Vietnam's seaport industry is gradually becoming a bright star on the global economic map thanks to the strong growth of FDI capital flows.

In the report "Container port industry - Reaching out to the ocean, seizing new opportunities" by VnDirect Research, the analysis team of VnDirect Research assessed that Vietnam's seaport industry is gradually becoming a bright star on the global economic map thanks to the strong development of FDI (foreign direct investment) capital flows and the ability to take advantage of strategic location and modern infrastructure.

“In recent years, Vietnam has affirmed itself as an open economy, deeply integrated into the global market. The shift from a trade deficit to a trade surplus since 2012 marks an important milestone, emphasizing the effectiveness of the country’s reform and integration policies,” said an analyst from VnDirect Research.

|

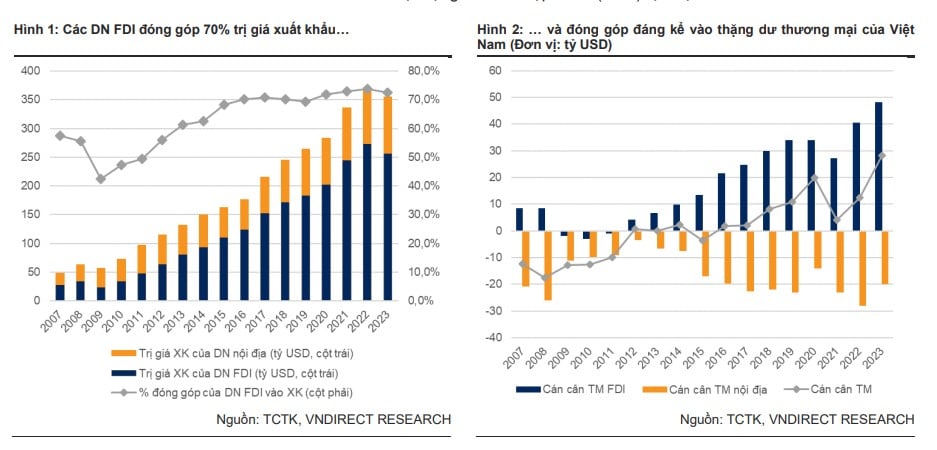

| FDI inflows have played a key role in boosting Vietnam’s export growth, where FDI enterprises account for more than 70% of total export value. Source: General Department of Customs, Vietnam Seaports Association (VPA), VNDirect Research |

FDI inflows have played a key role in boosting Vietnam’s export growth, where FDI enterprises account for more than 70% of total export value. The third wave of FDI (2015-2019) contributed greatly to the boom in import-export activities, helping Vietnam emerge as a dynamic trade hub in the region.

|

| Vietnam's container port industry has grown strongly, becoming an important link in the global supply chain. Photo: Thu Minh |

