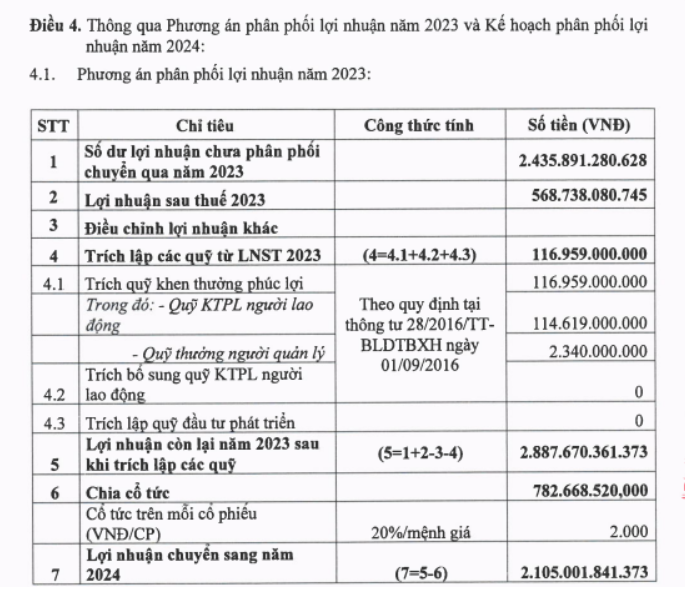

Phu My Fertilizer is about to spend more than 780 billion VND to pay dividends.

PetroVietnam Fertilizer and Chemicals Corporation (Dam Phu My - Code: DPM) announced that August 22 is the last registration date to receive 2023 cash dividends, at a rate of 20% (1 share receives 2,000 VND), corresponding to the ex-rights trading date of August 21.

With 391.3 million shares outstanding, the company needs to spend about VND782.7 billion to pay dividends. The expected payment date is September 24.

In this dividend payment, Vietnam Oil and Gas Group (PVN) can receive nearly 466 billion VND thanks to holding 59.59% of capital.

In recent years, Dam Phu My often pays cash dividends at a high rate, 70% in 2022 and 50% in 2021.

With 391.3 million shares outstanding, the company needs to spend about VND782.7 billion to pay dividends. The expected payment date is September 24.

Regarding the business situation in the first 6 months of this year, Phu My Fertilizer recorded net revenue of VND7,255 billion, up 4% over the same period last year. Gross profit increased 26% to VND1,146.6 billion, with gross profit margin improving to 16%. According to Phu My Fertilizer, strict cost control contributed to improving gross profit margin compared to 13.1% over the same period last year.

Phu My Fertilizer achieved pre-tax profit of VND578.4 billion and after-tax profit of VND503.3 billion, up 15% and 37% respectively over the previous year.

Phu My Fertilizer's 2024 target is a total consolidated revenue of VND12,755 billion, down 9% compared to last year, and a profit after tax of VND542 billion, down slightly from nearly VND570 billion in 2023. The company plans to contribute VND263 billion to the state budget. With the first half of the year's results, Phu My Fertilizer has completed 93% of the year's profit plan.

The financial situation continues to be maintained in a healthy manner with cash and bank deposits reaching over VND 9,700 billion, accounting for nearly 62% of total assets, up 46% compared to the beginning of the year. Not only is there a large amount of cash available, in the capital structure, undistributed after-tax profits at Phu My Fertilizer are also contributing a large proportion with a value as of December 31, 2023 of VND 3,268 billion.

By the end of the second quarter of 2024, Phu My Fertilizer's total assets reached more than VND 15,700 billion, an increase of 18% compared to the beginning of the year. Owner's equity increased to VND 12,000 billion, short-term financial debt was at a low level of VND 1,682 billion.

Compared with the 2024 plan, Phu My Fertilizer has achieved 93% of the profit target (542 billion VND).

In the second half of the year, Phu My Fertilizer sets a cautious target...

Urea prices have been on a recovery trend over the past six months after bottoming out in the second quarter of 2023. The recovery comes amid tightening global supplies as China and Russia restrict exports, along with some plants cutting capacity due to maintenance and gas shortages.

The price of urea in the past 6 months has increased slightly compared to the average price in 2023 but is still at a reasonable level. The price of fertilizer is stable so farmers can invest better in agricultural production. Thanks to that, the consumption of urea of Phu My Fertilizer in the domestic market and for export reached 501 thousand tons, an increase of 4% over the same period last year. With the slight increase in urea selling price and urea consumption output, the profit of Phu My Fertilizer has increased.

Along with urea, NPK fertilizer sales output in the first 6 months of the year reached 87 thousand tons, completing 61% of the yearly plan, up 21% over the same period.

According to forecasts, NPK consumption will continue to grow positively in 2024 thanks to factors such as lower selling prices boosting purchasing power, potential market share growth in the high-quality NPK segment and Phu My Fertilizer's Phu My NPK plant operating at high capacity.

At the same time, the decrease in input material prices also contributes to improving Phu My Fertilizer's profits. In addition, the current high selling price of agricultural products and the expanded export market for agricultural products are creating favorable conditions for farmers to increase investment and expand production, thus contributing to increasing the demand for fertilizers for production.

However, in addition to the advantages, in the second half of 2024, Phu My Fertilizer's production and business activities will still face exchange rate pressure, affecting the purchase price of raw materials, production equipment, goods, etc.

In the last 6 months of the year, Phu My Fertilizer plans to supply over 650,000 tons of fertilizers and chemicals, continue to develop new products and expand international markets to complete the 2024 plan.

To complete the 2024 plan, Phu My Fertilizer continues to operate fertilizer factories effectively, safely and stably; prioritizing cost reduction and product quality improvement.

Phu My Fertilizer also continues to closely monitor market developments and strengthen forecasts to make optimal business decisions. At the same time, Phu My Fertilizer also considers changing its business model and distribution system to suit the market context.

In addition, Phu My Fertilizer aims to seek and take advantage of all export opportunities to regional countries such as India, South Korea, Japan, Thailand, Taiwan (China) and the Philippines to reduce oversupply pressure from the domestic market during the low season.

Currently, Phu My Fertilizer accounts for 38% of domestic urea consumption market share, 11% of NPK market share and 25% of NH3 market share.

A corner of Phu My Fertilizer Plant. Photo: AN (TTXVN)

Dragon Capital Securities (VDSC) said that in the second half of the year, Phu My Fertilizer set a cautious target with urea consumption output of about 409,000 tons (up 3% over the same period but down 18% compared to the first half of the year).

NPK output was 55,000 tons (down 18% yoy and down 37% yoy). Imported fertilizer was 127,000 tons (down 18% yoy but up 13% yoy).

According to Dam Phu My, the company has planned cautiously due to concerns about weather problems and fluctuations in agricultural product prices affecting fertilizer consumption demand, and the second half of the year is also a lower season than the first half of the year.

The company said it is planning to double the current capacity of its NPK plant to 500,000 tons/year.

On the stock market, DPM's stock price on August 12 was at VND 36,000/share, an increase of 7% compared to the beginning of 2024. The market capitalization currently exceeds VND 14,100 billion.

Source: https://danviet.vn/loi-nhuan-tang-37-dam-phu-my-dpm-sap-chi-hon-780-ty-dong-tra-co-tuc-2023-20240812221522563.htm

![Tue Tinh gets rich from the fields: [Part 1] Carrots 'open up the land' throughout the region](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/11/29/1764389769377_1026-z7266742695736_f4e06e7df318c52c0fb916536279510f-nongnghiep-211017.jpeg)

Comment (0)