According to Decree 52/2024/ND-CP regulating cashless payments, effective from July 1st, banks have the right to freeze or close accounts that are not in the account holder's name or accounts used as a means of fraud without waiting for the police to intervene.

Under what circumstances can an account be frozen or closed?

Article 11 of Decree 52 specifies the cases in which accounts may be frozen. Accordingly, a payment account may be partially or completely frozen if the bank discovers an error or mistake when mistakenly crediting a customer's payment account, or when requesting a refund from the transferring bank due to an error or mistake compared to the payment order of the transferring party after crediting the customer's payment account.

According to Article 12 of Decree 52, the closure of a payment account will be carried out when the account holder violates prohibited acts such as: opening accounts under false identities, buying, selling, renting, or lending accounts; stealing, buying, or selling account information; using payment accounts for gambling, fraud, deception, illegal business activities, and other violations of the law.

Will accounts used for scams and fraud be removed?

With the regulations outlined in Decree 52, bank accounts used by criminals for fraudulent purposes are expected to be "cleaned up".

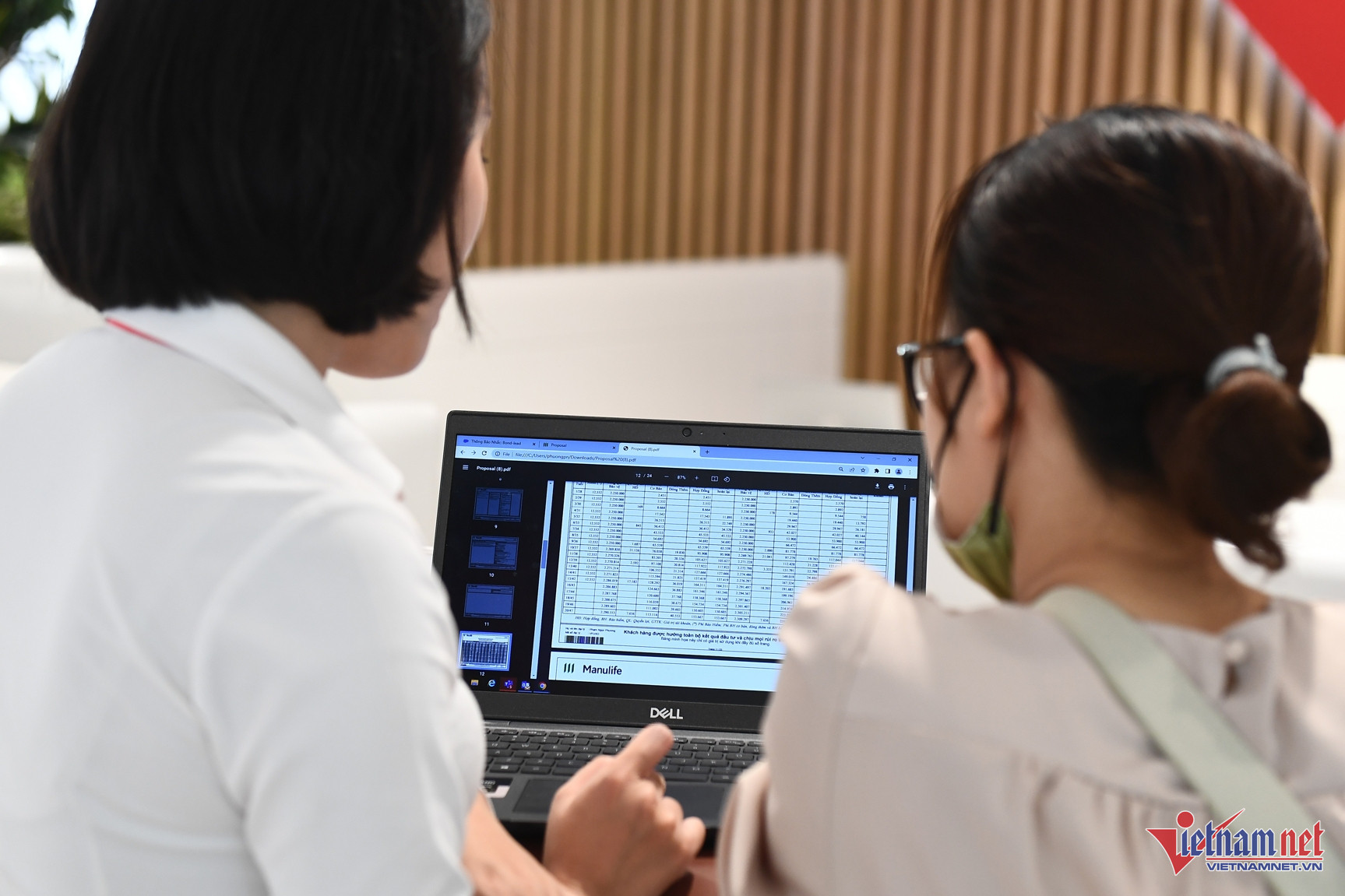

Speaking to VietNamNet, a representative of a major commercial bank said that, in fact, the bank has been compiling a list of suspicious accounts for the past three years.

"Previously, if a bank suspected an account was being used for fraud but there was no official conclusion or decision from the investigating authorities, the bank was not allowed to restrict the flow of money into or out of that account."

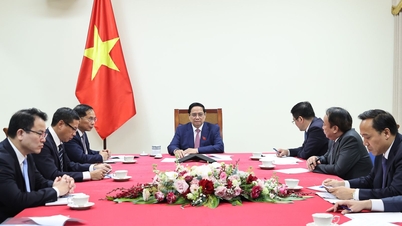

"But since July 1st, when Decree 52 officially comes into effect, banks can take stronger action against these accounts," a bank representative said.

However, very few banks have taken strong action to freeze or lock accounts showing signs of fraud, despite investing significant resources to prevent and eliminate fraudulent activities.

At MB, the bank has implemented a feature to identify fraudulent account information since June 18th.

