(NLDO) – In the trading week before the long Tet holiday, experts and investors expect cash flow to return.

Bottom-fishing demand increased at the end of the week, helping VN-Index close the week at 1,249.11 points, up 18.63 points compared to the end of last week; HNX Index also increased by 2.98 points and closed at 222.48 points.

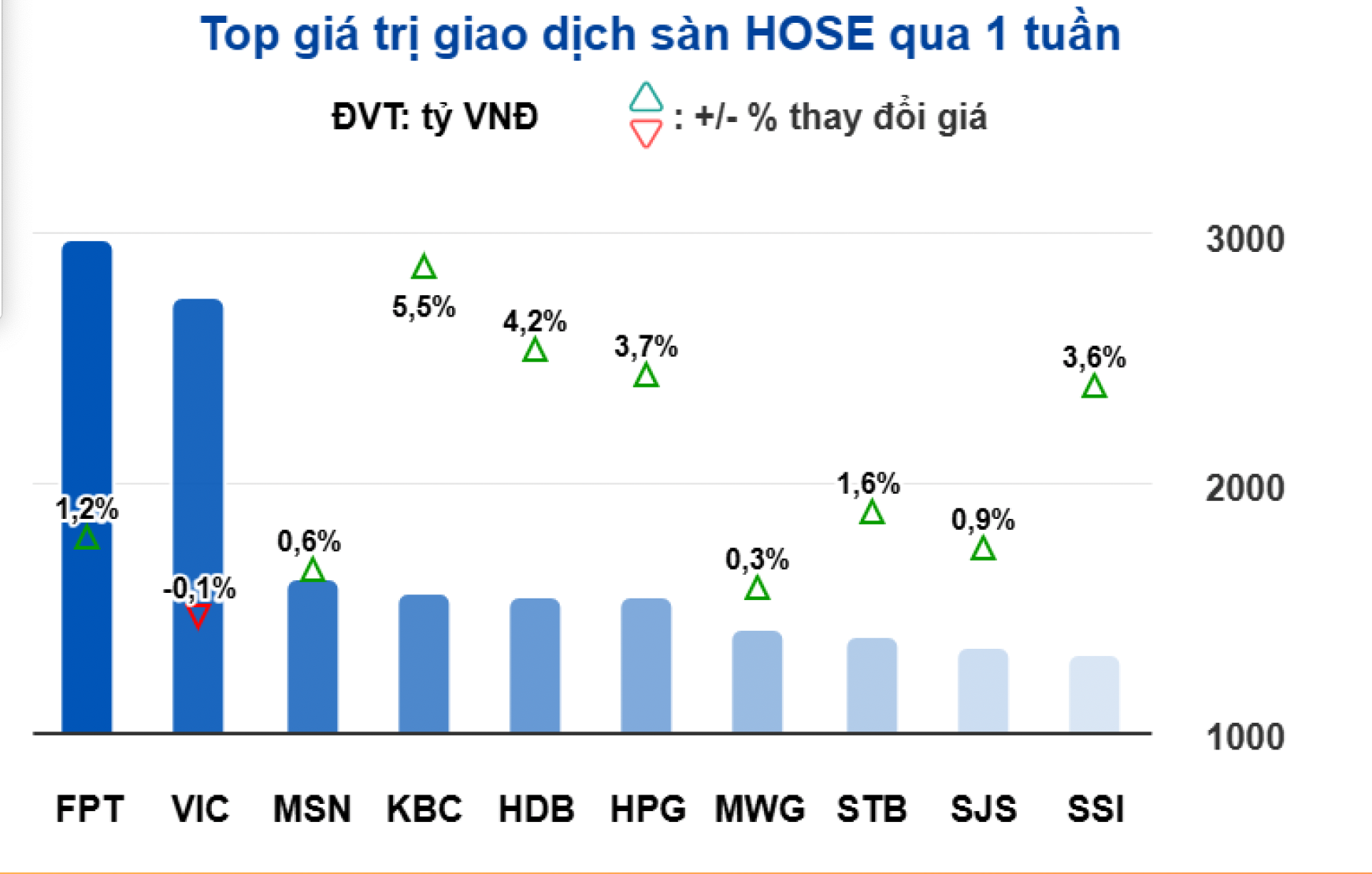

Banking stocks were a bright spot last week, contributing to the positive growth of the market with codes TCB, VCB, HPG, LPB, HDB... The total matched transaction value of VN-Index reached 42,517 billion VND.

The market increased despite foreign investors still net selling a "huge" amount of more than 4,600 billion VND.

Pinetree Securities Company commented that the market recorded the most prosperous week since the beginning of 2025, especially the developments of the last session of the week on January 17. The trend of VNIndex last week was similar to the Dow Jones index of US stocks, the common point is that both had a strong increase after news about inflation.

However, in the short term, next week is the last trading week of the lunar year, and the lack of liquidity continues to prevent the market from making a strong breakthrough.

Stocks expected to rise next week ahead of long Tet holiday

"The strongest drivers for the market now are the 2024 business results of enterprises and the official inauguration of US President Donald Trump to see how tariff policies will affect Vietnam's trade.

Although the information is not new, the market needs a reason to maintain its upward momentum before entering the long Tet holiday," said an expert from Pinetree Securities.

Mr. Vo Kim Phung, BETA Securities Company, said that the VN-Index recorded an increase of 18.63 points, showing that market sentiment has improved compared to last week. Selling pressure has decreased, replaced by the return of demand, although foreign investors are still net sellers continuously. The VN-Index is in a short-term correction phase.

The last trading week before the Lunar New Year holiday is expected to take place with investors being cautious, as cash flow tends to decline, possibly accompanied by profit-taking after the recent recovery period. Adjustment pressure may appear in the context of the market facing fluctuations.

"However, the intrinsic strength of the VN-Index is still maintained at a fairly good level, reflected in the persistent interest of cash flow in industries with growth potential. The corrections are opportunities for investors to accumulate quality stocks for long-term investment strategies at attractive prices," said Mr. Phung.

According to securities companies, in a positive scenario, the VN-Index could continue to advance to the 1,250-1,260 point range before the Tet holiday, with a minimum liquidity of about VND10,000 billion/session on the HOSE floor.

The industry group leading expectations is the securities group, as a number of large securities companies have gradually announced positive profit results and set ambitious targets for the market upgrade scenario in 2025.

Source: https://nld.com.vn/ky-vong-chung-khoan-tang-manh-trong-tuan-truoc-tet-196250119101851209.htm

![[Photo] More areas of Thuong Tin district (Hanoi) have clean water](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/55385dd6f27542e788ca56049efefc1b)

![[Photo] Prime Minister Pham Minh Chinh and Japanese Prime Minister Ishiba Shigeru attend the Vietnam - Japan Forum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/fc09c3784d244fb5a4820845db94d4cf)

![[Photo] Prime Minister Pham Minh Chinh receives Cambodian Minister of Commerce](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/be7f31fb29aa453d906df179a51c14f7)

Comment (0)