Entering the new year 2024, credit institutions in Ha Tinh have promptly "injected capital" and reduced lending interest rates to accompany businesses in implementing projects and production and business plans.

In 2024, Thanh Huy Group Joint Stock Company (Cam Xuyen town, Cam Xuyen district) will promote the construction of traffic works, participating in key national projects, including the North-South expressway construction project. In addition, the enterprise also implements many large projects in the area such as: Investment project to build, renovate, upgrade and repair National Highway 8A; Project to renovate and upgrade National Highway 8C; Project to build Ham Nghi extended road (Ha Tinh city)...

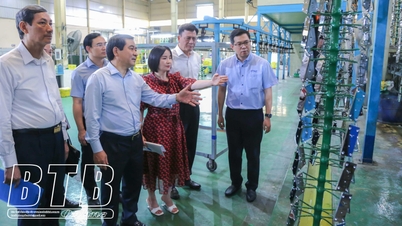

Thanh Huy Group Joint Stock Company is receiving loans from BIDV Ha Tinh and MB Bank Ha Tinh to implement many key projects.

Mr. Bui Dinh Uoc - Deputy General Director of Thanh Huy Group Joint Stock Company said: “In 2023, the unit achieved revenue of 500 billion VND. Entering the new year 2024, the enterprise continues to face difficulties due to increased costs of construction materials and many other costs. Currently, we are receiving loans from BIDV Ha Tinh and MB Bank Ha Tinh to invest in purchasing additional equipment and machinery, ensuring the construction of works and projects on schedule and with the committed quality”.

In 2023, Tran Chau Construction Investment Company Limited (Bac Cam Xuyen Industrial Park) achieved revenue of 165 billion VND (27% growth compared to the assigned plan). Continuing the growth momentum, in the first month of 2024, the enterprise set a target of earning 10 billion VND and strived to soon complete the plan of 155 billion VND in 2024.

Ms. Tran Thi Thanh - Chief Accountant of Tran Chau Construction Investment Company Limited said: "The company specializes in providing construction products such as: commercial concrete, unburnt bricks, sewer pipes... Continuously marketing and developing new customers is an effective solution for businesses to increase revenue. In addition, currently, key projects are being accelerated such as: the North - South expressway construction project through Ha Tinh, the Vung Ang II Thermal Power Plant construction project... have created room for revenue growth for the company. In particular, at the beginning of this year, the company continued to provide capital, increased the loan limit, creating conditions for businesses to meet the order needs of partners. In December 2023 and early January 2024 alone, banks have reduced lending interest rates by 0.2 - 0.4%/year".

In 2024, Tran Chau Construction Investment Company Limited sets a revenue target of 155 billion VND.

BIDV Ha Tinh is currently providing development capital for thousands of local businesses to invest in production and business. The branch is prioritizing low-cost capital for businesses in the fields of renewable energy, industrial park construction, factory construction for lease, industrial park real estate business, food production and processing, logistics infrastructure, pharmaceuticals, etc.

Ms. Le Thi Tuyet - Head of Planning and Finance Department, BIDV Ha Tinh said: “The total outstanding debt of the entire branch is currently over 6,700 billion VND, of which corporate debt is over 3,400 billion VND. Due to the impact of COVID-19 and the economic recession, many businesses in the area are facing many challenges at the same time. In that context, BIDV Ha Tinh has proactively implemented solutions such as: reducing lending interest rates, restructuring debt, extending repayment periods and creating conditions for disbursing new loans as soon as possible; helping businesses quickly recover and develop production and business in the new year 2024”.

Customers come to transact at BIDV Ha Tinh.

Accompanying businesses in implementing investment projects in the new year 2024, Vietcombank Ha Tinh continues to reduce lending interest rates at low levels and maintain fixed lending interest rates for a long time. By early January 2024, the branch's total outstanding debt reached over VND 15,133 billion, of which corporate debt reached over VND 9,366 billion.

Currently, ACB Ha Tinh is also implementing policies to support businesses with fixed interest rates in the short and long term depending on each customer. Mr. Dau Ba Hoan - Director of ACB Ha Tinh informed: "The total outstanding debt of the branch currently reaches 3,300 billion VND, of which the outstanding debt of businesses is over 1,000 billion VND. In order to open up capital sources for businesses, the solution prioritized by ACB is to further promote administrative procedure reform, simplify procedures and lending conditions; continue to accompany and reduce costs to reduce interest rates for business customers, especially businesses operating in the fields of import and export, construction, tourism, logistics...".

In recent times, the State Bank of Ha Tinh province has regularly directed credit institutions in the area to proactively implement policies to remove difficulties for economic sectors, especially the business community. The "banks" have updated the difficulties of enterprises in production and business activities and in credit relations with banks to have timely support solutions. As of early January 2024, the total outstanding debt of enterprises of the Ha Tinh banking sector is estimated at over VND 30,243 billion, accounting for over 32% of the total outstanding debt in the whole area.

By early January 2024, the total outstanding corporate debt of the Ha Tinh Banking industry is estimated to reach over 30,243 billion VND.

However, in 2024, economic experts predict that the Ha Tinh business community will still face many difficulties due to the impact of COVID-19 and economic recession such as: increased production costs, decreased orders, inventory pressure... In that context, the support measures of the banking industry such as: new loans, raising loan limits, reducing loan interest rates, restructuring debt repayment terms... are still considered fundamental solutions for the business community to gradually overcome difficulties and strive for the best results.

Accordingly, the solutions prioritized by credit institutions to increase corporate credit growth are to resolutely, strongly and effectively implement solutions to facilitate businesses' access to credit capital, improve the economy's ability to absorb capital; further strengthen the connection between banks and businesses; continue to support and share to help businesses overcome difficulties, promote the recovery of production and business activities...

Thu Phuong

Source

![[Photo] Prime Minister Pham Minh Chinh receives Ambassador of the French Republic to Vietnam Olivier Brochet](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/f5441496fa4a456abf47c8c747d2fe92)

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

![[Photo] Many people in Hanoi welcome Buddha's relics to Quan Su Pagoda](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/3e93a7303e1d4d98b6a65e64be57e870)

![[Photo] President Luong Cuong awarded the title "Heroic City" to Hai Phong city](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/d1921aa358994c0f97435a490b3d5065)

Comment (0)