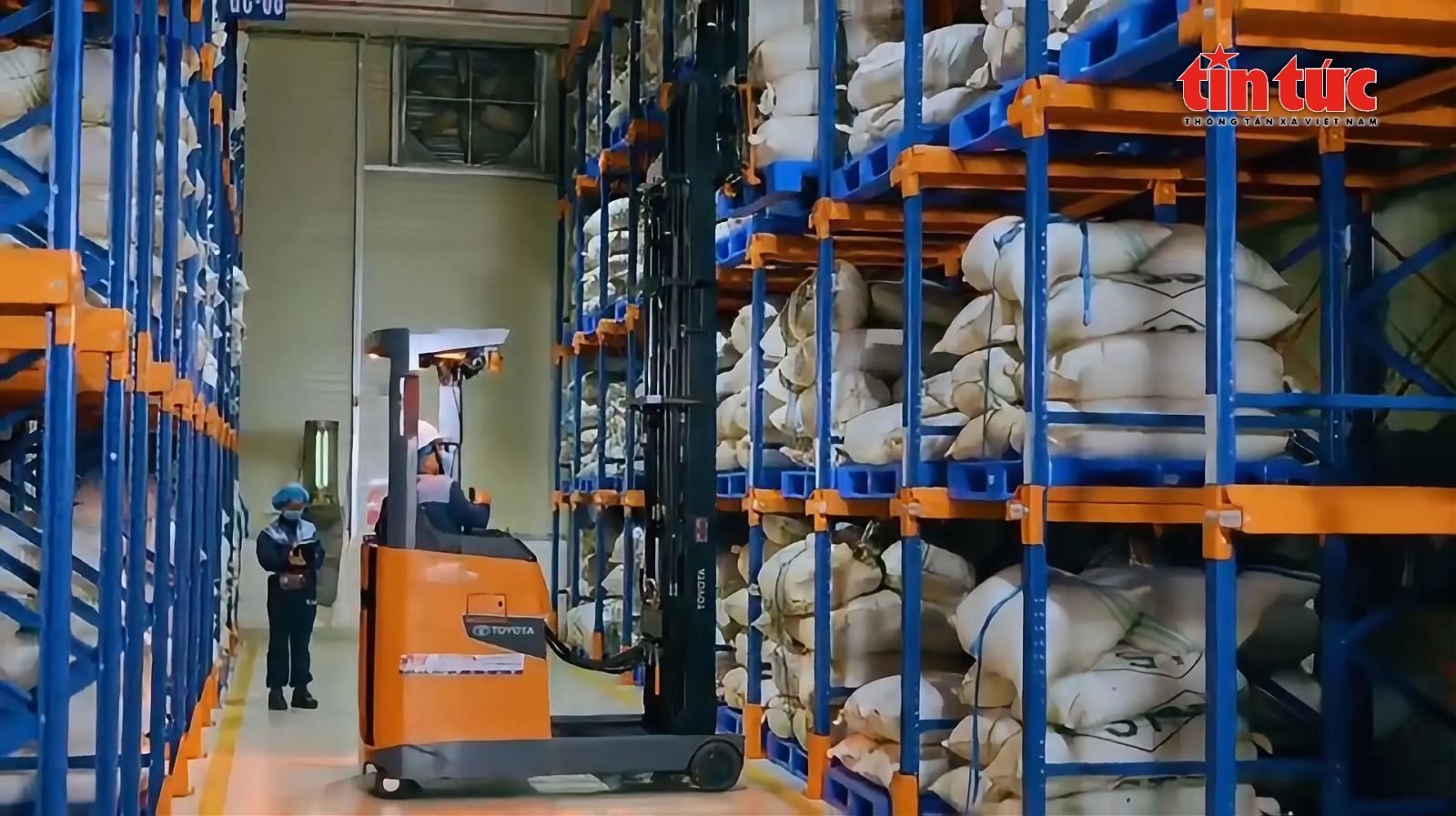

Accumulated by the end of the first quarter of 2025, Vietnam has exported 47,660 tons of pepper of all kinds.

Countervailing duties from the United States: A problem for the pepper industry

According to Mr. Le Viet Anh, General Secretary of the Vietnam Pepper and Spice Association (VPSA), by the end of the first quarter of 2025, Vietnam had exported a total of 47,660 tons of pepper of all kinds, including 39,853 tons of black pepper and 7,807 tons of white pepper. Total export turnover reached 326.6 million USD, a sharp increase of 38.6% over the same period in 2024, although export output decreased by 16.1%. The average export price continued to increase impressively, with black pepper reaching 6,711 USD/ton (up 94.9%), and white pepper reaching 8,617 USD/ton (up 73.9%).

In terms of market, the United States remains the largest importer of Vietnamese pepper, accounting for about 25% of total turnover. On the other hand, Vietnam is the leading pepper supplier to the United States, contributing up to 77% of the total pepper imported by this country.

However, according to VPSA, this trade relationship is being strongly affected by the new tax policy of the United States. Specifically, from April 5, 2025, the US will apply a temporary countervailing tax of 10% during the 90-day negotiation period for many countries, including Vietnam. The potential countervailing tax rate for Vietnam could be up to 46%, the highest in the taxable group. This puts the pepper export industry at risk of a sharp decrease in competitiveness.

According to Ms. Hoang Thi Lien, Chairwoman of VPSA, Vietnam has committed to reducing tariffs on US goods to 0%, and hopes to be treated accordingly. However, the outcome of the negotiations depends on many political and commercial factors.

