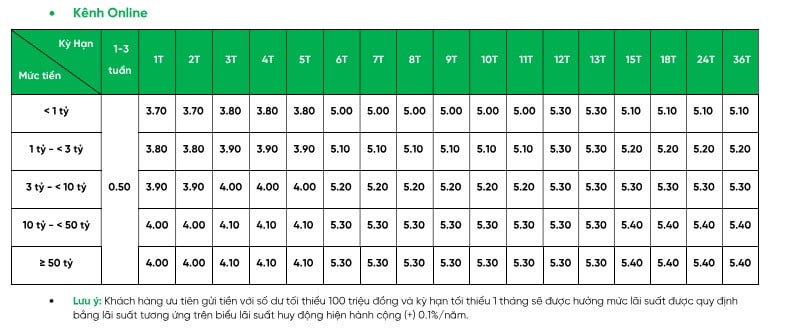

After increasing all terms by 0.2% per year on May 16, Vietnam Prosperity Joint Stock Commercial Bank (VPBank) has continued to sharply increase deposit interest rates from today, up to 0.8% per year.

According to the online interest rate schedule for individual customers with deposit accounts under 1 billion VND, the 1-month term increased by 0.8%/year to 3.7%/year. The 2-month term interest rate increased by 0.5%/year to 3.7%/year.

Deposit terms from 3-5 months were all listed at 3.8%/year after all three terms were adjusted up by 0.6%/year. 0.6%/year is also the increase in deposit interest rates for terms from 6-11 months after these terms reached 5%/year after many months.

Interest rates for 12-13 month terms increased by 0.3%/year to 5.3%/year. Interest rates for 15-18 month terms increased by 0.1%/year to 5.1%/year.

Notably, VPBank has reduced the interest rate for 24-36 month term deposits by 0.3%/year to 5.3%/year from today.

VPBank adds 0.1%/year interest rate for deposit accounts from 1 billion VND to under 3 billion VND, adds 0.2%/year interest rate for deposit accounts from 3 billion VND to under 10 billion VND; and adds 0.3%/year interest rate for deposit accounts from 10 billion VND or more.

The highest interest rate at VPBank for deposit accounts from 10 billion VND is 5.4%/year, applied for terms of 15-36 months.

This bank maintains a policy of adding 0.1%/year interest rate for deposit accounts from 100 million VND, applied to all terms from 1-36 months. Therefore, the highest mobilization interest rate at VPBank as announced is up to 5.5%/year.

The only bank that reduced deposit interest rates for all terms in May is Vietnam Thuong Tin Commercial Joint Stock Bank (VietBank), which has just increased interest rates for the first time in more than a year.

Accordingly, the mobilization interest rate from today will increase by 0.1%/year for terms of 2-5 months and terms of 12-36 months, and increase by 0.2%/year for 6-month term deposits. Meanwhile, the interest rates of some remaining terms will remain unchanged.

According to VietBank's online deposit interest rate table on May 29, 1-month term is 3%/year, 2-month term is 3.1%/year, 3-4 months is 3.4%/year, 5 months is 3.5%/year.

Bank interest rate for 6-month term is 4.6%/year, 7-8 months is 4.5%/year.

Online deposit terms from 9-11 months still maintain interest rates of 4.6%/year, while 12 months has the latest interest rate of 5.2%/year, 14-month term 5.3%/year, and 15-month term 5.5%/year.

The two deposit terms of 16 and 17 months have new interest rates of 5.7%/year, while the highest mobilization interest rate belongs to the terms of 18-6 months, up to 58%/year.

Although this is the first time raising deposit interest rates, VietBank is still in the Top of banks maintaining the highest deposit interest rates in the market.

Except for VietBank and VPBank, interest rates at other banks remain unchanged.

