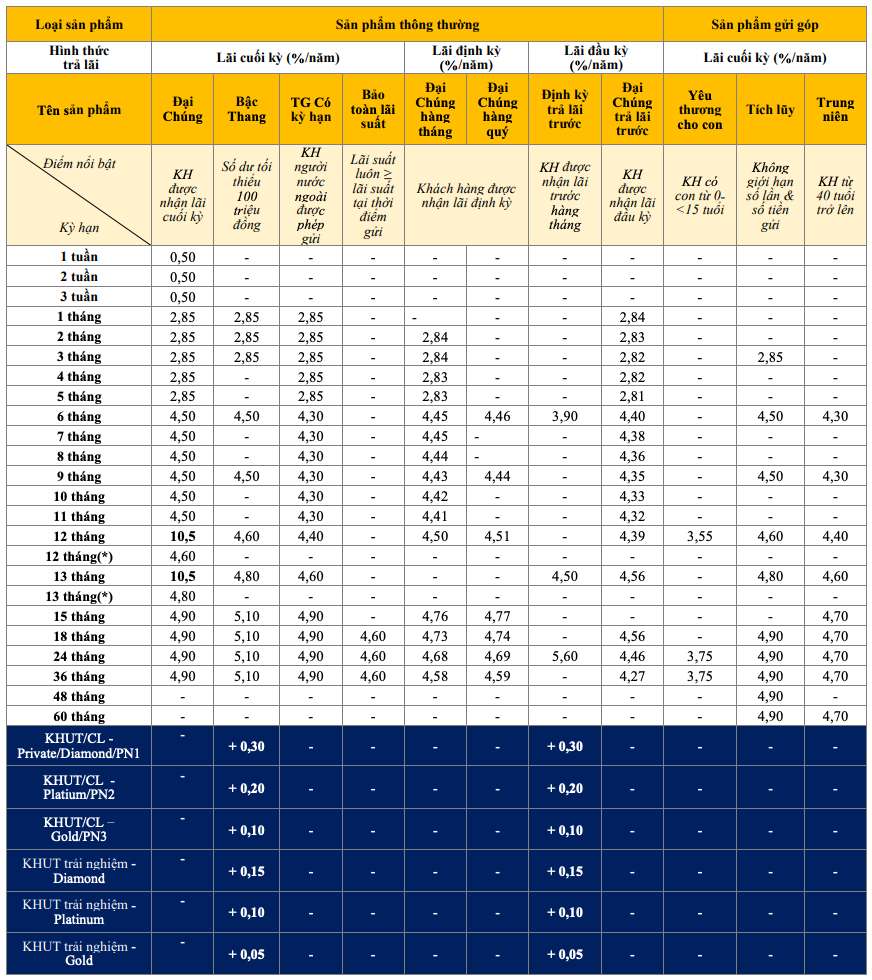

According to a survey by Lao Dong Newspaper reporters, PVcomBank is leading the 12-month savings interest rate list with an interest rate of up to 10%/year. However, to enjoy this extremely high interest rate, customers need to meet the condition of depositing at least 2,000 billion VND at the counter and it only applies to products that receive interest at the end of the term.

Under normal conditions, PVcomBank is listing the highest interest rate at 4.9%/year when customers deposit savings online and receive interest at the end of the term. If customers deposit money at the counter, they will only receive an interest rate of 4.6%/year.

