The stock market in 2024 closed with the overall score still increasing by more than 12%, but the portfolio of some businesses investing in the securities sector still struggled.

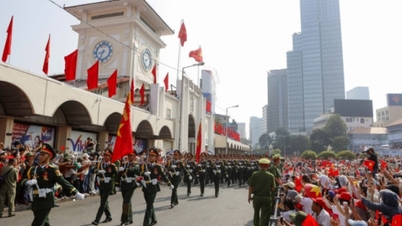

Many investors cannot beat the stock market in 2024 - Photo: QUANG DINH

For example, DRH Holdings Joint Stock Company (DRH) has just recorded a loss due to liquidation of investments and securities of more than 75 billion VND in the fourth quarter of 2024, a sharp increase compared to the same period last year.

This loss contributed to pushing financial costs up to approximately VND 113 billion, three times higher than the same period in 2023.

While financial expenses increased sharply, net revenue for the last quarter of the year was only over VND500 million, down 45% compared to the same period last year. DRH recorded a gross loss of over VND1.1 billion when the cost of goods sold was higher than revenue.

Finally, after deducting expenses and taxes, DRH had a net loss of nearly VND 118 billion, while in the fourth quarter of 2023, it only lost more than VND 38 billion.

Accumulated for the whole of last year, DRH recorded revenue of more than 2.66 billion VND, down 70% compared to 2023. This is also the record loss ever for this enterprise specializing in financial investment, business and real estate brokerage.

At the end of 2024, DRH's total assets reached VND 3,896 billion, a slight decrease compared to the beginning of the year. Of which, cash and cash equivalents decreased from VND 104 billion to nearly VND 16 billion after one year.

DRH has recorded an investment of more than VND 800 billion in joint venture companies, all of which are shares in Binh Duong Minerals and Construction Joint Stock Company (KSB).

Financial reports show that many businesses are making financial investments in securities in 2024 but the results are not very positive.

Specifically, at the end of last year, the asset size of Van Lang Technology Investment and Development Joint Stock Company (VLA) exceeded 50 billion VND.

Notably, there is a stock investment of nearly VND6.3 billion in codes such as: BID of BIDV; GVR of Vietnam Rubber Industry Group; PVS of Vietnam Oil and Gas Technical Services Corporation; VIX of VIX Securities and VLC of Vietnam Livestock Corporation. This portfolio has a provision of nearly VND700 million.

VLA is known as a company specializing in selling investment and wealth-building courses. Mr. Nguyen Thanh Tien - Chairman of the Board of Directors of VLA - introduced himself as "the number 1 highest paid real estate expert in Vietnam".

Source: https://tuoitre.vn/mot-dai-gia-lo-nang-vi-choi-chung-khoan-he-lo-danh-muc-cua-cong-ty-chuyen-day-lam-giau-20250205160152383.htm

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)