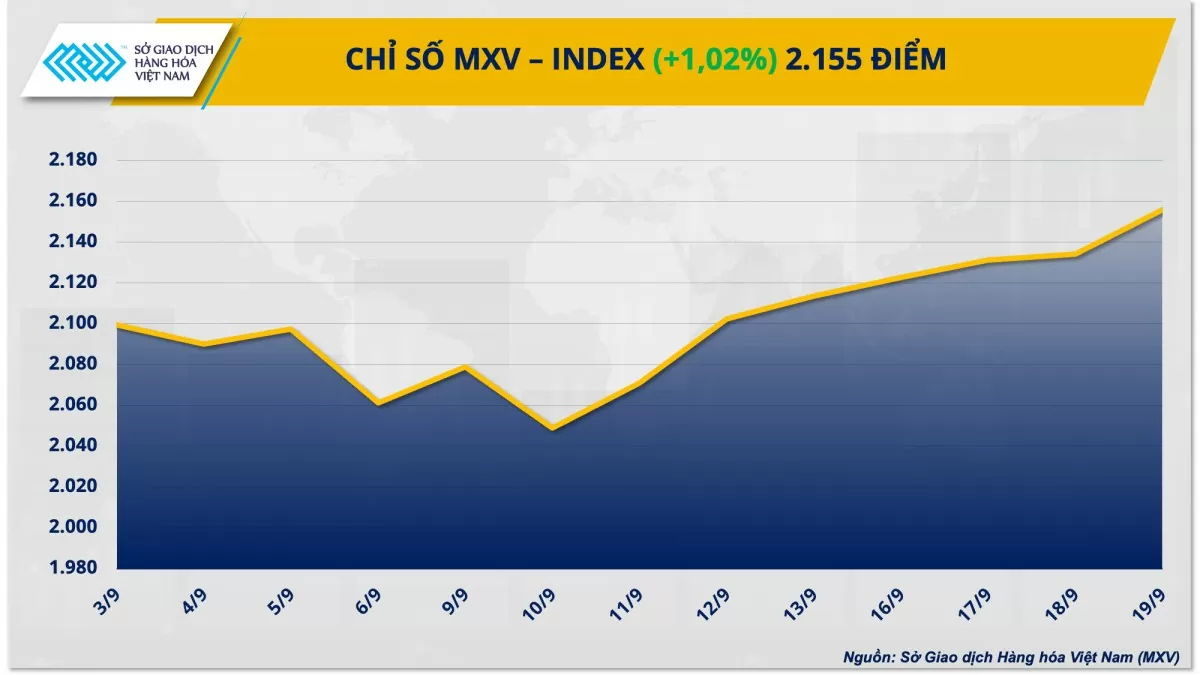

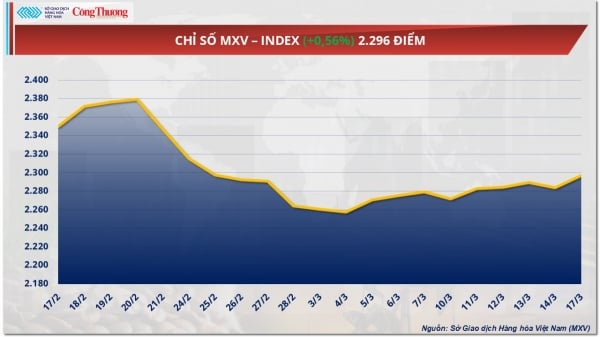

| Commodity market today September 18: The world's raw material commodity market attracts investment cash flow Commodity market today September 19: The commodity market fluctuates, facing profit-taking pressure |

Notably, the agricultural market saw many items turn down after two sessions of slight increases despite the general trend of the entire market. Meanwhile, green covered the remaining three groups: industrial materials, metals and energy.