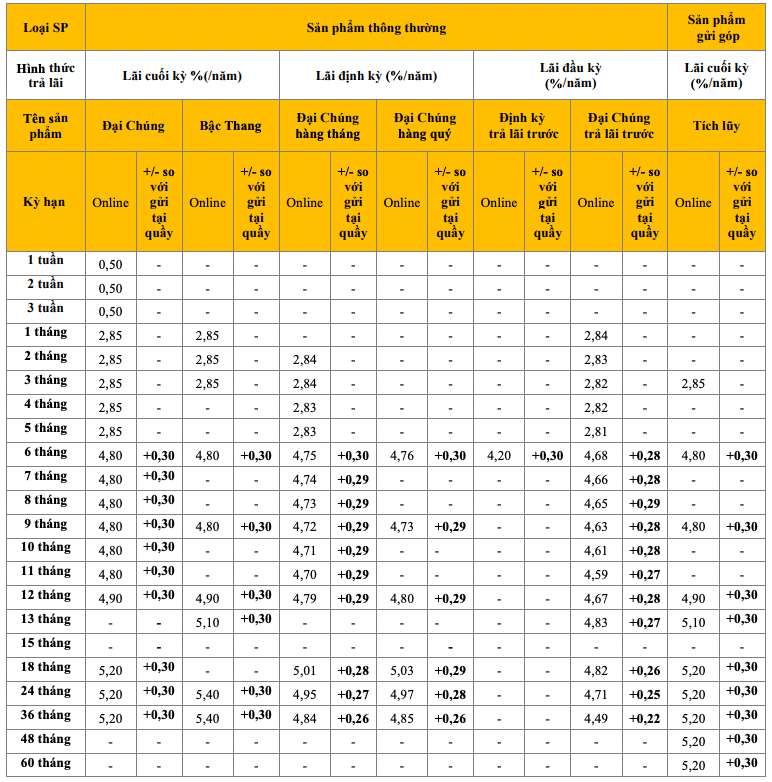

Ranked second, HDBank applies an interest rate of 7.8%/year for a 12-month term with the condition of maintaining a minimum balance of VND300 billion. Under normal conditions, when making an online deposit for a 12-month term, customers receive an interest rate of 5.1%/year. If customers deposit money at the counter, they only receive an interest rate of 5%/year.

Under normal conditions, HDBank is listing the highest interest rate at 6%/year when customers deposit money online for an 18-month term.

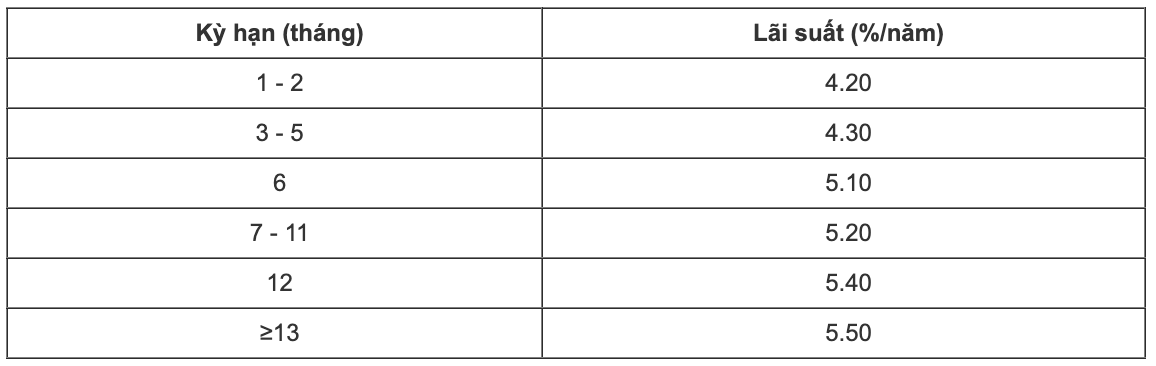

NamABank is listing the highest interest rate for a 12-month term at 5.4%/year when customers deposit money online and receive interest at the end of the term.

