A series of new economic policies such as new regulations on railway vehicle registration; additional regulations on lending by electronic means; cases where credit institutions are not allowed to lend... will officially take effect from September 2023.

New regulations on registration of railway vehicles

The Ministry of Transport issued Circular 14/2023/TT-BGTVT dated June 30, 2023 regulating the registration of railway vehicles and the movement of railway vehicles in special cases.

According to Circular 14/2023/TT-BGTVT, the competent state agency to issue, reissue, revoke and delete the Vehicle Registration Certificate is prescribed as follows:

1- Vietnam Railway Authority organizes the issuance, re-issuance, revocation and deletion of Vehicle Registration Certificates on national railways, urban railways and specialized railways, except for the cases specified in (2) below.

2- The People's Committees of provinces and centrally-run cities with specialized railways and urban railways listed in Appendix II issued with this Circular (Provincial-level People's Committees) shall organize the issuance, re-issuance, revocation and deletion of Certificates of vehicle registration on specialized railways and urban railways according to the provisions of this Circular.

The Circular clearly states that in case of not issuing or re-issuing the Vehicle Registration Certificate, the competent state agency shall notify the owner in writing and state the reasons.

The Circular takes effect from September 1, 2023.

|

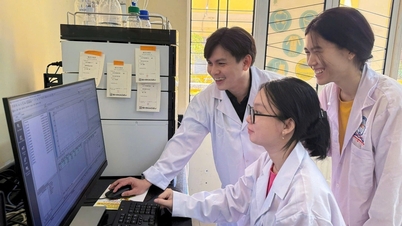

The new regulations on railway vehicle registration are a policy that will take effect from September 2023. |

Supplementing regulations on lending by electronic means

The State Bank has issued Circular 06/2023/TT-NHNN dated June 28, 2023 amending and supplementing a number of articles of Circular No. 39/2016/TT-NHNN dated December 30, 2016 of the Governor of the State Bank of Vietnam regulating lending activities of credit institutions and foreign bank branches to customers. In particular, the Circular supplements Section 3, Chapter II on lending activities by electronic means.

According to the Circular, credit institutions shall make loans by electronic means in accordance with the business conditions of the credit institution, the characteristics of the loan, ensuring security, safety, protection of data messages and information confidentiality in accordance with the provisions of law on anti-money laundering, electronic transactions, instructions of the State Bank of Vietnam on risk management and relevant legal documents.

Information systems that perform lending activities by electronic means must comply with regulations on ensuring information system security at level 3 or higher according to Government regulations on ensuring information system security at each level and regulations of the State Bank of Vietnam on information system security in banking activities.

Credit institutions must store and preserve information and data in accordance with the provisions of law, ensure safety, security and backup to ensure the completeness and integrity of records, allowing access and use when necessary or to serve the work of inspection, comparison, settlement of inquiries, complaints, disputes and provide information upon request from competent state management agencies.

Credit institutions shall decide on their own measures, forms, and technologies to serve lending activities by electronic means, bear the risks that may arise (if any), and must meet at least the following requirements:

- Have technical solutions and technologies to ensure accuracy, security and safety in the process of collecting, using and checking information and data;

- Have measures to check, compare, update and verify information and data; have measures to prevent acts of forgery, interference and editing that distort information and data;

- Have measures to monitor, identify, measure and control risks; have risk handling plans;

- Assign specific responsibilities to each individual and relevant department in electronic lending activities and in risk management and monitoring.

The Circular takes effect from September 1, 2023.

Cases where credit institutions are not allowed to lend

Also in Circular 06/2023/TT-NHNN, the Circular amends and supplements Article 8 on capital needs that are not allowed to be lent. Accordingly, credit institutions are not allowed to lend for the following capital needs:

- To carry out business investment activities in industries and professions prohibited from investment and business according to the provisions of the Investment Law.

- To pay expenses and meet financial needs of business investment activities in industries and professions prohibited from investment and business according to the provisions of the Investment Law and other transactions and acts prohibited by law.

- To purchase and use goods and services in industries and professions prohibited from investment and business according to the provisions of the Investment Law.

- To buy gold bars.

- To repay the credit loan at the lending credit institution itself, except for the case of lending to pay loan interest arising during the construction process, in which the loan interest expense is calculated in the total construction investment approved by the competent authority according to the provisions of law.

