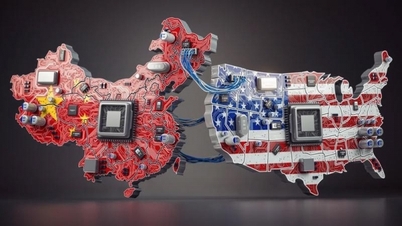

Gloomy economy, Chinese people maintain "belt tightening"

Báo Quốc Tế•26/12/2023

Báo Quốc Tế•26/12/2023 Millions of middle-class Chinese are practicing a "belt-tightening" policy, not daring to spend until the economy gradually recovers.

Same tag

Same category

Fascinated by birds that lure mates with food

What do you need to prepare when traveling to Sapa in the summer?

The wild beauty and mysterious story of Vi Rong cape in Binh Dinh

When community tourism becomes a new rhythm of life on Tam Giang lagoon

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)