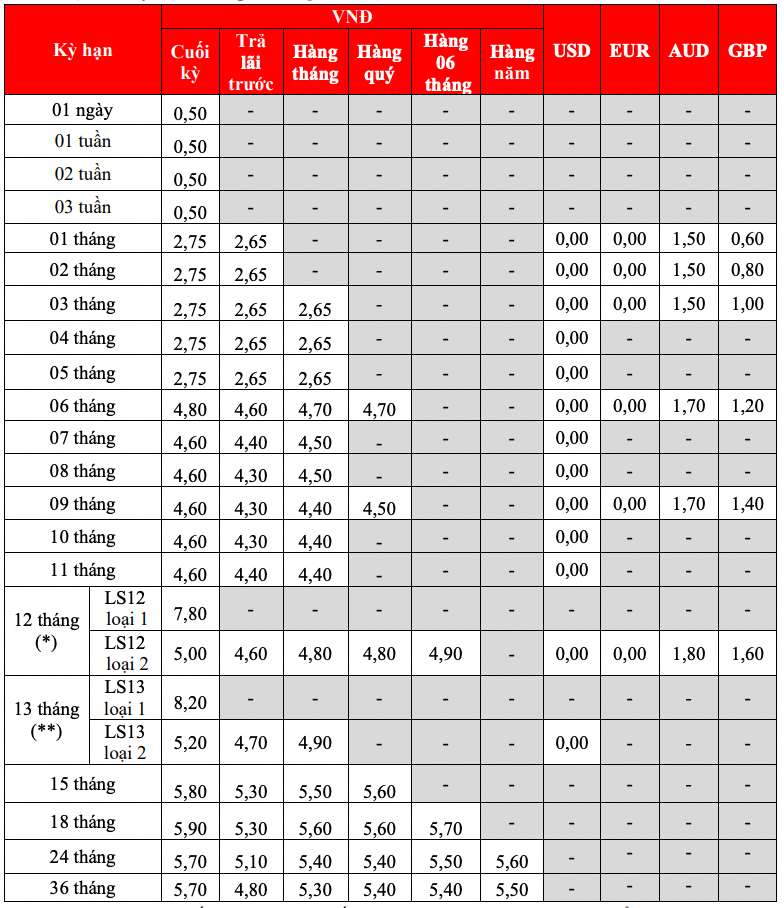

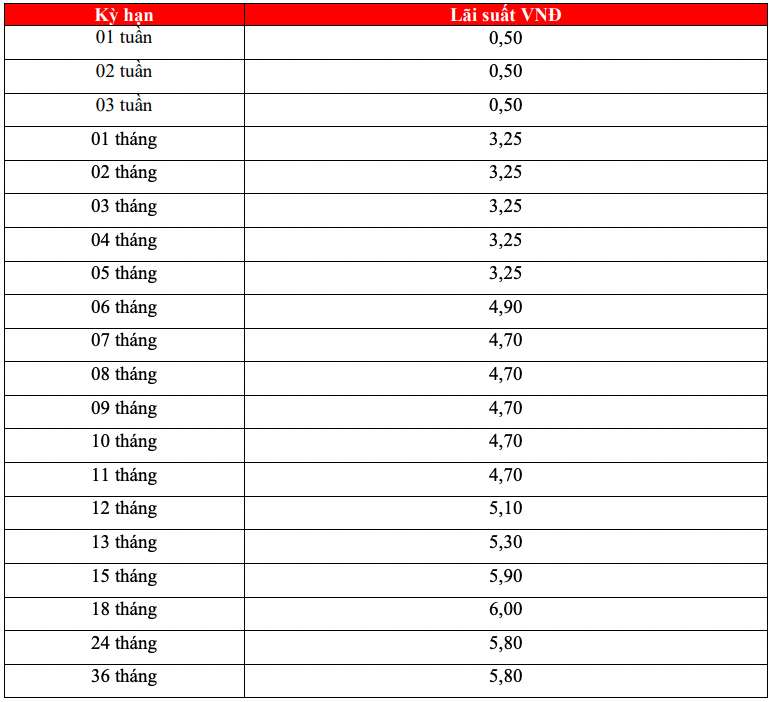

BaoVietBank is listing the highest interest rate for a 12-month term at 5.5%/year when customers deposit money online and receive interest at the end of the term. Customers receiving interest periodically receive a lower interest rate of 5.3%/year.

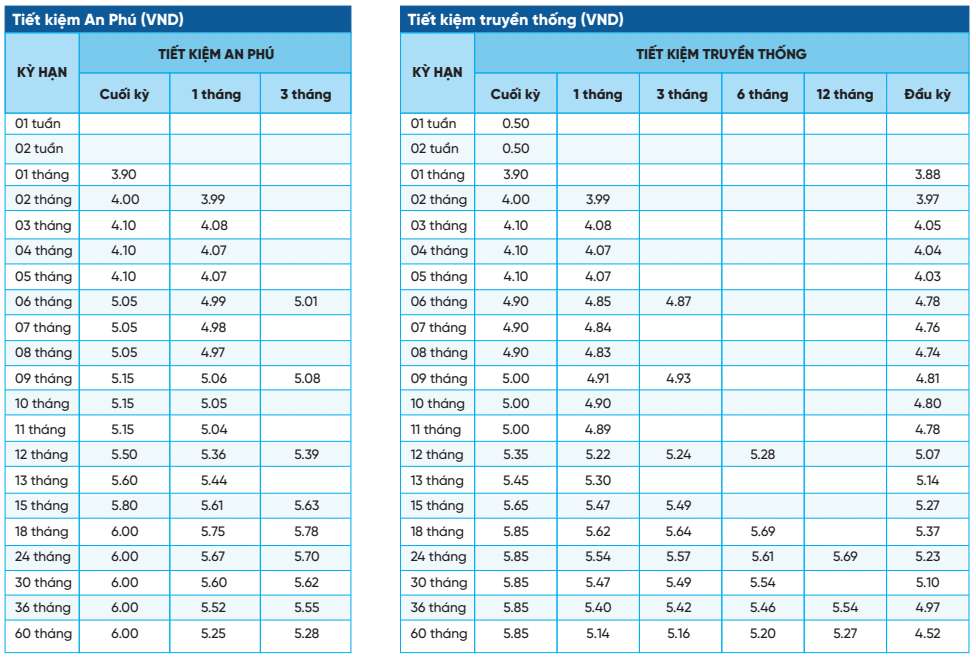

NCB listed the highest interest rate for a 12-month term at 5.5%/year when customers deposit savings at An Phu. Customers with traditional deposits only receive an interest rate of 5.35%/year.

