Up to this point, tens of thousands of billions of VND have been committed by banks to lend with interest rates reduced by 0.5 - 2% to customers affected by storms and floods.

The lending activities of the Vietnam Bank for Agriculture and Rural Development (Agribank) focus on the agricultural, rural and farmer markets, and this is currently the area most heavily affected after the pandemic. Storm No. 3. According to Ms. Phung Thi Binh - Deputy General Director of Agribank - about 21,000 billion VND of outstanding debt of 12,000 customers of Agribank was affected by storm No. 3 and flooding after the storm.

“We are implementing solutions to support customers such as exempting and reducing interest, restructuring debt, and continuing to provide new loans to restore production and business activities.” - Ms. Phung Thi Binh informed.

It is known that the bank is calculating the level of damage to customers to have appropriate solutions. Because some customers are completely damaged, some are partially damaged... “Agribank is planning to reduce lending interest rates for customers affected by storm No. 3 and post-storm flooding by 0.5 - 2% per year compared to the interest rates currently applied to customers in mid-September 2024.” - Mrs. Binh affirmed.

In fact, the number of customers affected by storm No. 3 and floods at commercial banks is up to hundreds of thousands of customers, equivalent to hundreds of thousands of billions of VND in outstanding loans. The plan to support customers with loans is being actively implemented by banks.

For example, at the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank), Mr. Le Hoang Tung - Deputy General Director of Vietcombank shared: It is estimated that nearly 6,000 Vietcombank customers are affected with a total outstanding debt of about 71,000 billion VND, of which in Hai Phong and Quang Ninh alone, there are 230 customers affected with a total outstanding debt of about 13,300 billion VND. In this situation, to support and accompany people and businesses to overcome difficulties, Vietcombank has considered reducing interest rates by 0.5% in the period from September 6, 2024 to December 31, 2024 for customers borrowing capital for production and business, with an outstanding debt of about 130 trillion VND and the number of customers receiving interest rate reduction is nearly 20,000 customers. Mr. Tung expressed that the interest rate reduction program applies to existing and new loans to create conditions for businesses and people to stabilize production, stabilize their lives and access bank credit capital.

Debt restructuring, partial interest reduction on existing loans and new loans with preferential interest rates are forms of customer support that banks are focusing on applying.

Specifically, Vietnam Maritime Commercial Joint Stock Bank (MSB) made a downward adjustment. loan interest rate 1%/year compared to the current interest rate, from now until December 31, 2024, for customers who are business households borrowing capital from MSB with a loan term of up to 60 months. For new customers who are business households, the bank offers preferential loan packages including unsecured credit limits of up to VND 2 billion with interest rates from only 11.5%/year and mortgage limits of up to VND 20 billion with interest rates from 5.8%. For customers who are small businesses, MSB also promotes competitive credit packages with mortgage limits of up to VND 6 billion, interest rates from only 4.99% and unsecured credit limits of up to VND 2 billion, interest rates from 7.7%. Regarding loan terms, small businesses are supported with loans of up to 36 months and various loan forms such as working capital supplements, medium and long-term loans, overdrafts, credit cards and trade finance... contributing to solving difficulties and damages caused by storms and floods.

MSB representative said that this preferential loan interest program demonstrates the bank's timely support for business owners and small businesses during difficult times. " We are committed to continuing to accompany and support customers at all stages, contributing to the recovery and sustainable development of the community" - MSB leadership representative confirmed.

At TPBank, the program to support individual customers affected by storms and floods applied by this bank has a limit of up to 2,000 billion VND. In addition to reducing the current interest rate by up to 50%, the bank will keep this reduced interest rate fixed until January 31, 2025 at the latest. In addition, the bank also has loan packages with long-term fixed preferential interest rates such as: 6.8%/year fixed for the first 12 months; 7.3%/year fixed for the first 18 months; 7.8%/year fixed for the first 24 months; 8.8%/year fixed for the first 36 months. This interest rate is applied until the end of February next year.

Another bank, VPBank, has also announced a 1% reduction in existing interest rates for medium and long-term loans and 0.5% reduction in interest rates for short-term loans for individual customers with collateral at the bank, from September 13 to December 31, 2024; applied in all provinces and cities directly affected by storm Yagi such as Quang Ninh, Hai Phong, Hanoi, Thai Nguyen, Yen Bai, etc.

