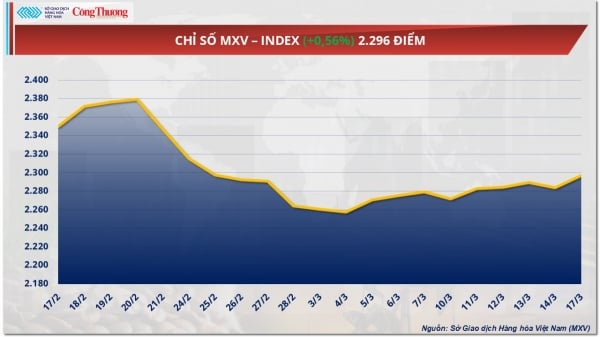

| Commodity market today, July 17, 2024: MXV-Index hits its lowest level in the past 4 months Commodity market today, July 18, 2024: Metal market in red |

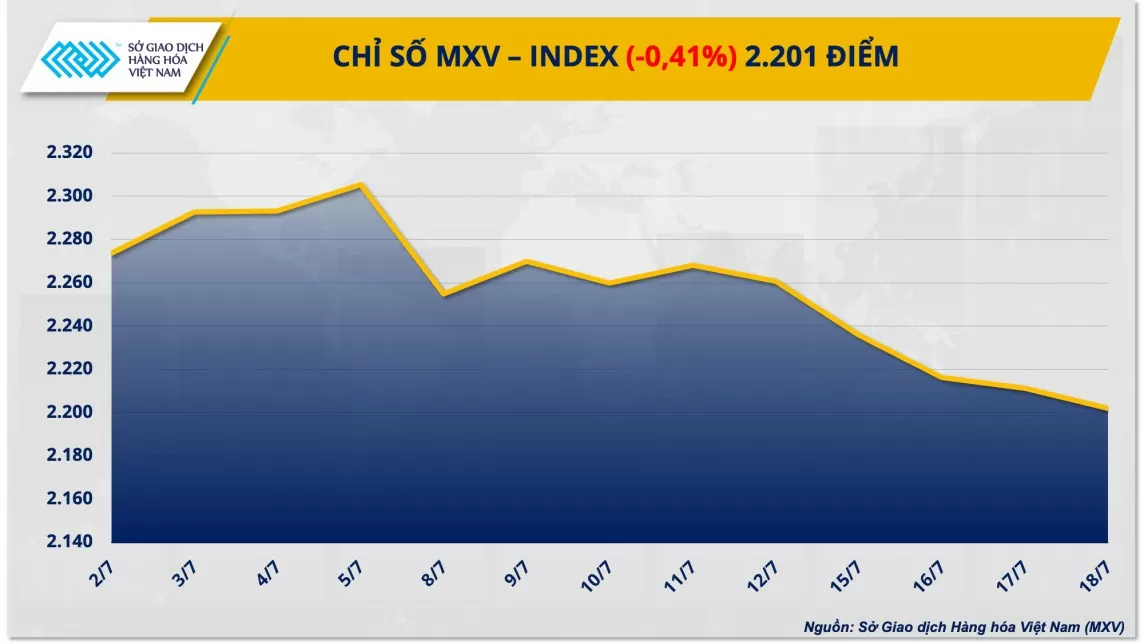

In the industrial raw materials market, cocoa prices jumped more than 4% after three sessions of decline. Continuing the weakening trend, red also covered the metal market in yesterday's trading session. Overwhelming selling pressure pulled the MXV-Index down another 0.41% to 2,201 points.

|

Cocoa prices recover strongly

After three consecutive sessions of decline, cocoa prices recovered nearly 4% at the close of yesterday's trading session. According to MXV, concerns about supply shortages contributed to the increase in cocoa prices.