- To repay foreign loans (excluding foreign loans in the form of deferred payment for goods purchase), credit granted at other credit institutions, except for loans to repay debts before maturity of loans that fully meet the following conditions: Loan term does not exceed the remaining loan term of the old loan; is a loan that has not been restructured for repayment term.

- To deposit money.

- To pay for capital contributions, purchase, and receive transfers of capital contributions of limited liability companies and partnerships; to contribute capital, purchase, and receive transfers of shares of joint stock companies that are not listed on the stock market or have not registered for trading on the Upcom trading system.

- To pay for capital contributions under capital contribution contracts, investment cooperation contracts or business cooperation contracts to implement investment projects that do not meet the conditions for putting into business according to the provisions of law at the time the credit institution decides to lend.

- To compensate financially, except in cases where the loan fully meets the following conditions: The customer has advanced the customer's own capital to pay for and cover the costs of implementing the business project, and the costs of implementing this business project arise within 12 months from the time the credit institution decides to lend; the costs paid and covered by the customer's own capital to implement the business project are costs that use the credit institution's loan capital according to the capital use plan submitted to the credit institution for consideration of medium and long-term loans to implement that business project.

This Circular takes effect from September 1, 2023.

Instructions on using state budget funds to support small and medium enterprises

The Ministry of Finance has just issued Circular No. 52/2023/TT-BTC dated August 8, 2023 guiding the mechanism for using state budget funds for regular expenditure to support small and medium enterprises according to the provisions of Decree No. 80/2021/ND-CP of the Government.

According to the Circular, the subjects of application are enterprises established, organized and operating in accordance with the provisions of the law on enterprises, and at the same time meeting the provisions in Chapter II of Decree No. 80/2021/ND-CP on criteria for determining small and medium enterprises.

The funding for implementing the contents of supporting small and medium enterprises prescribed in this Circular includes: Regular state budget expenditure sources, including central budget, local budget according to budget decentralization; contributions and sponsorships from domestic and foreign enterprises, organizations and individuals and other legal funding sources outside the state budget.

Regarding state budget sources: State budget funding to support small and medium-sized enterprises is implemented through state budget estimates assigned to agencies and organizations supporting small and medium-sized enterprises. The process of preparing, deciding, assigning estimates, implementing, accounting, auditing, and finalizing state budget to support small and medium-sized enterprises is in accordance with the provisions of the law on state budget, ensuring the correct purpose, objects, expenditure contents, expenditure norms, support levels and principles of support implementation as prescribed in Decree No. 80/2021/ND-CP, instructions in this Circular and other relevant legal provisions. Support is based on the ability to balance resources and priority support orientations in each period of the annual state budget.

Regarding contributions and sponsorships: The mobilization, management and settlement of funds must comply with current legal regulations. In case there is an agreement with enterprises, organizations and individuals on the use of contributions and sponsorships to pay for the State budget support, it must be implemented in accordance with the agreement.

The principle of determining costs is as follows: For expenditure contents with specific standards and norms in legal documents issued by competent authorities, costs shall be determined in accordance with the prescribed regime.

For expenditure contents that do not have specific standards and norms: Determine costs based on specific cases, nature, scope and related factors, with reference to similar costs implemented within 12 months (if any) up to the time of cost determination.

This Circular takes effect from September 23, 2023.

VNA

* Please visit the Economics section to see related news and articles.

Source

![[Photo] Flooding on the right side of the gate, entrance to Hue Citadel](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761660788143_ndo_br_gen-h-z7165069467254-74c71c36d0cb396744b678cec80552f0-2-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chaired a meeting to discuss solutions to overcome the consequences of floods in the central provinces.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/29/1761716305524_dsc-7735-jpg.webp)

![[Photo] Hue: Inside the kitchen that donates thousands of meals a day to people in flooded areas](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/29/1761738508516_bepcomhue-jpg.webp)

![[Photo] National Assembly Chairman Tran Thanh Man received a delegation of the Social Democratic Party of Germany](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761652150406_ndo_br_cover-3345-jpg.webp)

![[Infographic] Vietnam's socio-economic situation in 5 years 2021-2025: Impressive numbers](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/29/1761730747150_anh-man-hinh-2025-10-29-luc-16-38-55.png)

Comment (0)