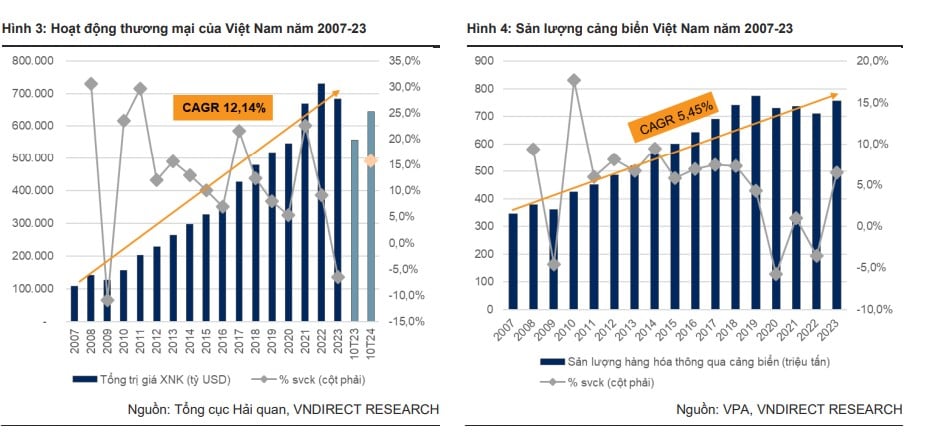

The impressive growth rate of Vietnam’s trade activities from 2007 to 2023, with a compound annual growth rate (CAGR) of 12.1%, has boosted the demand for cargo transportation through seaports. This strong export growth has significantly boosted the demand for cargo transportation through seaports, reflected in a CAGR of 5.45% of seaport throughput.

Although trade activities decreased by 6.5% compared to the same period in 2023, port output increased by 6.5%. This shows that despite the decline in the phone and components industry, the port industry still maintained stable growth thanks to other factors such as the growth of other export industries and improvements in port infrastructure.

|

| Vietnam's seaport trade and throughput growth in the period 2007-2023. Source: General Department of Customs, Vietnam Seaports Association (VPA), VNDirect Research |

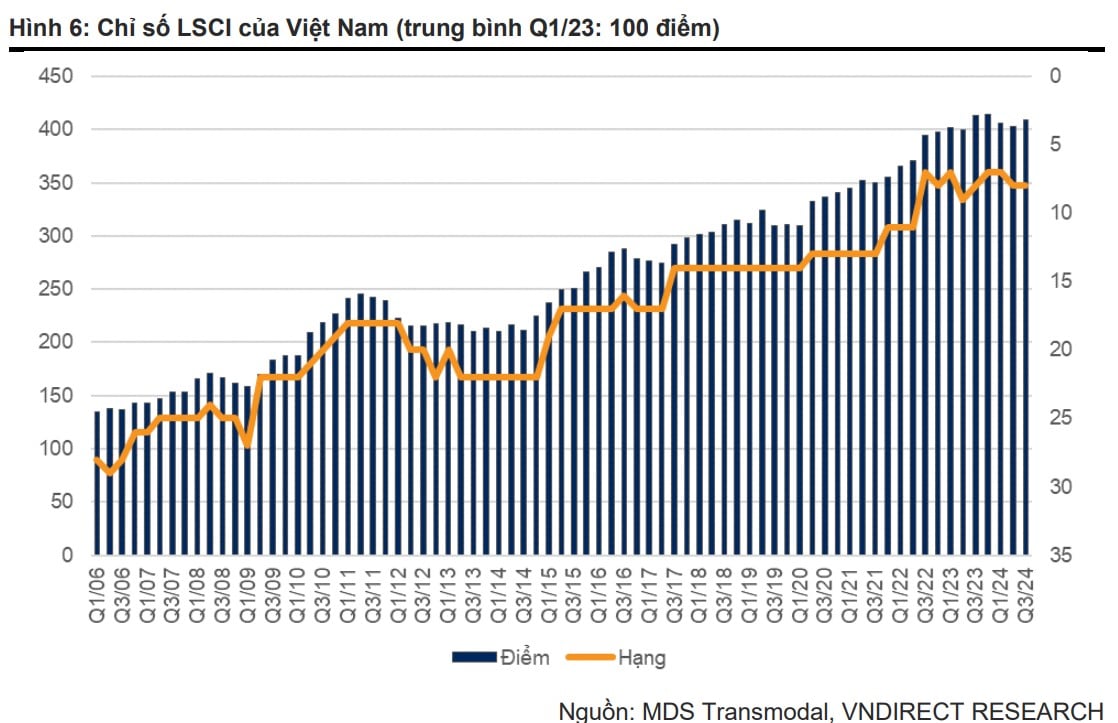

In addition, the favorable geographical location and high connectivity have helped Vietnam's seaport industry take full advantage of the increase in global trade activities. Vietnam's Global Connectivity Index (LSCI) has been continuously increasing since 2013, reaching 409.1 points in the second quarter of 2024, bringing Vietnam to 8th place in the rankings. This significant improvement is the result of the development of large port clusters, with the potential for deep-water port development and a long coastline, helping Vietnam enhance its connectivity with international shipping routes.