If a customer transfers money via an online banking app to an 'unsafe' account, the bank immediately sends a warning that it is a fraudulent account, prompting the customer to stop the transaction. Thanks to this warning, many customers have been able to promptly stop transferring money to accounts they suspect may have transferred by mistake or scammed.

However, MB stated that because it is still in the pilot phase, there are no specific statistics or assessments of its effectiveness in preventing fraud.

Speaking to VietNamNet about why the feature of warning customers about fraudulent accounts when transferring money online has not been widely adopted by banks, a representative from one bank said that although this feature is very useful in protecting customers' assets, it could lead customers to mistakenly believe that only accounts that receive a warning are fraudulent.

In reality, account holders can open multiple accounts simultaneously for fraudulent purposes, but if they are not detected at one bank, they may have already received money from another bank.

Previously, before authorities released lists of fraudulent accounts, banks compiled their own lists of accounts to be wary of, but lacked a basis for warning customers.

According to this expert, even if banks collectively implement features to detect and warn about fraudulent accounts, it would be difficult to completely prevent fraudulent activities, because fraudulent accounts can still be opened at any time.

This expert assessed that, when the full identities of fraudulent accounts are not yet available, the widespread implementation of facial biometric authentication can significantly reduce the risk of fraud, in order to prevent and warn customers when transferring money.

Source: https://vietnamnet.vn/ngan-hang-chua-manh-tay-phong-toa-khoa-tai-khoan-lua-tien-vi-sao-2300879.html

![[Photo] Closing Ceremony of the 10th Session of the 15th National Assembly](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765448959967_image-1437-jpg.webp&w=3840&q=75)

![[Photo] Prime Minister Pham Minh Chinh holds a phone call with the CEO of Russia's Rosatom Corporation.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765464552365_dsc-5295-jpg.webp&w=3840&q=75)

![[OFFICIAL] MISA GROUP ANNOUNCES ITS PIONEERING BRAND POSITIONING IN BUILDING AGENTIC AI FOR BUSINESSES, HOUSEHOLDS, AND THE GOVERNMENT](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/11/1765444754256_agentic-ai_postfb-scaled.png)

Comment (0)