Since officially launching the domestic credit card product line in early 2021, NAPAS has strengthened its cooperation with banks and financial companies to deploy cards to users. To date, 14 member banks and financial companies have participated in issuing domestic credit cards, thereby providing people with a convenient, simple and low-cost payment method.

As part of the strategy to expand the development of domestic credit cards through cooperation with financial companies, Mcredit is the fourth financial company that NAPAS has cooperated to deploy recently. With full convenient payment features like regular credit cards, NAPAS domestic credit cards issued by Mcredit stand out with their 3-in-1 feature. The card can be used for payment at payment acceptance devices (POS) at stores, restaurants, supermarkets, etc.; online payment on e-commerce sites, hotel reservations, airline tickets, etc.; and cash withdrawal at all ATMs nationwide of more than 43 banks in the NAPAS member network. In particular, the advantage of using a domestic credit card is that the ATM withdrawal fee is much lower than other credit card products.

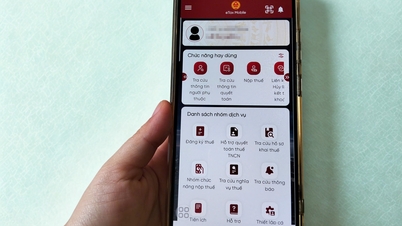

In addition, customers can choose to open a virtual card right on the Mcredit app, then spend comfortably after only 4 hours and receive a physical card after 48 hours. Through the function of spending first and paying later and opening a card simply and quickly, this is also an effective method to help people access official loans from banks and financial companies, especially in cases of sudden personal financial needs, without having to resort to black credit loans with high interest rates.

Sharing about the cooperation with Mcredit, Mr. Nguyen Dang Hung - Deputy General Director of NAPAS said: In addition to the participation of banks, in recent times, NAPAS has strengthened cooperation with reputable financial companies to deploy the provision of domestic credit cards to people. With the proportion of domestic credit cards issued through financial companies accounting for 30% of the total number of domestic credit cards today, it can be seen that this will become a strategic product of many financial companies in the coming time. The cooperation between NAPAS and Mcredit this time will be a step forward to promote the development of domestic credit cards more strongly, thereby bringing a cashless payment ecosystem with many utilities, meeting the needs of the majority of people, contributing to the universalization of comprehensive finance in Vietnam.

Domestic credit cards are deployed by NAPAS in coordination with Vietnamese banks and financial companies, ensuring the technical standards of domestic chip cards of the State Bank, as well as compatibility and meeting the strict requirements of international standards on safety and security in payment.

With the goal of providing convenient and reliable payment products, aiming for a "cashless society", NAPAS has coordinated with member organizations to diversify products and services applying modern technology at reasonable costs to serve the payment needs of all people and economic development.

The list of 10 banks issuing domestic credit cards includes Agribank, Vietinbank, Sacombank, ACB , NAB, HDBank, Vietbank, Baovietbank, VCCB, OCB and 4 financial companies including Vietcredit, FCCom, Mirae Asset, Mcredit.

Vietnam National Payment Corporation (NAPAS) is currently managing and operating a switching system connecting more than 19,200 ATMs and more than 300,000 POS machines serving nearly 120 million cardholders. NAPAS's network of member organizations includes more than 60 Banks and Finance Companies, more than 40 Payment Intermediaries and provides services to more than 200 businesses/service providers.

NAPAS cards are applied with modern chip technology that meets the basic standards for domestic chip cards issued by the State Bank and the international standards of EMV Co., helping to increase the safety and security of information for cardholders, preventing risks of fraudulent and counterfeit transactions. In addition, NAPAS develops the NAPAS247 Express Transfer Services and NAPAS247 Express Transfer with VietQR code, allowing money transfer and receiving transactions to be carried out anytime, anywhere, 24/7.

Regarding MCredit, the company was established in 2016. Mcredit is a joint venture financial company between the Military Commercial Joint Stock Bank (under MB Group) and SBI Shinsei Bank (Japan).

Consistent with the business strategy of "Customer-centric", Mcredit provides convenient financial solutions for customers by applying smart digital technology, comprehensive product strategy and the best customer experience. Mcredit's products are: Cash loans, Installment loans, Credit cards with outstanding product advantages, quick approval procedures, dedicated after-sales service, competitive interest rates. At the same time, to maximize customer convenience in payment, Mcredit has connected 26,884 payment points Payoo, MoMo, Viettel, VnPost and MBBank 's branch and transaction office system nationwide.

Source

![[Photo] Welcoming ceremony for Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra on official visit to Vietnam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/cdd9e93739c54bb2858d76c3b203b437)

![[Photo] Prime Minister Pham Minh Chinh holds talks with Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/23b5dd1e595d429491a54e3c1548fb79)

![[Photo] The Prime Ministers of Vietnam and Thailand witnessed the signing ceremony of cooperation and exchange of documents.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/935407e225f640f9ac97b85d3359c1a5)

Comment (0)