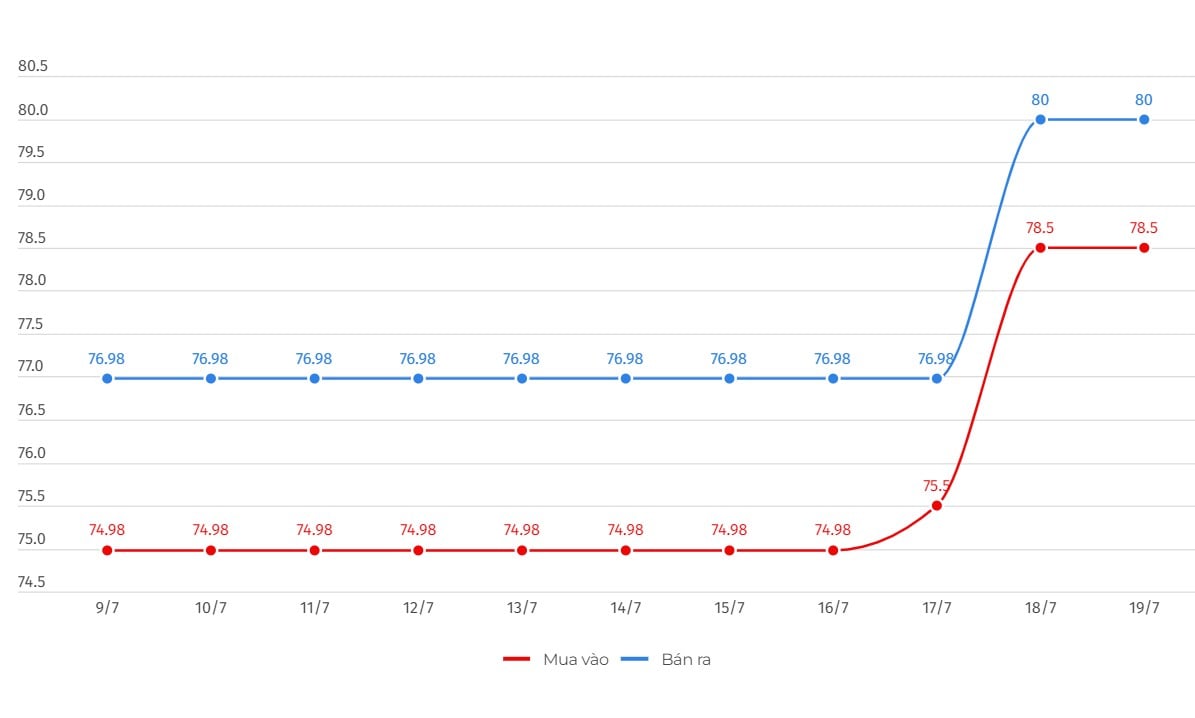

SJC gold bar price

At 9:00 a.m., DOJI Group listed the price of SJC gold at 78.5-80 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at DOJI is at 1.5 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold at 78.5-80 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at Saigon Jewelry Company SJC remained unchanged in both buying and selling directions. The difference between the buying and selling price of SJC gold at Saigon Jewelry Company SJC is at 1.5 million VND/tael.

9999 gold ring price

As of 9:00 a.m., the price of 9999 Hung Thinh Vuong round gold rings at DOJI Gold and Gemstone Group was listed at 76.10-77.35 million VND/tael (buy - sell); down 250,000 VND/tael for buying and down 200,000 VND/tael for selling.

Saigon Jewelry Company listed the price of gold rings at 75.9-77.3 million VND/tael (buy - sell); down 100,000 VND/tael for buying and down 200,000 VND/tael for selling.

Bao Tin Minh Chau listed the price of gold rings at 76.08-77.38 million VND/tael (buy - sell); down 200,000 VND/tael for both buying and selling.

