|

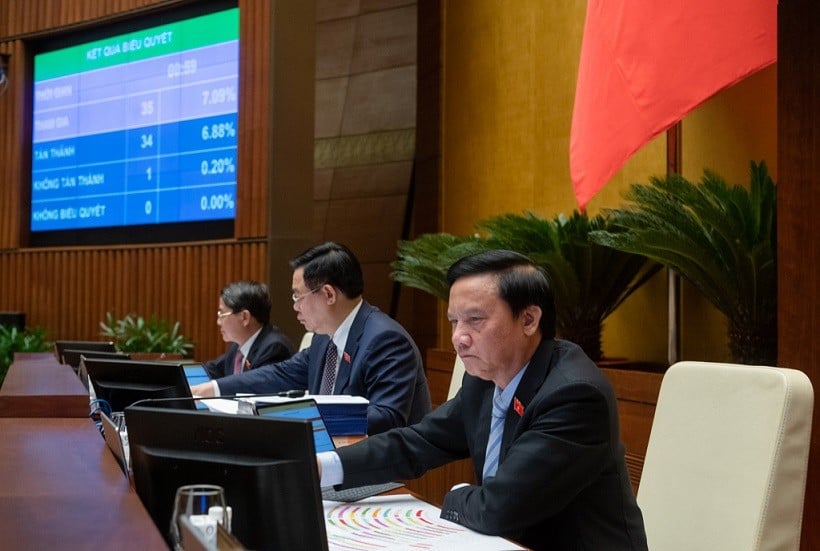

| National Assembly leaders participated in voting to pass the Resolution on the central budget allocation plan for 2024. |

Total central budget revenue is 852,682 billion VND

The resolution was passed: Total central budget revenue is 852,682 billion VND. Total local budget revenue is 848,305 billion VND. The remaining revenue transferred from local budget salary reform by the end of 2023 to the 2024 budget arrangement of some localities is 19,040 billion VND to implement the basic salary level of 1.8 million VND/month.

Total central budget expenditure is VND 1,225,582 billion, of which VND 426,266 billion is estimated to supplement the budget balance (including a 2% increase in the balance supplement compared to the 2023 state budget estimate), targeted supplement for local budgets (including targeted supplement for some localities to ensure that the estimated level of local budget balance expenditure in 2024 is not lower than the estimated local budget balance expenditure in 2023).

The National Assembly assigns the Government to assign the tasks of state budget collection and expenditure and the central budget allocation level to each ministry, central agency and each province and centrally run city in accordance with the provisions of the State Budget Law, the Resolution of the National Assembly and notify in writing each National Assembly delegation of the province and centrally run city.

The Government needs to tighten financial discipline, strictly handle violations, and obstruct the progress of capital allocation, implementation, and disbursement; individualize the responsibility of the head in case of slow implementation and disbursement, and evaluate the level of completion of assigned tasks.

In addition, the Government directs the People's Committees of provinces and centrally run cities to submit to the People's Councils of the same level for decision on the state budget revenue estimates in the locality, local budget revenue and expenditure estimates, local budget deficit, total borrowing of the local budget (including borrowing to offset deficit and borrowing to repay principal), and decide on the allocation of budget estimates according to their authority, in accordance with the provisions of the State Budget Law.

Environmental protection tax on gasoline and oil products shall be divided between the central budget and local budgets according to the provisions of the State Budget Law for 2024 and 2025 on the basis of the volume of gasoline and oil produced and sold domestically compared to the total volume of gasoline and oil consumed in the market, specifically: 60% shall be divided between the central budget and local budgets, the remaining 40% shall be 100% regulated to the central budget.

The Government shall specify the collection, payment, exemption, management and use of road use fees collected through the vehicle vehicle in a uniform manner nationwide, including roads under central management and roads under local management.

Continue to collect 100% of this revenue in 2024 and 2025 for the central budget and allocate 65% of the revenue to the central budget and allocate a targeted additional central budget estimate for the local budget, equivalent to 35% of the revenue, to carry out road management and maintenance work.

At the same time, the Government shall allocate a budget for the Ministry of Public Security equivalent to 85% of the revenue from administrative fines for traffic safety violations that the central budget will enjoy in 2022 (the budget for the task of modernizing facilities, equipment and means of the traffic police force shall be implemented according to the provisions of Clause 10 of this Article) and supplement the remaining revenue to localities equivalent to 15% of the remaining revenue to serve the work of other local forces participating in ensuring traffic order and safety.

Continue to distribute revenue from granting water resource exploitation rights in 2024 according to the provisions of Resolution No. 64/2018/QH14 dated June 15, 2018 of the National Assembly.

Prioritize investment in education - training and health care

The Government uses revenue from lottery activities for development investment; in which, priority is given to investment in the fields of education - training and vocational education (including purchasing teaching equipment for the program of renewing general education textbooks), and the health sector; the remaining amount is prioritized for implementation of other important and urgent development investment tasks that are subject to investment from the local budget.

Localities, based on actual conditions and balancing capacity, shall allocate the central budget to support compensation for local budget balance expenditures in 2024, ensuring that it is not lower than in 2023, to carry out local budget balance expenditure tasks. Regarding the increase in local budget revenue in 2024 compared to the 2024 estimate (if any), after allocating resources for salary reform as prescribed, localities shall allocate according to the provisions of Clause 2, Article 59 of the 2015 State Budget Law.

Use the budget allocated from savings to support regular activities in the field of state administrative management and support public service units of the local budget, according to the principle: 50% to supplement the source of salary reform according to regulations; the remaining 50% to prioritize payment of social security policies issued by the locality and increase spending on the task of strengthening the material facilities of the corresponding field. The decision on spending for each content is decided by the locality according to the authority prescribed in the State Budget Law.

Assign the budget for additional charter capital to the Bank for Agriculture and Rural Development. Review and accurately calculate the amount of compensation funds in the product consumption of the Nghi Son Refinery and Petrochemical Project (including the outstanding funds in the period 2018-2023 and the funds arising in 2024) in accordance with regulations, and the data must be determined by the State Audit before submitting to the National Assembly for consideration and decision; in urgent cases, during the period between two National Assembly sessions, report to the National Assembly Standing Committee for consideration, decision and report to the National Assembly at the nearest session.

Source

![[Photo] Russian military power on display at parade celebrating 80 years of victory over fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/ce054c3a71b74b1da3be310973aebcfd)

![[Photo] General Secretary To Lam meets with Chairman of the Federation Council, Parliament of the Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/2c37f1980bdc48c4a04ca24b5f544b33)

![[Photo] Ho Chi Minh City: Many people release flower lanterns to celebrate Buddha's Birthday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/5d57dc648c0f46ffa3b22a3e6e3eac3e)

![[Video] 24-hour news on May 9, 2025: General Secretary To Lam officially visits the Russian Federation and attends the 80th anniversary of Victory Day in the Great Patriotic War](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/5eaa6504a96747708f2cb7b1a7471fb9)

![[Photo] General Secretary To Lam and international leaders attend the parade celebrating the 80th anniversary of the victory over fascism in Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/4ec77ed7629a45c79d6e8aa952f20dd3)

Comment (0)