The amount of yen sold by four major South Korean banks reached 30.16 billion yen ($213 million) in May 2023, a sharp increase from 6.28 billion yen in the same period last year.

The amount of yen purchased by South Koreans at local banks in May 2023 increased nearly fivefold from a year earlier, as many took advantage of the weak yen.

According to market data, the amount of yen sold at four major South Korean banks reached 30.16 billion yen ($213 million) in May 2023, a sharp increase from 6.28 billion yen in the same period last year.

The surge came as many people took advantage of the weak yen in recent weeks, which has fallen to an eight-year low against the won.

On Friday (June 16), the Korean won closed at 903.82 won per 100 yen, marking its highest level since June 2015, when it traded at 905.4 won per 100 yen.

The easing of travel restrictions amid the COVID-19 pandemic has also led to more people coming to Japan, many of whom want to buy yen for future gains.

Yen deposits at four South Korean banks reached 810.9 billion yen as of Thursday (June 15), up 16% from 697.8 billion yen at the end of May 2023.

The yen's latest slide comes as the US continues to maintain its monetary easing policy, despite other major economies including the US and Europe raising interest rates .

Meanwhile, market watchers warned that domestic investors should not bet on the yen for short-term gains, and the currency could continue to depreciate, potentially hitting 890 won per 100 yen in the near future.

"While the yen may be seen as a safe haven asset, it may not be an attractive investment option for those betting on the currency's recovery," said Baek Seok-hyun, an economist at Shinhan Bank.

This expert also recommends that the yen should not account for a significant proportion of people's investment portfolios./.

Source

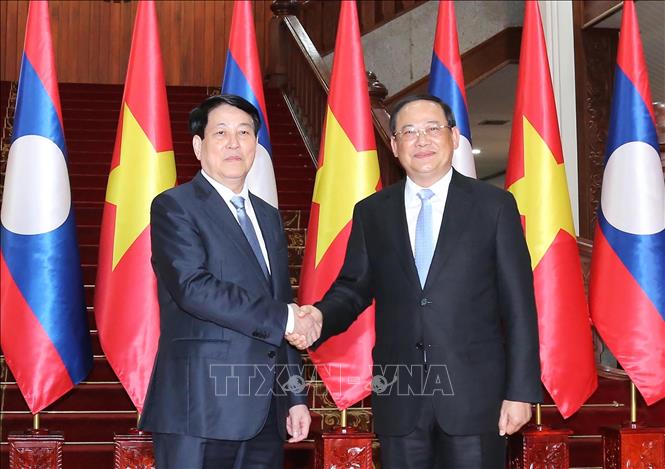

![[Photo] President Luong Cuong meets with Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/3d70fe28a71c4031b03cd141cb1ed3b1)

![[Photo] Liberation of Truong Sa archipelago - A strategic feat in liberating the South and unifying the country](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/d5d3f0607a6a4156807161f0f7f92362)

![[Photo] Ho Chi Minh City welcomes a sudden increase in tourists](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/dd8c289579e64fccb12c1a50b1f59971)

Comment (0)