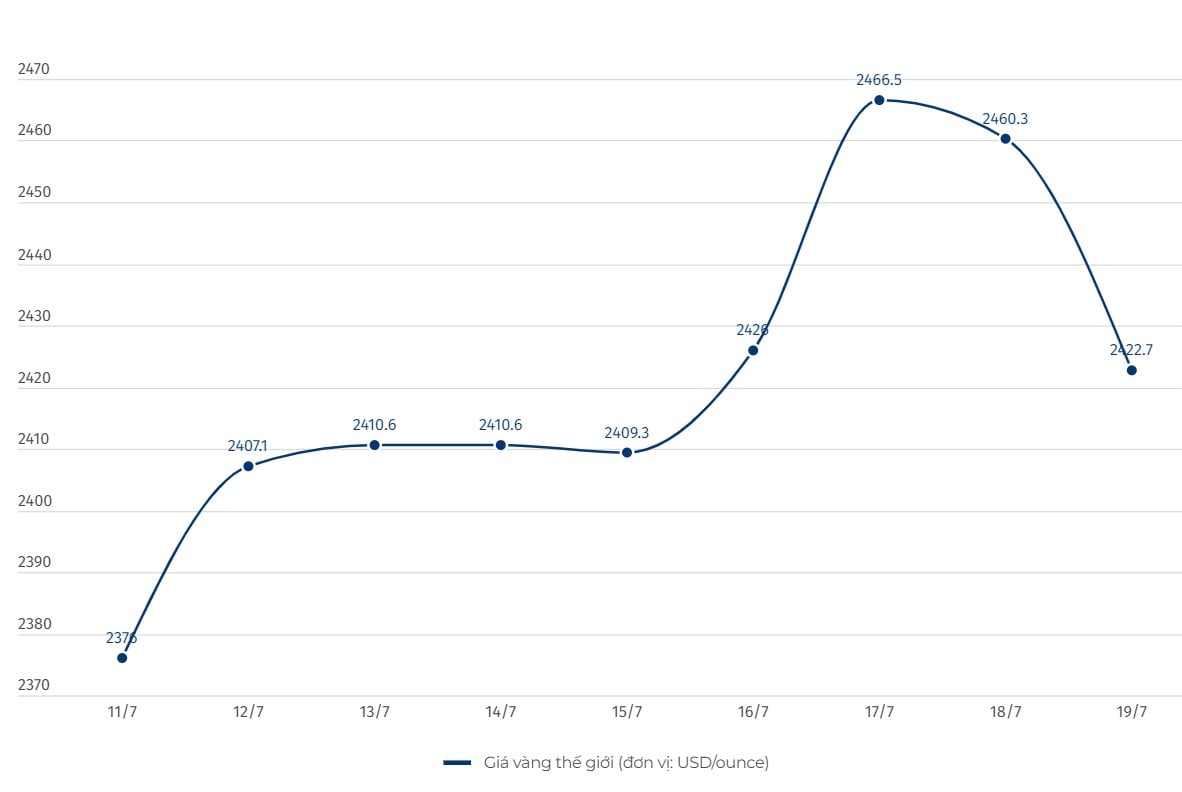

World gold price

As of 8:30 a.m., the world gold price listed on Kitco was at 2,422.7 USD/ounce, down 37.6 USD/ounce compared to the beginning of the trading session yesterday morning.

Gold Price Forecast

World gold prices cooled down amid an upward trend in the USD index. Recorded at 8:30 a.m. on July 19, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 103.967 points (up 0.05%).

The US Federal Reserve's expected interest rate cut in September and US presidential candidate Donald Trump's support for lower interest rates and tariffs are combining to boost demand for gold, said Arslan Ali, currency and commodities analyst at FX Empire.

“Lower interest rates typically make non-yielding assets like gold more attractive to investors. Additionally, former US President Donald Trump’s support for tax cuts, interest rate cuts and tariff hikes has further supported gold prices. This policy stance is seen as potentially inflationary and could weaken the US dollar, making gold a more attractive safe-haven asset,” said Arslan Ali.

However, this expert commented that despite these many favorable factors, the strength of the USD is still holding back the increase in gold.

“US retail sales in June remained steady at $704.3 billion, indicating steady consumer spending. Despite a stronger US dollar, the stability of retail sales coupled with the Fed’s cautious stance on rate cuts has contributed to gold’s recent rally.

Investors are turning to gold as a hedge against future Fed rate hikes and economic growth prospects,” said Arslan Ali.

Analysts expect gold to continue to be a long-term source of profit, boosted by the Fed's preparations to cut interest rates, believing inflation will be controlled, said Russell Shor, senior market expert at Tradu.

In addition, geopolitical instability and demand from central banks are also creating a positive medium- and long-term outlook for gold.

According to the CME FedWatch Tool, the market is pricing in a 100% chance of a US interest rate cut in September.

Source: https://laodong.vn/tien-te-dau-tu/gia-vang-hom-nay-197-lao-doc-du-co-nhieu-yeu-to-ho-tro-1368550.ldo

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting on the implementation of the Lao Cai-Hanoi-Hai Phong railway project.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/0fa4c9864f63456ebc0eb504c09c7e26)

Comment (0)