|

| MXV-Index |

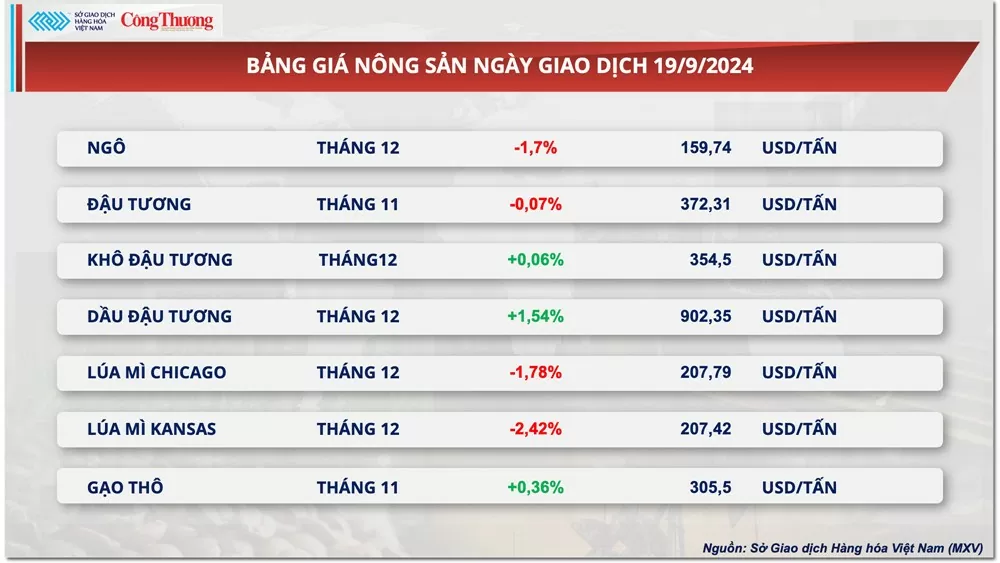

Grain prices plummet after US export results

December corn futures plunged 1.7% on Friday, erasing gains from the previous four sessions. Pressure from the growing harvest and unimpressive U.S. export data weighed on corn prices yesterday.

|

| Agricultural product price list |

In its Export Sales report yesterday, the US Department of Agriculture (USDA) said the country sold 847,350 tonnes of 2024-25 corn in the week ending September 12, up 27% from a week earlier and within the market’s previous expectations. Despite the improvement, the US corn sales figures for the review week did not impress the market and only partially limited the decline in corn prices.

In addition, the International Grains Council (IGC) lowered its forecast for global corn production in 2024-25 to 1.22 billion tons, down 2 million tons from its previous estimate. This resulted in a 1 million tonne reduction in world corn ending stocks to 276 million tons. The IGC's revised forecast has helped support corn prices.

Wheat led the decline among agricultural commodities yesterday, falling 1.78%. Sellers dominated the market right after the open, amid negative US export results and competition from Black Sea supplies.

According to data from the Export Sales report, the US sold over 246,300 tonnes of 2024-2025 wheat in the week ending September 12, down 48% from a week ago and below market expectations. The figure shows a significant decline in international demand for US wheat, putting great pressure on prices.

IGC also lowered its forecast for global wheat production to 798 million tonnes in its monthly report, down 1 million tonnes from its previous estimate. However, the cut was not significant, which helped to somewhat limit yesterday's decline in wheat prices.

