidating due to the supply exceeding the demand that can meet financial capacity for many years to come.

"However, with the completion and implementation of new legal regulations on land, housing and real estate business, many obstacles are gradually being resolved, VARs expects to support the market to recover and stabilize more in the coming time," VARs stated.

Real estate supply in Hanoi is double that of Ho Chi Minh City

VARS forecasts that in the short term, the supply of residential real estate in 2025 will continue to grow, about 10% compared to 2024. In fact, many projects also have plans to "launch" to anticipate the market's recovery opportunity.

However, the real estate supply is expected to be mainly contributed by large urban areas in the provinces and cities of the Northern region of major investors. In Hanoi and satellite cities alone, it is estimated to reach about 37 thousand products in 2025. Meanwhile, Ho Chi Minh City and its suburbs are estimated to reach about 18 thousand products.

The apartment segment, mainly the segment priced from 50 million VND/m2 and above, continues to "lead" the market, with an increase in luxury supply.

The villa/townhouse type is also gradually becoming the "focus" of the market with new supply growth from large urban projects with synchronized infrastructure and utilities expected to be opened for sale. Meanwhile, the supply of land will continue to decrease with the "tightening" regulations on subdivision and sale of land. However, the supply of housing will continue to be scarce, especially in the affordable housing segment.

VARs said that the supply from social housing projects is expected to grow “significantly” in 2025 but still accounts for a very small proportion of the total housing supply structure of the market.

VARs assess: Supply is growing but still scarce compared to demand and mainly comes from large urban projects of large investors, which will continue to help newly launched housing projects maintain high "anchored" selling prices. Meanwhile, the secondary price level will continue to grow more slowly.

Specifically, the price level of apartments will continue to increase in large cities, with a lower increase, from 7-10% compared to 2024, because the current price level is quite high, the growth momentum in the market slows down when many old apartment products, lacking infrastructure and utilities, have transfer prices too high compared to their actual value.

In the land segment, the primary price level has increased sharply thanks to good price increase potential. The price level of villas/townhouses and townhouses will also continue to remain high in the context of scarce land funds and increasing investment costs, especially costs related to land.

VARS believes that housing projects launched in 2025 will still attract attention, be traded, and be well absorbed, but the absorption rate is likely to slow down. The apartment segment will continue to "dominate" market liquidity.

However, apartment liquidity will still be concentrated in large urban projects. Housing demand, especially investment demand, will continue to shift to suburban areas and tier 2 and tier 3 cities, where prices are lower and there is more room for growth in the future. Land plots that have been divided into plots, with "standard" legal status in areas with developed infrastructure and high potential, are still the segment that many people are willing to "pay for".

Source: https://www.congluan.vn/nguon-cung-bat-dong-san-tai-ha-noi-gap-doi-tp-hcm-trong-nam-2025-post331064.html

![[Photo] Prime Minister Pham Minh Chinh chairs a special Government meeting on the arrangement of administrative units at all levels.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/6a22e6a997424870abfb39817bb9bb6c)

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

![[LIVE] MILITARY PARLAY TO CELEBRATE THE 80TH ANNIVERSARY OF VICTORY IN THE WORLD PATRIOTIC WAR](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/9/cc9a3d18f01946a78a1f1e7c35ed8b31)

Comment (0)