According to the International Cocoa Organization (ICCO), the major cocoa-producing region of Ghana, the world’s second-largest cocoa grower, has seen 81% of its cocoa plantations infected with the disease. This could have a major impact on cocoa yield and production. On the other hand, Asia’s cocoa grinding, a measure of demand, also fell 1.4% year-on-year to nearly 210,970 tonnes in the second quarter.

|

| Industrial raw material price list |

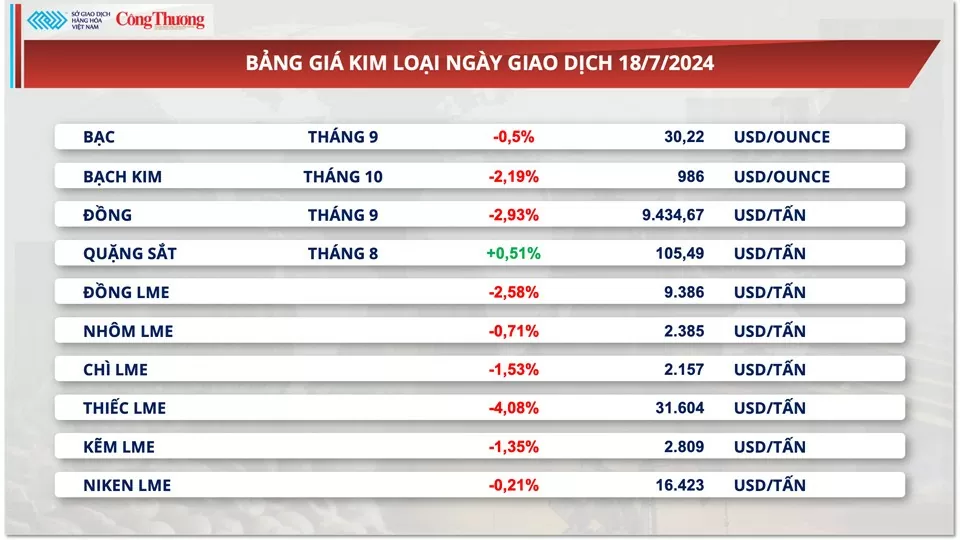

Red continues to dominate the metal market

At the end of the trading day on July 18, the metal market continued to be dominated by red. For precious metals, platinum lost the $1,000/ounce mark after falling 2.19%, closing at $986/ounce, the lowest in a month. Silver also weakened by more than 0.5% to $30.22/ounce, the lowest level in more than two weeks.

The main reason for the pressure on the precious metals group was the strengthening of the US dollar. The Dollar Index recovered from a four-month low, closing up 0.41% at 104.17 points. The rising US dollar has reduced the attractiveness of precious metals, thereby weakening buying power.

|

| Metal price list |

In addition, market sentiment has also become more cautious as the US Federal Reserve (FED) still leaves open the possibility of lowering interest rates and the timing of the policy pivot remains unknown. Some experts have warned that the market is too optimistic about the FED. Meanwhile, the International Monetary Fund (IMF) yesterday forecast that the FED should wait until at least the end of 2024 to start lowering interest rates. This is contrary to current market expectations that the FED will have up to three cuts by the end of this year, the first of which will fall in July or September.

For base metals, COMEX copper prices fluctuated the most in the group, losing nearly 3% to $9,434.67/ton, the lowest level in more than three months. This was also the session that recorded the largest decrease in copper prices since early June. Recently, copper prices have been under pressure due to weak demand, especially in China, the leading copper consumer.

