2025 is forecast to be a year full of challenges but also opportunities for the Vietnamese economy.

In the report sent to the National Assembly, the Government showed great determination when setting the GDP growth target for 2025 at 8%... (higher than the Central target, the National Assembly has resolved at 6.5-7%, striving for 7-7.5%) and compared to 7.09% in 2024.

This is an ambitious figure in the context of a world economy that is still very unstable. So, what are the main drivers of growth and what challenges lie ahead?

Government determined, businesses expect

According to the project, the Government is determined to achieve rapid but sustainable growth, maintain macroeconomic stability, control inflation, and ensure major balances.

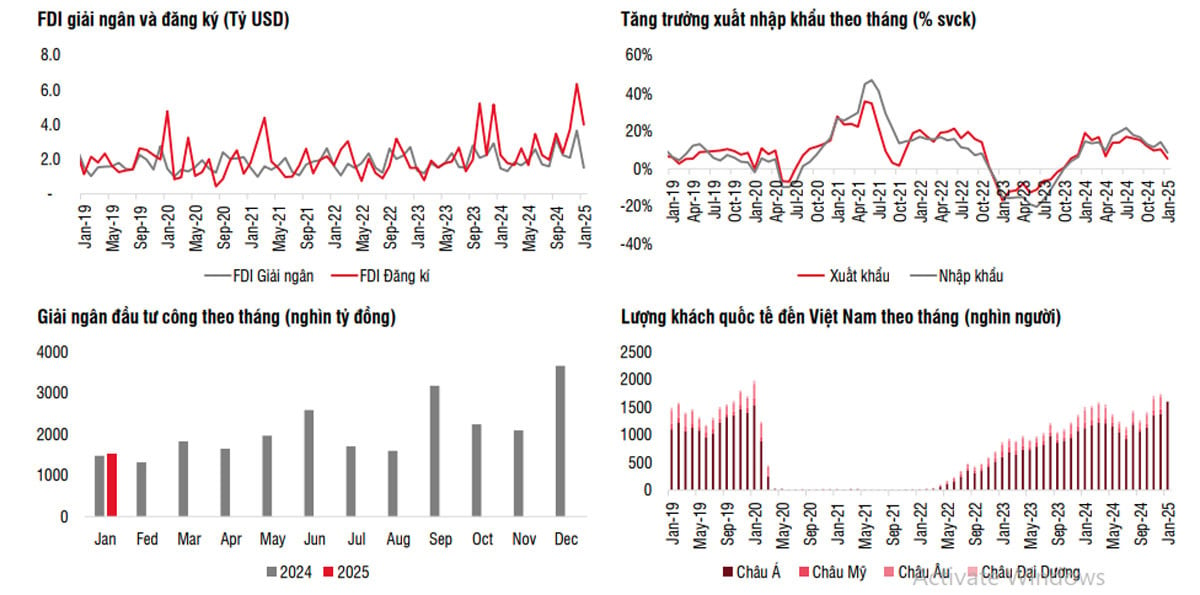

SSI Research's February 2025 Strategy Report shows that the Government accepts higher inflation and budget deficit to concentrate resources on development investment.... The focus will be on infrastructure projects, aiming to create a spillover effect for the entire economy.

Public investment is expected to be one of the main drivers of growth in 2025. The determination to accelerate the progress of key infrastructure projects will help disburse public investment capital achieve positive results, create jobs and promote growth in many other sectors.

The Government also identified key tasks and solutions. In particular, regarding exports, proactively deploy comprehensive and synchronous solutions in politics, economics and diplomacy; promote economic diplomacy, promote harmonious and sustainable trade with the US, China and Vietnam's major partners. In addition, effectively exploit opportunities from a series of signed free trade agreements (FTAs), especially EVFTA, RCEP, CPTPP...

Recently, UOB Bank raised its forecast for Vietnam's GDP growth to 7%, from 6.6%, thanks to expectations of positive changes in production, domestic consumption and tourist arrivals... UOB also believes that the ambitious target of 8% still has room to be achieved.

On the business side, expectations are also high. SSI Research forecasts that the profits of listed companies on the Ho Chi Minh City Stock Exchange (HoSE) will continue to grow. The profits of 84 companies studied by SSI Research are estimated to increase by 18.6% in 2025, higher than the 11.5% in 2024. This shows that businesses are well prepared and expect a prosperous business year.

External risks increase, internal strength needs to be strengthened

While the domestic government is very determined and businesses are hopeful, there are also huge external challenges.