| INTEREST RATES AT BANKS ON MAY 29 | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| AGRIBANK | 1.6 | 1.9 | 3 | 3 | 4.7 | 4.7 |

| BIDV | 2 | 2.3 | 3.3 | 3.3 | 4.7 | 4.7 |

| VIETCOMBANK | 1.6 | 1.9 | 2.9 | 2.9 | 4.6 | 4.6 |

| VIETINBANK | 1.8 | 2.1 | 3.1 | 3.1 | 4.7 | 4.7 |

| ABBANK | 2.9 | 3 | 4.7 | 4.1 | 5.2 | 4.1 |

| ACB | 2.5 | 2.9 | 3.5 | 3.8 | 4.5 | 4.6 |

| BAC A BANK | 3.1 | 3.3 | 4.6 | 4.6 | 5.4 | 5.5 |

| BAOVIETBANK | 3 | 3.25 | 4.3 | 4.4 | 4.7 | 5.5 |

| BVBANK | 3.2 | 3.4 | 4.7 | 4.6 | 5.3 | 5.5 |

| CBBANK | 3.4 | 3.6 | 5.15 | 5.1 | 5.3 | 5.55 |

| DONG A BANK | 2.8 | 3 | 4 | 4.2 | 4.5 | 4.7 |

| EXIMBANK | 3 | 3.3 | 4.1 | 4.1 | 4.9 | 5.1 |

| GPBANK | 2.5 | 3.02 | 4.35 | 4.6 | 5.15 | 5.25 |

| HDBANK | 3.25 | 3.25 | 4.9 | 4.7 | 5.3 | 6.1 |

| KIENLONGBANK | 3 | 3 | 4.7 | 5 | 5.2 | 5.5 |

| LPBANK | 2.6 | 2.7 | 4 | 4.1 | 5 | 5.6 |

| MB | 2.6 | 3 | 3.9 | 4 | 4.8 | 4.7 |

| MSB | 3.5 | 3.5 | 4.1 | 4.1 | 4.5 | 4.5 |

| NAM A BANK | 2.7 | 3.4 | 4.3 | 4.7 | 5.1 | 5.5 |

| NCB | 3.4 | 3.7 | 4.85 | 5.05 | 5.4 | 5.9 |

| OCB | 3 | 3.2 | 4.6 | 4.7 | 4.9 | 5.4 |

| OCEANBANK | 2.9 | 3.2 | 4 | 4.1 | 5.4 | 5.9 |

| PGBANK | 2.9 | 3.2 | 4.2 | 4.2 | 5 | 5.2 |

| PVCOMBANK | 3.15 | 3.15 | 4.3 | 4.3 | 4.8 | 5.3 |

| SACOMBANK | 2.7 | 3.2 | 4 | 4.1 | 4.9 | 5.1 |

| SAIGONBANK | 2.3 | 2.5 | 3.8 | 4.1 | 5 | 5.6 |

| SCB | 1.6 | 1.9 | 2.9 | 2.9 | 3.7 | 3.9 |

| SEABANK | 2.7 | 2.9 | 3.6 | 3.8 | 4.45 | 5 |

| SHB | 3.1 | 3.2 | 4.5 | 4.6 | 5 | 5.3 |

| TECHCOMBANK | 2.75 | 3.05 | 3.95 | 3.95 | 4.65 | 4.65 |

| TPBANK | 3 | 3.3 | 4.2 | 4.9 | 5.3 | |

| VIB | 2.8 | 3.1 | 4.1 | 4.1 | 4.9 | |

| VIET A BANK | 3 | 3.3 | 4.5 | 4.5 | 5 | 5.3 |

| VIETBANK | 3 | 3.4 | 4.6 | 4.6 | 5.2 | 5.8 |

| VPBANK | 3.7 | 3.8 | 5 | 5 | 5.3 | 5.1 |

According to statistics from the beginning of May 2024, a series of banks increased deposit interest rates including: ACB, VIB, GPBank, NCB, BVBank, Sacombank, CB, Bac A Bank, Techcombank, TPBank, PGBank, SeABank, Viet A Bank, ABBank, VPBank, HDBank, SHB, VietBank and MB.

Of which, ABBank is the bank that has increased interest rates 4 times, while VIB has also experienced 3 increases since the beginning of the month.

CB, SeABank, NCB, Techcombank, Bac A Bank, BVBank, PGBank, VPBank are banks that have increased interest rates twice.

On the contrary, VietBank is the bank that adjusted the mobilization interest rate down for all terms, while MB reduced the mobilization interest rate for 12-month term, VIB reduced the mobilization interest rate for 24 and 36-month term, VPBank reduced the interest rate for 24-36-month term. All three banks reduced the interest rate by 0.1 percentage point, lower than the mobilization interest rate increase of these banks.

Source: https://vietnamnet.vn/lai-suat-ngan-hang-hom-nay-29-5-2024-ong-lon-tang-manh-lai-suat-2285492.html

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)