In addition to reducing loan interest rates, VPBank also adjusted the preferential interest rate to only 6.5%/year fixed for the first 12 months for all customers who need to repay loans early at other banks or borrow to buy real estate, build and repair houses.

According to economic experts, the average interest rate for production and business loans at banks is currently fluctuating around 6.3 - 7.8%/year; preferential loans for priority sectors are at 5 - 6%/year. Therefore, the reduction of 0.5 - 2% in interest rates per year as announced by banks is truly a source of support for people and businesses affected by storms and floods to restore production and business to have a source of money to repay the bank.

Accompanying and supporting businesses, not collecting debts by any means is the State Bank's direction to commercial banks at this time. “Must be flexible, become a 'support' for businesses” - Deputy Governor of the State Bank Dao Minh Tu emphasized.

Currently, one of the most affected loan customer sectors is agriculture, especially aquaculture. To help businesses overcome difficulties, the Government has asked the State Bank to study increasing the scale of the credit package for forestry and aquaculture, currently VND30,000 billion, to about VND50,000 - 60,000 billion, to support recovery from storm damage.

| One of the solutions to overcome the consequences of storm No. 1 that the Prime Minister emphasized at the Conference on urgently overcoming the consequences of storm Yagi, quickly stabilizing the people's situation, restoring production and business, and promoting growth is: Requesting the State Bank and the banking system to study policies on debt extension, deferral, and debt forgiveness, credit policies, and zero-interest packages. |

Source

![[Photo] General Secretary To Lam's wife and Japanese Prime Minister's wife make traditional green rice cakes together](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/7bcfbf97dd374eb0b888e9e234698a3b)

![[Photo] Fireworks light up Hanoi sky to celebrate national reunification day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/5b4a75100b3e4b24903967615c3f3eac)

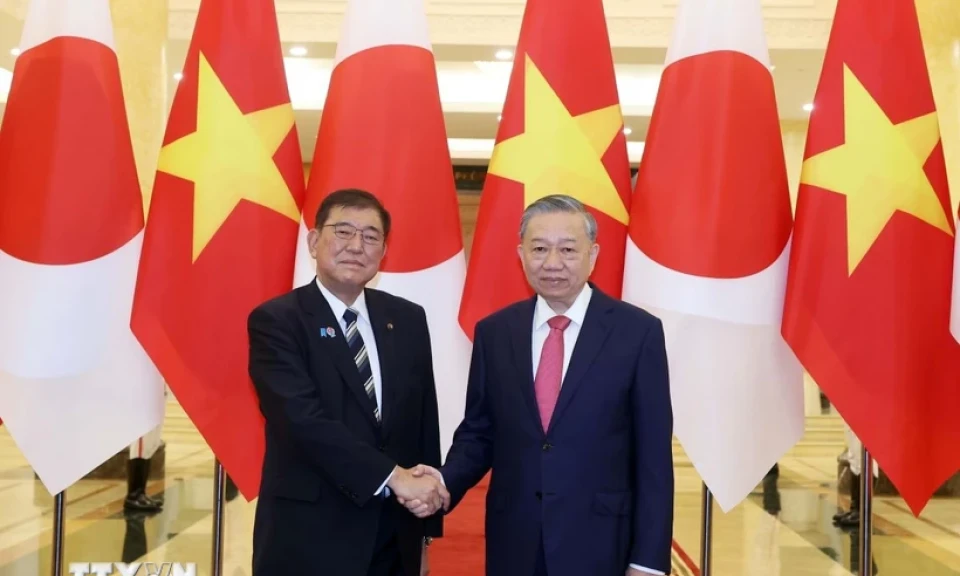

![[Photo] General Secretary To Lam receives Chairman of the Liberal Democratic Party, Japanese Prime Minister Ishiba Shigeru](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/63661d34e8234f578db06ab90b8b017e)

![[Photo] Living witnesses of the country's liberation day present at the interactive exhibition of Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/b3cf6665ebe74183860512925b0b5519)

![[Photo] Japanese Prime Minister's wife visits Vietnamese Women's Museum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/27/8160b8d7c7ba40eeb086553d8d4a8152)

Comment (0)