CBBank lists the highest 12-month term interest rate at 5.4%/year when customers deposit money online. In addition, CBBank is listing the highest interest rate at 5.5%/year.

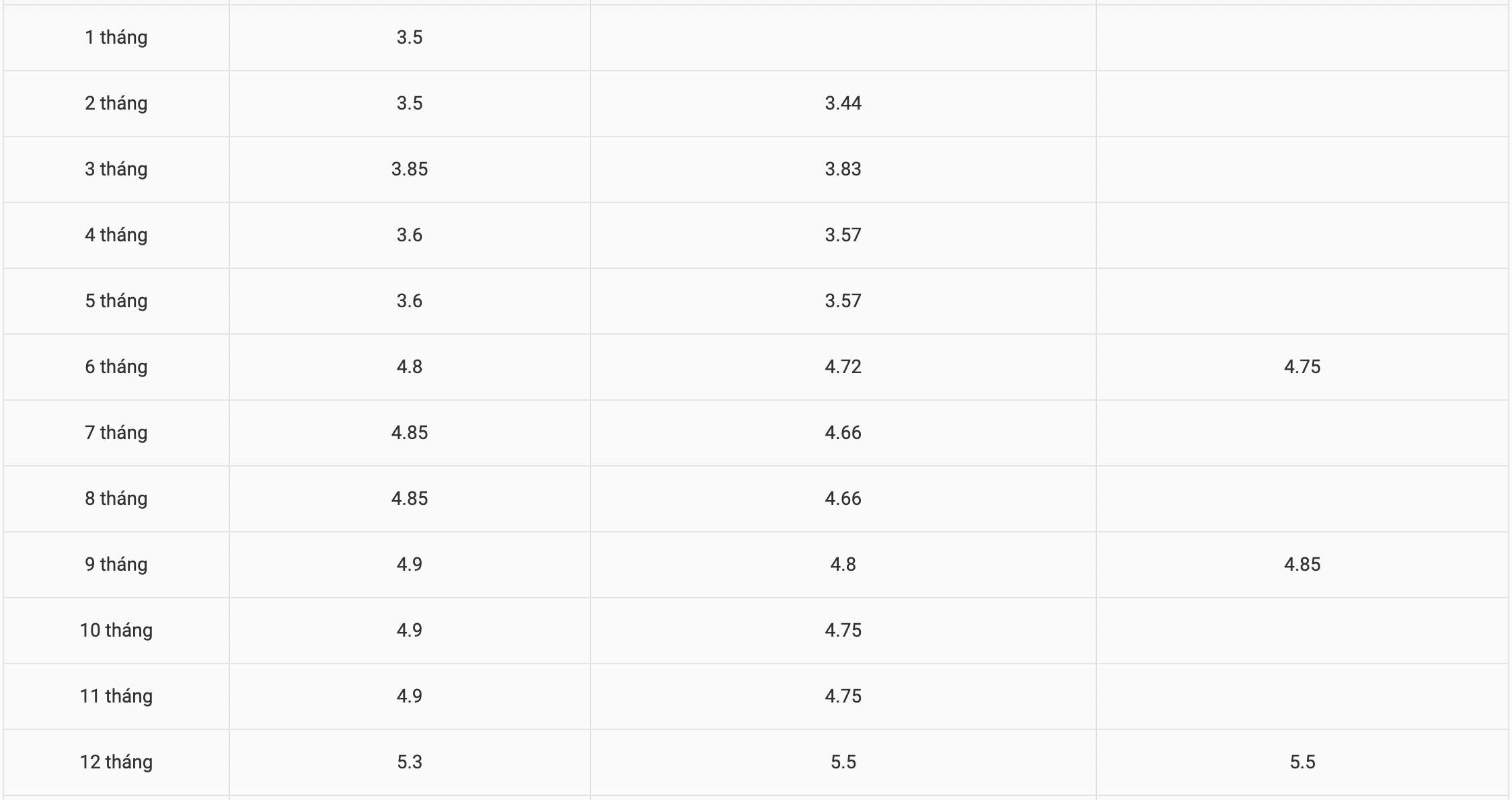

Deposit 2 billion VND, after 12 months how much interest will I receive at most?

You can refer to the interest calculation method to know how much interest you will receive after saving. To calculate interest, you can apply the formula:

Interest = deposit x interest rate %/12 x number of months of deposit.

For example, you deposit 2 billion VND in Bank A, term 12 months and enjoy interest rate 5.1%/year, the interest received is as follows:

2 billion VND x 5.1%/12 x 12 = 102 million VND.

* Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to more information about interest rates HERE.

Source

![[Photo] Buddha's Birthday 2025: Honoring the message of love, wisdom, and tolerance](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/8cd2a70beb264374b41fc5d36add6c3d)

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

Comment (0)