Meanwhile, in February 2025, the amount of pepper Vietnam exported to the US reached only 5,942 tons, down more than 33% compared to the previous month. Many businesses began to slow down production, waiting for the results of negotiations and re-evaluating export directions.

Although the total pepper export volume in the first quarter of 2025 decreased by 16.1% compared to the same period last year, the export turnover still increased sharply by 38.6%, thanks to the export price of black pepper increasing by nearly 95% and white pepper increasing by nearly 74%. However, this increase is not enough to offset the risk from the instability of the US market, which still accounts for a large proportion.

Ms. Hoang Thi Lien, President of VPSA shared information.

Ms. Hoang Thi Lien is concerned that if an agreement is not reached, Vietnam will lose its competitive advantage over countries with lower tax rates such as Brazil (10%), Indonesia (32%) or Malaysia (24%). However, that does not mean "losing everything". The pepper industry can still maintain a certain proportion in this market. However, maintaining a market share of more than 20% in the US is difficult if the official tax rate is 46%. Under such pressure, Vietnam is forced to reallocate production to other markets such as the EU, China, India, and at the same time seek opportunities in new potential areas.

Although each market has its own requirements and standards, with more than 90% of pepper output being for export (the domestic market accounts for only a very small portion), ensuring sufficient output is imperative. The industry needs to proactively adapt to maintain growth and stabilize the livelihoods of pepper growers.

According to Ms. Hoang Thi Lien, in the long term, tariff policies will force the pepper industry to restructure the export ecosystem and reallocate markets more flexibly. “If we cannot maintain one market, we need to quickly shift to another. Although there are many fluctuations at present, the industry still has grounds to hope and continue to strive to maintain its market share in the United States,” Ms. Lien emphasized.

Flexible market diversity

Not only facing difficulties with taxes, the Vietnamese pepper industry also faces technical barriers, especially in food safety issues. Ms. Hoang Thi Lien warned that farmers using colored packaging for preservation can cause contamination with Sudan red, a banned substance in the international market. "We need to replace it with white packaging immediately to ensure long-term stability of the storage process, while avoiding the risk of being rejected for import," Ms. Lien emphasized.

In addition, the uncontrolled spraying of pesticides by agricultural drones is also seriously affecting organic pepper growing areas. Mr. Ngo Ba Luong, Manager of the Southern Raw Material Area of Huong Gia Company, said: “Just a light wind is enough to contaminate pesticides from conventional farming areas to organic pepper areas, causing us heavy losses. We really need a strict management mechanism from the State.”

Huong Gia Company is one of the pioneers in organic pepper production with more than 11 years of experience. Each year, the company supplies about 500 - 700 tons, accounting for more than 30% of Vietnam's organic pepper output, mainly exported to Europe and the US. However, this unit is also facing many difficulties when the trend of using chemical pesticides increases due to improved pepper prices.

Mr. Luong shared: “Previously, pepper prices were low so people did not invest much in care. Now that prices have increased, they have started using chemicals to increase productivity, leading to the risk of pollution for organic pepper areas. Uncontrolled spraying of pesticides by agricultural drones is becoming a big problem in Binh Phuoc and the Central Highlands. We hope to have a specific solution to protect clean raw material areas.”

Mr. Ngo Ba Luong talks to the press.

Mr. Huynh Tien Dung, Country Director of IDH Vietnam, emphasized that in the context of many global changes, the Vietnamese pepper industry needs a more sustainable and flexible development strategy to adapt effectively. “We cannot wait until the water reaches our feet to jump. We can absolutely do it if we proactively improve quality control from harvesting to preservation, at the same time build a sustainable production model, reduce carbon emissions and enhance traceability value,” Mr. Dung shared.

According to Mr. Dung, in order for the pepper industry to develop steadily in the future, it is necessary to prioritize a number of specific solutions such as increasing commercial value through improving product quality, enhancing traceability and diversifying income sources, especially in intercropping models. At the same time, it is necessary to focus on stabilizing farmers' livelihoods by promoting sustainable production in integrated farming systems, while promoting regenerative agricultural models to increase carbon absorption and reduce emissions.

Overview of the conference on the Pepper industry in the face of US tariff challenges.

Faced with this situation, pepper businesses are considering reallocating export output to potential markets such as the EU, China, India and the Middle East. Although these markets have their own technical barriers, if they meet the standards, they will be an important “escape route”.

In addition, according to Mr. Le Viet Anh, the high export price of pepper is a good sign, helping businesses have more resources to invest in improving quality and diversifying product lines. Accordingly, shifting to organic products, with traceability and meeting sustainability standards is a mandatory trend if Vietnam wants to maintain its market share and increase long-term value. Only then can Vietnam maintain its position on the global trade map.

Source: https://baobinhphuoc.com.vn/news/4/171785/nganh-ho-tieu-viet-nam-linh-hoat-tim-duong-giua-song-gio-thue-quan

![[Photo] April 30, 1975 - Steel imprint engraved in history](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/b5a0d7f4f8e04339923978dfe92c78ef)

![[Photo] Panorama of the rehearsal of the parade to celebrate the 50th anniversary of national reunification](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/afd7e872ef6646f288807d182ee7a3da)

![[Photo] Attractive extracurricular lessons through interactive exhibition at Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/1f307025e1c64a6d8c75cdf07d0758ce)

![[Photo] President Luong Cuong meets with Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/3d70fe28a71c4031b03cd141cb1ed3b1)

Comment (0)