Receive huge capital from abroad

On September 25, Tin Thanh Group (TTG) signed a contract confirming the provision of capital with Acuity Funding, an Australian capital arrangement and management organization, to receive capital of up to 6.4 billion USD for projects in Vietnam and the US.

Of which, Acuity Funding agreed to provide $1 billion to be used to develop four biomass power plants and thousands of hectares of sorghum in Central and Southern Vietnam. $1.7 billion will be used by TTG to build a tire retreading and trucking service plant in South Carolina, serving more than 1 million trucks in the US with the goal of reducing emissions, saving costs and switching to green energy.

Tin Thanh Group receives $6.4 billion in investment capital from Acuity Funding for projects in Vietnam and the US

About $3.7 billion is being spent on building a green hydrogen production facility in South Carolina. TTG said the group is partnering with Air Products - a $67 billion corporation on the NYSE. The output will bring a big change to the auto industry and especially outdated, polluting coal-fired power plants.

At the signing ceremony, Mr. Tran Dinh Quyen - Chairman of the Board of Directors of Tin Thanh Group said: "The above projects of the enterprise have been approved and supported by the Vietnamese and US governments and many patents have been registered. The models and technologies of the projects are highly practical and can be applied on a global scale."

TTG's "not-so-average" background

Tin Thanh Group, formerly known as Tin Thanh Industrial Steam Electric Company Limited, was established in September 2009, operating mainly in the field of boiler manufacturing (except central boilers). The initial charter capital was 100 billion VND contributed by three shareholders including Ms. Nguyen Le Vy (35%), Nguyen Thi Thanh Hien (20%) and Mr. Tran Dinh Anh Khoa (45%).

In November 2011, Mr. Tran Dinh Quyen (born in 1960) became Chairman of the Board of Directors after receiving all the capital contributions from Mr. Khoa and another shareholder to become the largest shareholder. By the first month of 2017, the company increased its charter capital from VND 108 billion to VND 200 billion, with two shareholders, Mr. Tran Dinh Quyen holding 80% and Ms. Nguyen Thi Thanh Hien holding 20%.

In 2018, the company changed its model to a joint stock company, with the name Tin Thanh Group Joint Stock Company (Tin Thanh Group), and Mr. Tran Dinh Quyen was the Chairman of the Board of Directors and legal representative. In mid-2018, the company continued to increase its charter capital to 250 billion VND, of which Mr. Quyen still owned the most with 74% of the shares, Ms. Hien held 16%, and the rest belonged to Ms. Nguyen Thi Bich Hoai.

After many times of capital increase and additional business lines, Tin Thanh Group currently has a capital of 432 billion VND. The Group's activities are mainly in the field of sustainable development related to biomass energy, including industrial electricity and steam, renewable energy, biomass electricity, saving and reducing emissions, waste recycling, closed industry and agriculture; in addition, there is also the tire rental business.

In addition, Tin Thanh Group has five member units, including three energy enterprises in Vietnam, one import-export enterprise, and one industrial electricity enterprise in the United States. Mr. Tran Dinh Quyen's group also owns Tin Thanh Oakwood Bank Corp and FIAT Chrysler Automobiles Automobile Manufacturing and Assembly Plant, headquartered in Florida, United States. Recently, Tin Thanh Group has cooperated with Ms. Le Hoang Diep Thao's King Coffee to build a tire retreading and recycling plant in South Carolina.