|

| Vietnam's Sea Transport Connectivity Index (LSCI) from Q1/2006 to Q3/2024. Source: MDS Transmodal, VNDirect Research |

In recent years, the global shipping industry has seen a significant increase in vessel size to increase productivity and reduce shipping costs. Statistics from the Vietnam Maritime Administration (VMA) show that the number of large vessels calling at Vietnamese ports has increased over the past five years, reflecting a global trend. In 2019, there were approximately 4,538 large vessel calls, a figure that increased to 5,474 in 2023, marking a total increase of 20.6%. The Cai Mep – Thi Vai port cluster, with its ability to handle large vessels, plays an important role in connecting international routes from Asia to the US and Europe.

Vung Tau Port, one of the largest ports in Vietnam, has seen a dramatic increase in the number of large vessel calls, from more than 300 in 2013 to more than 2,100 in 2023. The port can now accommodate container ships ranging from more than 80,000 DWT to more than 232,000 DWT. In addition, the berthing time at Vietnamese ports is estimated at 10-15 hours, lower than the global average of 22.7 hours and the median of 19.3 hours, according to S&P Global Market Intelligence's 2023 data from a sample of 4,864 vessel calls, indicating the efficiency of cargo handling operations and port infrastructure.

According to VnDirect Research, Vietnam's seaport industry is being led by two large enterprises, Saigon Newport Corporation (SNP) and Vietnam National Shipping Lines - Vinalines (MVN). These are the two leading enterprises in the seaport sector and are both in the group of most efficient state-owned enterprises from 2020 to 2023.

SNP is a leading company in Vietnam in the fields of port operations, logistics services, transportation and maritime industry. The company has developed a diverse ecosystem, connecting logistics centers, inland container depots (ICDs), gateway ports and deep-water ports, while maintaining close ties with import-export enterprises, shipping lines, government agencies and associations. SNP focuses on sustainable development, digital economy, green economy and clean energy use. Currently, SNP owns 16 port facilities, of which HICT and SICT are the two most prominent ports. It is estimated that SNP accounts for about 39.4% of Vietnam's container market share, with throughput reaching 9.75 million TEU.

MVN (listed on UPCOM) is a core enterprise in the Vietnamese maritime industry, specializing in maritime transport, port operations and maritime services. MVN is a pioneer in expanding international cooperation and integration, providing global maritime services and making significant contributions to the development of Vietnam's maritime economy. Since 2020, VIMC has operated as a joint stock company. MVN also owns a number of prominent listed companies such as PHP, SGP, VOS and CDN.

The financial report shows that in the first 9 months of 2024, SNP's revenue increased by 16.2%, while the system-wide profit increased by 35.5% over the same period last year. For MVN, consolidated profit after tax in the first 6 months of 2024 increased by about VND 715 billion over the same period last year. The strong growth in revenue and profit of port operators such as SNP and MVN shows the recovery and stable development of Vietnam's seaport industry, especially in the context of the global economy facing many challenges.

The container port industry is not only an important link in the supply chain but also a key driver of national economic growth. With its prime geographical location, stable FDI inflows and determination to invest in infrastructure, Vietnam is on track to assert its role as Asia’s new logistics hub – where all trade routes converge.

Source: https://congthuong.vn/nganh-cang-bien-viet-nam-dang-dan-tro-thanh-ngoi-sao-sang-tren-ban-do-kinh-te-toan-cau-363314.html

![[Photo] Prime Ministers of Vietnam and Thailand visit the Exhibition of traditional handicraft products](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/6cfcd1c23b3e4a238b7fcf93c91a65dd)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Thai Prime Minister Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/e71160b1572a457395f2816d84a18b45)

Comment (0)