Portrait of an education business that bought 197 apartments at Nam Long's project

On December 11, 2023, Khai Sang Group signed a contract to purchase all 197 apartments in block A2, Ehome Southgate project of Nam Long Investment Joint Stock Company (code NLG) to serve as a boarding facility for students of EMASI Plus International Bilingual School.

The EHome Southgate project was developed by Nam Long on an area of 4.5 hectares in An Thanh commune, Ben Luc district, Long An province. The project has a scale of 7 apartment blocks, 12 floors high, providing 1,357 apartments with areas ranging from 51-74m2. The selling price of the apartment is about 1 billion VND/apartment.

Earning hundreds of billions from education every year, but only reporting a profit of a few billion, Khai Sang Group suddenly "spent a lot of money" to buy 197 apartments from Nam Long.

Established in 2005, Khai Sang Group is an educational investment organization with the Renaissance Saigon international school system and EMASI schools in provinces and cities across the country such as Hanoi, Ho Chi Minh City, Quy Nhon.

Khai Sang's current headquarters is in Binh Thuan Ward, District 7, Ho Chi Minh City. The Chairman of the Board of Directors and co-founder of Khai Sang is Mr. Nguyen Tuyen (born in 1972). Mr. Nguyen Tuyen is also the legal representative of Khai Sang Joint Stock Company.

As part of the cooperation agreement between Khai Sang Group and Nam Long Group, in the coming time, the two sides will promote the plan to build the EMASI Plus International Bilingual Boarding School inside the Waterpoint integrated urban area to put into operation in 2024.

This is the third school of the EMASI School System and the first international standard bilingual boarding school in Long An. EMASI Plus officially started construction in September 2022 and will open its first school year in August 2024.

According to the website, Khai Sang's legal representative, Mr. Nguyen Tuyen, was born and raised in Ho Chi Minh City, graduating from Ho Chi Minh City University in 1994. He used to live in Houston, Texas, USA with his wife, Ms. Nguyen Thuy Quynh (Founder of The Nguyen Art Foundation) and four children.

After successfully establishing and developing Renaissance International School Saigon since 2007, Mr. Tuyen continued to research, invest and develop a system of schools with suitable tuition fees called EMASI International Bilingual School, aiming to help students develop important skills needed in the modern world and become fluent in English.

According to the introduction, Mr. Nguyen Tuyen used to hold the position of Chairman, CEO and founder of Saigon Gas Holdings Corporation, established in 1998, one of the large-scale gas distribution companies in Vietnam.

In 2008, he successfully completed an M&A transaction with Total Oil and Gas, a major global oil and gas company. He is also a member of the Board of Directors of companies including Viet Huong Joint Stock Company, a major flavor company in Vietnam established in 1995; co-founder and Director of Rivermark Development Company - a real estate development company in Texas, USA since 2012.

With hundreds of billions in revenue, but only a few billion in profit, and a long-term financial imbalance, why did Khai Sang Group still buy a whole lot of huge apartments from Nam Long?

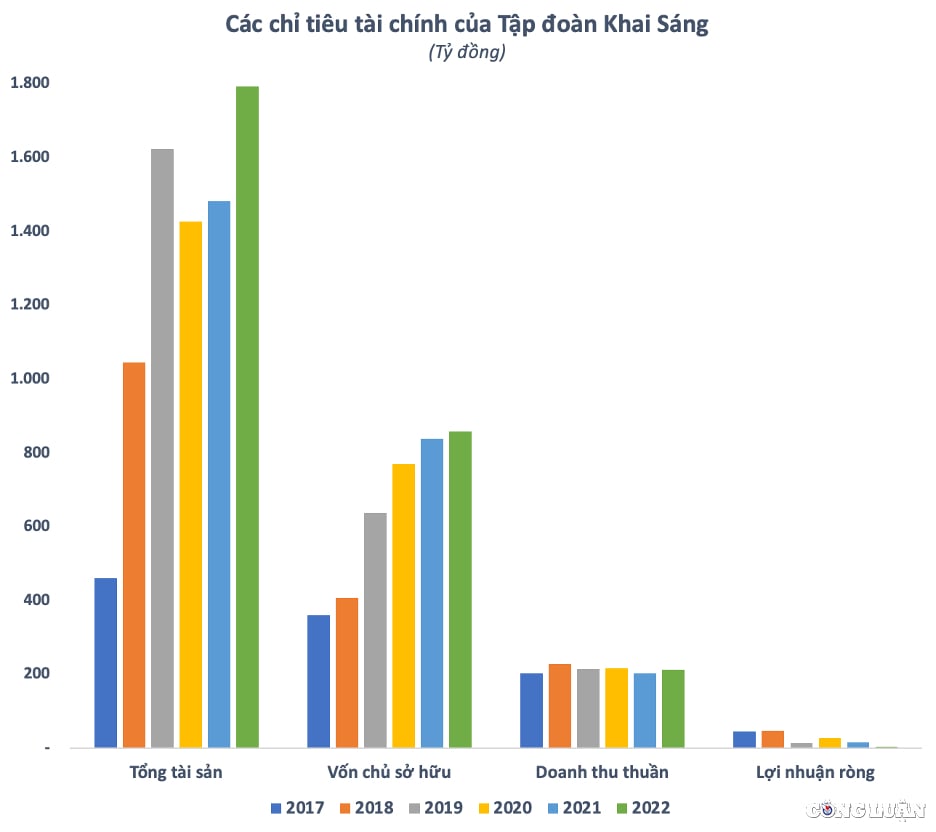

Over the years, Khai Sang's capital scale has continuously expanded. By the end of 2022, the company's charter capital reached more than 771 billion VND, 2.4 times higher than 5 years ago. Along with the annual accumulated profits, the company's equity has also continuously increased year by year, reaching 858 billion VND by the end of 2022.

However, Khai Sang's total assets fluctuated quite erratically due to payable debts. By the end of 2022, the total assets of this enterprise reached nearly 1,800 billion VND, an increase of more than 300 billion compared to the beginning of the year. The main reason was that payable debts increased by one and a half times to more than 900 billion VND.

It is worth mentioning that this enterprise has suffered from a prolonged financial imbalance when short-term debt exceeded short-term assets for many years. In 2022, Khai Sang had a negative net working capital of VND 15 billion. This figure was negative VND 225 billion in the same period in 2021 and negative VND 208 billion in 2020.

This shows that the company has been using short-term capital to finance long-term assets for many years and may be the reason why Khai Sang has had to increase capital rapidly in recent years. This is a huge pressure for the company when the business situation is not really improving, even showing a tendency to decline in profits.

In 2022, Khai Sang's net profit was only 4 billion VND, only 1/4 of the previous year, although its revenue increased slightly to more than 214 billion VND. This is the second consecutive year that this enterprise has recorded a decline in profit. Meanwhile, its annual revenue remains steady at over 200 billion VND, although it has not decreased, there has been no breakthrough growth despite its continuous expansion.

This makes investors question the efficiency of capital and asset use of Khai Sang, especially when the company has just spent a lot of money to buy a whole lot of huge apartments from Nam Long.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)