“Paper thin” profit

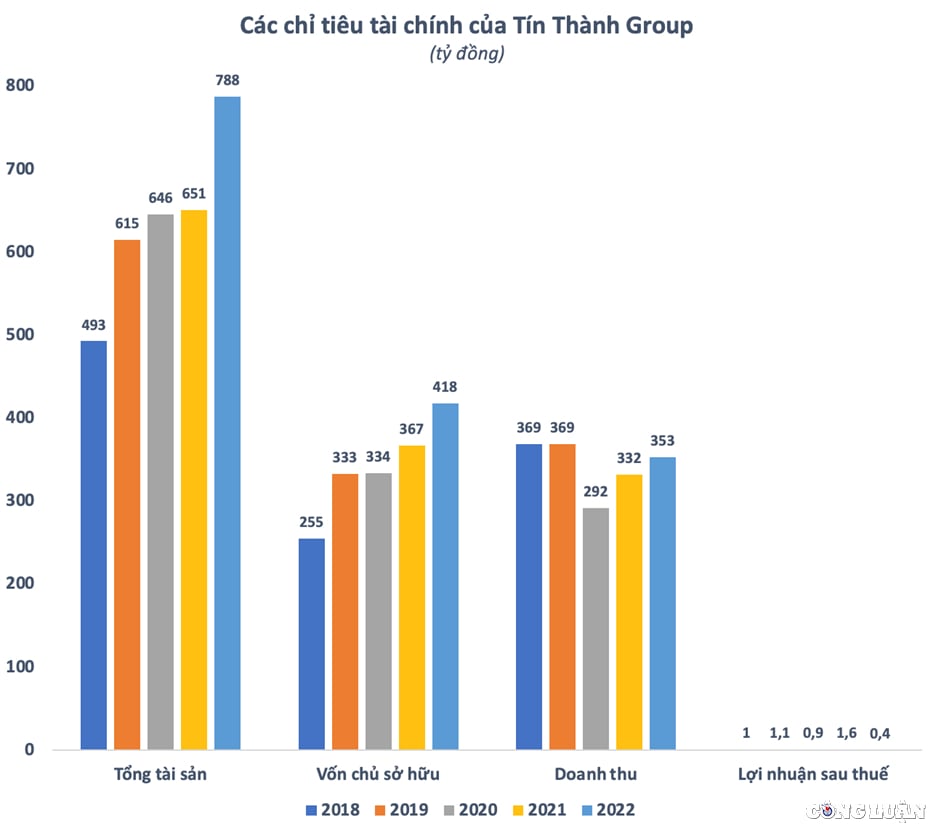

Along with the capital increase process, Tin Thanh Group has also continuously expanded its scale with total assets and equity continuously increasing year by year. By the end of 2022, the total assets of the enterprise reached 788 billion VND, an increase of 60% compared to 4 years ago. Of which, 53% of assets are financed by equity with a value of 418 billion VND at the end of 2022.

Thanks to the continuous increase in charter capital, Tin Thanh Group is not too dependent on debt capital. The total debt of the enterprise at the end of last year was only 370 billion VND, equivalent to nearly 90% of equity. Compared to the end of 2018, the debt of the enterprise has increased by more than 55%, but in absolute terms, it is not too large.

Tin Thanh Group is currently a saturated steam supplier for many large enterprises such as Sabeco, Habeco, Coca-Cola, Carlsberg, Long Thanh Paper Factory, DRC Da Nang Rubber... Therefore, it is not surprising that the enterprise has a steady revenue of hundreds of billions each year. In the last 5 years, only in 2020 did the enterprise record revenue of less than 300 billion VND.

In 2022, Tin Thanh Group recorded revenue of 353 billion VND, an increase of more than 6% over the same period last year. This is the second consecutive year that the company's revenue has grown over the same period. However, the current revenue level is still slightly lower than the 2018-2019 period despite its much larger scale.

Notably, despite a steady revenue of hundreds of billions, Tin Thanh Group's profit is very thin, only about 1 billion VND per year. In 2022, the company's after-tax profit even dropped sharply to less than 400 million VND, nearly 1/4 of the previous year in 2021. The net profit margin was only 0.11%, meaning that 1,000 VND of revenue was exchanged for more than 1 VND of profit.

The profitability indicators of Tin Thanh Group are of course very modest. The return on total assets (ROA) is only 0.05%, equivalent to 2,000 VND of assets generating 1 VND of profit. The return on equity (ROE) is also only slightly better, reaching nearly 0.1%, equivalent to 1,000 VND of capital generating 1 VND of profit. This makes investors question the efficiency of capital and asset use of the group under Mr. Tran Dinh Quyen.

Source

![[Photo] Prime Minister Pham Minh Chinh receives Country Director of the World Bank Regional Office for Vietnam, Laos, Cambodia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/2c7898852fa74a67a7d39e601e287d48)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Thai Prime Minister Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/e71160b1572a457395f2816d84a18b45)

Comment (0)