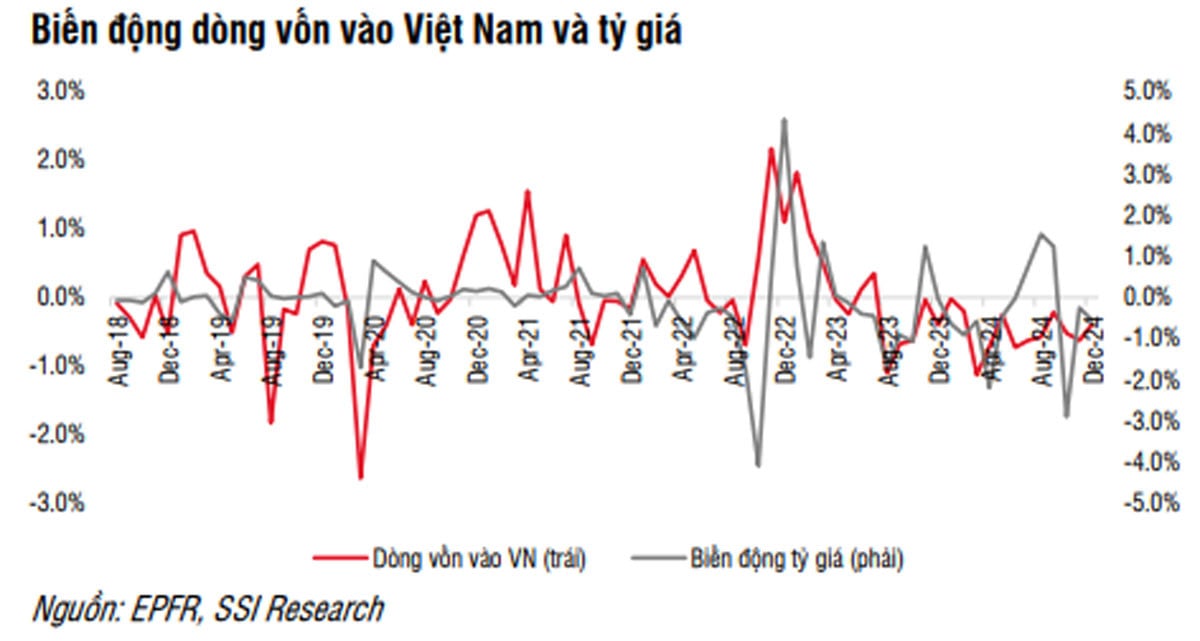

According to SSI, the slowing pace of interest rate cuts by the US Federal Reserve (Fed) could put pressure on the USD/VND exchange rate and reduce the attractiveness of the Vietnamese market to foreign investors....

US President Donald Trump’s protectionist and unpredictable policies are “unpredictable variables” for export growth, which is one of Vietnam’s important growth drivers. Imposing tariffs on imported goods could reduce the competitiveness of Vietnamese goods in the international market.

On February 9, Mr. Trump said he would announce a 25% tariff on all steel and aluminum imported into the country and would announce retaliatory tariffs on all countries that have imposed tariffs on the US.

SSI’s report also mentioned concerns about the risk of a global trade war, especially after President Trump took office. This could cause unpredictable fluctuations for the world economy in general and Vietnam in particular.

The internal health of the economy also faces many difficulties. First of all, domestic consumption has not shown clear signs of recovery..., indicating that domestic demand is still weak. This could reduce the effectiveness of economic stimulus policies and slow down the recovery of the service sector.

Besides, exchange rate risk is also a factor that needs attention.... The DXY index (measuring the fluctuations of the greenback against a basket of 6 major currencies in the world) remaining at a high level can put pressure on the USD/VND exchange rate, affecting import and export activities and increasing the cost of foreign debt repayment.

According to SSI, in the context of increasing external risks, to achieve the growth target of 8%, Vietnam needs to focus on internal growth drivers such as consumption, public investment and digital transformation...

Along with that, it is necessary to continue improving the investment environment, minimizing barriers for businesses and attracting foreign investment capital. Policies such as implementing the KRX trading system, applying the amended Securities Law and the amended Decree 155/2020 will create the premise for the development of the capital market in the medium and long term....

Controlling inflation and stabilizing exchange rates are very important to maintain macroeconomic stability and create confidence for investors. The State Bank needs to proactively and flexibly manage monetary policy.

Strengthening institutional reform is also an important factor. The reform process that began in late 2024 needs to be further accelerated, including streamlining the government apparatus and resolving outstanding issues in the real estate sector.

At a meeting with businesses on February 10, Prime Minister Pham Minh Chinh said that institutional problems are "the bottleneck of bottlenecks" but also "the breakthrough of breakthroughs".

Despite facing many challenges, exports remain an important growth driver. It is necessary to diversify export markets, take advantage of FTA agreements and improve the competitiveness of Vietnamese goods.

It can be seen that the 8% growth target for 2025 is a big challenge, requiring the efforts and coordination of the Government, businesses and people. Despite many challenges and difficulties, with appropriate solutions, Vietnam is expected to achieve this goal, creating momentum for sustainable development in the following years.

Source: https://vietnamnet.vn/kinh-te-viet-nam-2025-nhung-dong-nang-nao-dua-tang-truong-ve-dich-8-2370091.html

![[Photo] Attractive extracurricular lessons through interactive exhibition at Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/1f307025e1c64a6d8c75cdf07d0758ce)

![[Photo] Panorama of the rehearsal of the parade to celebrate the 50th anniversary of national reunification](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/afd7e872ef6646f288807d182ee7a3da)

![[Photo] April 30, 1975 - Steel imprint engraved in history](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/b5a0d7f4f8e04339923978dfe92c78ef)

![[Photo] Ho Chi Minh City people's affection for the parade](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/26/7fcb6bcae98e46fba1ca063dc570e7e5)

![[Photo] President Luong Cuong meets with Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/25/3d70fe28a71c4031b03cd141cb1ed3b1)

Comment (0)