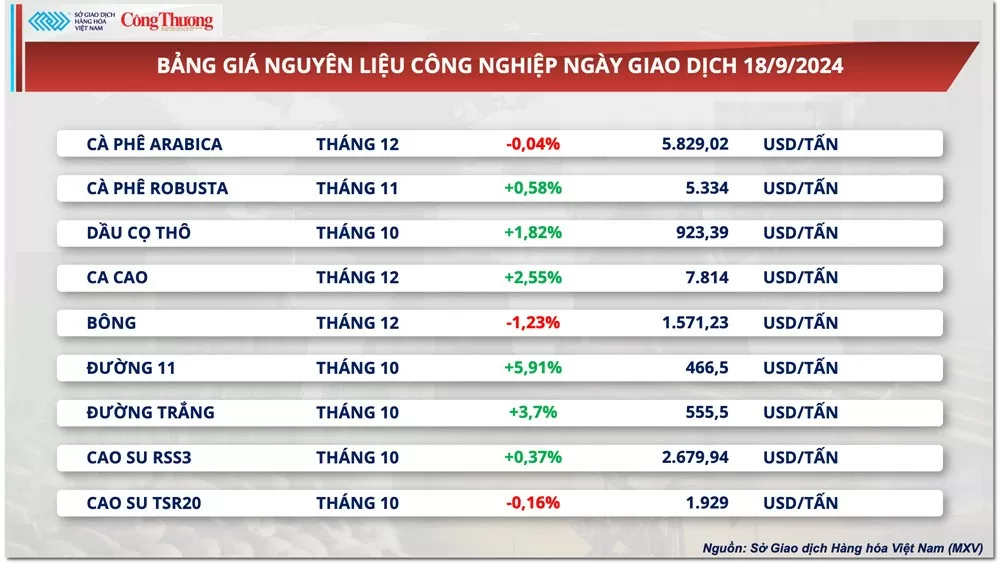

Coffee prices struggle despite CONAB's drastic production cuts in Brazil

Closing the trading session on September 19, although the general trend of the entire industrial raw material group was increasing in price, the two coffee products had mixed developments due to the conflicting impacts from supply and macro factors. At the end of the session, the price of Arabica coffee decreased by 1.04% and the price of Robusta coffee was 1.61% lower than the reference price.

|

| Industrial Raw Material Price List |

On the one hand, CONAB has drastically cut the 2024 coffee harvest in Brazil by more than 4 million bags, creating a drag on the price decline. Brazil's 2024 coffee harvest is estimated at nearly 54.8 million 60kg bags, down 6.8% from the previous forecast and 0.5% lower than the 2023 harvest. Of which, Arabica coffee output decreased by 2.52 million bags compared to the previous report. Robusta coffee decreased by more than 1.5 million bags to 15.2 million bags, 6% lower than the previous year. Prolonged drought and heat at the right stage of crop development have reduced the initial yield outlook.

On the other hand, the Dollar Index increased in the first half of the evening session, causing the USD/BRL exchange rate to recover. This put pressure on prices and made Brazilian farmers reluctant to sell. Prices continued to fluctuate throughout the evening session.

Another notable development is that sugar prices increased for the fourth consecutive session and reached a five-and-a-half-month high. Concerns about production cuts in Brazil, the world's largest sugar exporter, continued to be the main factor supporting prices. Centro de Tecnologia Canaviera (CTC) forecasts that sugarcane yields in the 2024-2025 crop in the Central-South region, Brazil's key production area, fell 7.4% year-on-year through August. Drought and forest fires in the world's largest sugar producer are the main reasons for the yield decline.

Prices of some other goods

|

| Energy price list |

|

| Metal price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-209-mxv-index-noi-dai-chuoi-tang-sang-phien-thu-7-347136.html

![[Photo] Special supplement of Nhan Dan Newspaper spreads to readers nationwide](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/0d87e85f00bc48c1b2172e568c679017)

![[Photo] Prime Minister Pham Minh Chinh receives Cambodian Minister of Commerce](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/be7f31fb29aa453d906df179a51c14f7)

![[Photo] Signing ceremony of cooperation and document exchange between Vietnam and Japan](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/e069929395524fa081768b99bac43467)

![[Photo] A long line of young people in front of Nhan Dan Newspaper, recalling memories of the day the country was reunified](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/4709cea2becb4f13aaa0b2abb476bcea)

![[Photo] People lined up in the rain, eagerly receiving the special supplement of Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/ce2015509f6c468d9d38a86096987f23)

Comment (0)