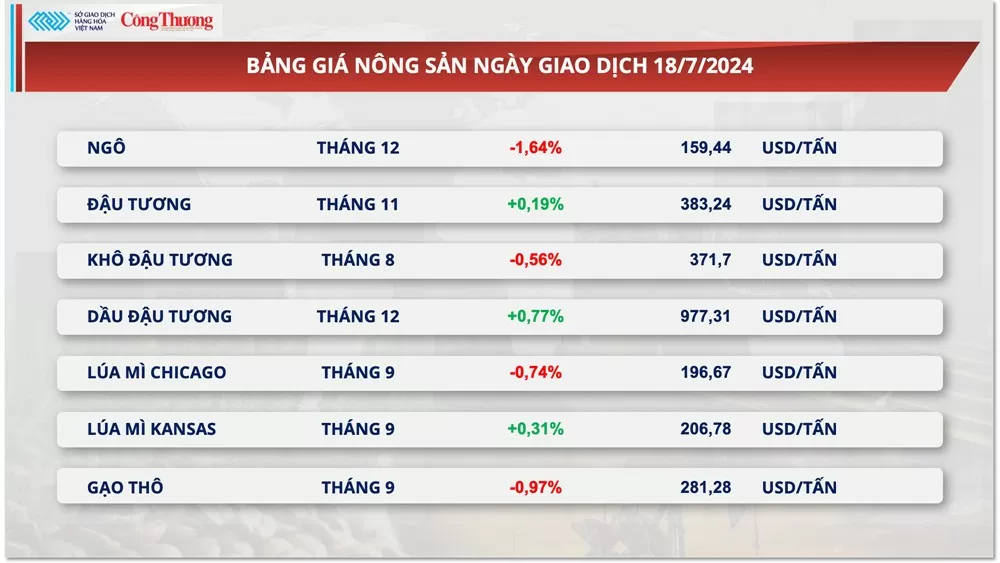

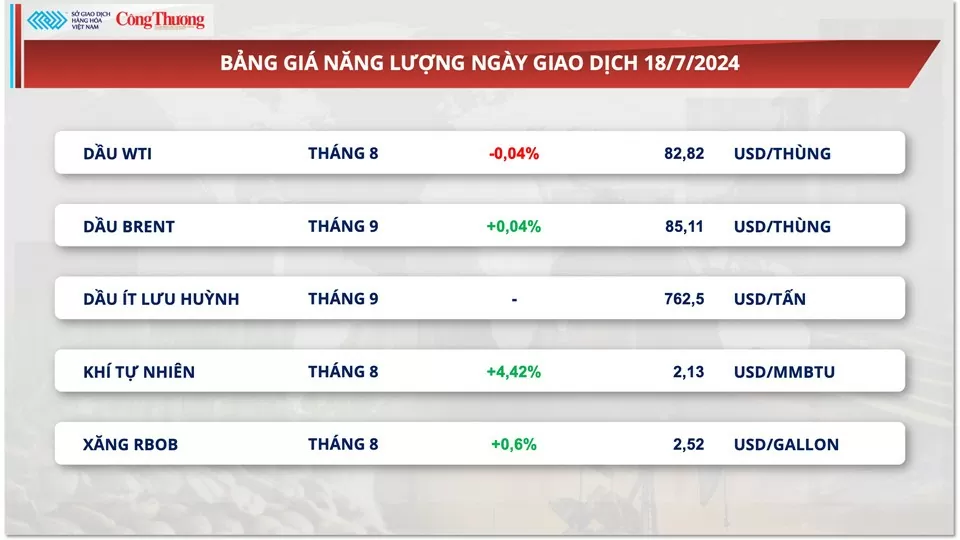

Prices of some other goods

|

| Agricultural product price list |

|

| Energy price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-ngay-1972024-luc-ban-ap-dao-tren-thi-truong-hang-hoa-nguyen-lieu-the-gioi-333319.html

![[Photo] Special supplement of Nhan Dan Newspaper spreads to readers nationwide](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/0d87e85f00bc48c1b2172e568c679017)

![[Photo] Prime Minister Pham Minh Chinh receives Cambodian Minister of Commerce](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/be7f31fb29aa453d906df179a51c14f7)

![[Photo] A long line of young people in front of Nhan Dan Newspaper, recalling memories of the day the country was reunified](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/4709cea2becb4f13aaa0b2abb476bcea)

![[Photo] Signing ceremony of cooperation and document exchange between Vietnam and Japan](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/e069929395524fa081768b99bac43467)

![[Photo] People lined up in the rain, eagerly receiving the special supplement of Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/ce2015509f6c468d9d38a86096987f23)

Comment (0)